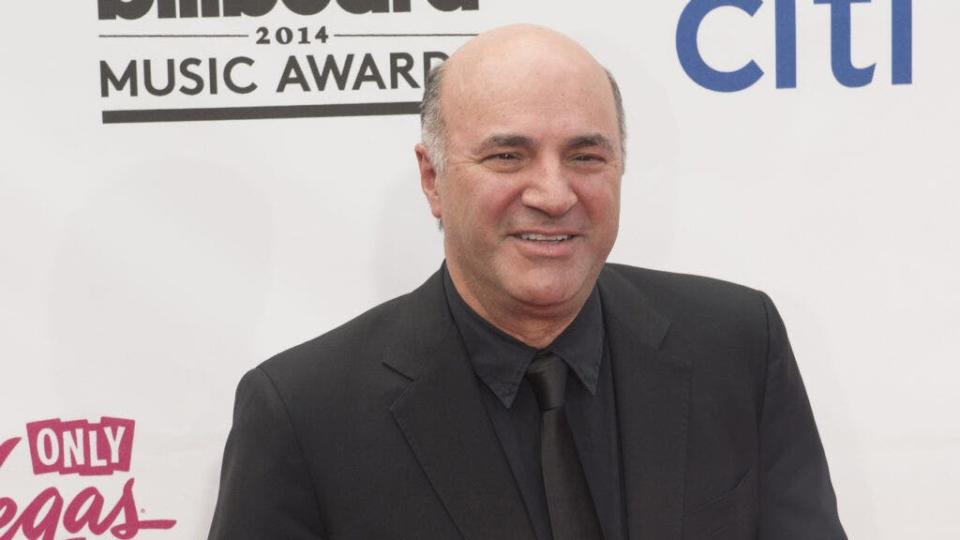

‘You Never Ask Me for Money Again’: Kevin O’Leary Explains Instead Of Investing In Family Members’ Businesses, He Gifts Cash With A Caveat

Kevin O’Leary, a big-name investor known for his no-nonsense approach to business, has a unique strategy for dealing with family members who ask him for money. He’s had his fair share of relatives coming to him with big ideas and high hopes, looking for a hefty investment. And with O’Leary’s financial standing, it’s not surprising. The Canadian business owner and Shark Tank star has a net worth of around $400 million.

Don’t Miss:

But while he’s generous, he’s also got boundaries that help keep family and finances from clashing. In a short YouTube video, O’Leary explained his actions when family members ask him for money. He acknowledges the age-old truth: “More money, more problems.” O’Leary says, “It’s a fantastic thing because it buys you freedom but it makes your life complicated because many people want some of it from you for free – particularly family members. This is a huge issue.”

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

O’Leary clarifies that people come to expect something for nothing just because you have money. And to handle this, he’s developed a straightforward method that keeps things clear and avoids awkward Thanksgiving dinners.

When a family member approaches him for money – whether it’s to start a restaurant or launch a new business – he offers a one-time gift. In the case he mentions, it’s $50,000. Not a loan, not an investment, just a gift. But there’s a catch: “You never ask me for money again. Ever.” O’Leary’s rule is simple: after that check, there will be no more handouts, no future expectations, and no financial entanglements. As he humorously adds, he hands over the money and then “goes back to polishing his eggs.” It’s a clean break that leaves no room for future financial disputes or awkward family interactions.

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $500

For those who don’t have a portfolio like O’Leary’s, his approach still offers a valuable lesson. Setting clear boundaries is crucial when lending or gifting money to family. Getting caught up in the emotions and obligations that come with helping loved ones is easy, but things can get messy without clear rules. A good approach for the rest of us might be to only give what we can afford to lose – whether that’s $50, $500, or $5,000 – and make it clear that it’s a one-time deal. No loans, no strings, no awkward family gatherings.

Handling family and money can be tricky, but O’Leary’s approach shows that it’s all about setting expectations and sticking to them. And maybe, just maybe, it’s also about having a little humor to keep things from getting too tense.

It’s always smart to consult with a financial advisor before making big decisions, especially when family is involved. They can help you determine what makes the most sense for your situation and set the right boundaries. It’s not just about the money – it’s about keeping relationships intact while making choices that work for everyone. A little guidance can go a long way in ensuring your finances and family ties stay strong.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article ‘You Never Ask Me for Money Again’: Kevin O’Leary Explains Instead Of Investing In Family Members’ Businesses, He Gifts Cash With A Caveat originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.