Zuu Co. Ltd. executives purchase $32,037 in Pono Capital two shares

Executives at ZUU Co. Ltd., including President Kazumasa Tomita, have made significant share purchases in Pono Capital Two, Inc. (NASDAQ:PTWO), according to recent filings with the Securities and Exchange Commission. The transactions, which took place at the end of July and beginning of August, involved the acquisition of Class A Common Stock with a total value of $32,037.

The purchases were executed at prices ranging from $12.5 to $13.0 per share. On July 31, 2024, a total of 12 shares were bought at $12.5 each, followed by an additional 888 shares at the same price on August 1. On the same day, another 1,599 shares were acquired at a slightly higher price of $13.0 per share. Following these transactions, the executives’ holdings in Pono Capital Two have increased significantly.

The reporting documents also noted that the securities are held directly by ZUU Funders Co. Ltd. and may be deemed to be held indirectly by other related entities and individuals, including ZUU Co. Ltd. and Tomita Kazumasa. The filings emphasize that the reporting of these transactions should not be considered an admission of beneficial ownership of the reported securities.

Investors and market watchers often look to insider buying as a signal of executives’ confidence in the company’s future prospects. The recent purchases by ZUU Co. Ltd. executives in Pono Capital Two, a company within the healthcare sector, could be interpreted as a positive sign by the market.

Pono Capital Two, Inc., headquartered in Honolulu, Hawaii, operates within the healthcare industry, specifically in offices and clinics of doctors of medicine. The company’s Class A Common Stock is traded on the NASDAQ under the ticker symbol PTWO.

InvestingPro Insights

As ZUU Co. Ltd. executives demonstrate their faith in Pono Capital Two, Inc. (NASDAQ:PTWO) through recent stock purchases, it’s essential to consider the company’s financial health and market performance. According to InvestingPro, PTWO currently has a market capitalization of approximately $63.8 million, reflecting its size and investor valuation within the healthcare sector. Despite the insider buying, PTWO’s financials reveal some challenges. The company has not been profitable over the last twelve months, with an adjusted P/E ratio for the last twelve months as of Q1 2024 standing at -116.56, indicating that earnings do not currently support the share price.

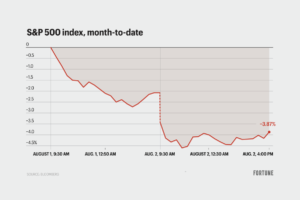

Moreover, the stock has experienced high price volatility, which is reflected in its price movements over various periods. The 1-month and 3-month price total returns as of a recent 2024 date were -5.53% and -11.54%, respectively, suggesting recent downward pressure on the share price. However, looking at a longer timeframe, the 6-month and 1-year price total returns show a more positive picture, with increases of 15.53% and 20.63%, respectively. This could suggest that while the stock has faced recent challenges, it has performed better over an extended period.

An InvestingPro Tip worth noting is that PTWO’s short-term obligations exceed its liquid assets, which could raise concerns about the company’s ability to meet its immediate financial liabilities. Additionally, PTWO trades at a high Price / Book multiple of 7.32 as of the last twelve months ending Q1 2024, which may suggest the stock is valued richly in relation to its net asset value. For investors considering PTWO, these financial metrics and insights are crucial for making informed decisions. For additional insights and tips on PTWO, investors can explore the 5 additional tips available on InvestingPro at https://www.investing.com/pro/PTWO.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.