Why Occidental Petroleum Is Selling Shares of This 9.5%-Yielding Dividend Stock

Occidental Petroleum (NYSE: OXY) recently closed its needle-moving acquisition of CrownRock. It paid $12 billion for the fellow oil company, which will significantly enhance its position in the prolific Permian Basin. The acquisition should also boost its annual free cash flow by about $1 billion.

However, the oil stock took on a boatload of debt to close the deal (it issued $9.1 billion of new debt while also assuming $1.2 billion of CrownRock’s existing debt). Because of that, the company’s near-term focus is on paying down its debt as fast as possible. It recently took another step toward that goal by selling some of its interest in master limited partnership (MLP) Western Midstream Partners (NYSE: WES). That move should come as no surprise and might not be the last time it taps into this source of value.

Choppy progress on its plan

Occidental plans to repay at least $4.5 billion of debt within 12 months of closing its CrownRock deal via its increased free cash flow and the proceeds from asset sales. The oil company aims to raise $4.5 billion to $6 billion from selling assets over the coming years to help repay debt.

The company has already made some progress on that plan. It recently agreed to sell some non-core assets in the Delaware Basin to Permian Resources for $818 million. The company also sold some other non-core assets for $152 million. Those sales will give it $970 million to repay debt.

Occidental was working on an even larger deal. It had agreed to sell a 30% stake in CrownRock to its joint-venture partner in the Permian, Ecopetrol. The deal would have raised $3.6 billion, enabling it to achieve the low end of its target range well ahead of schedule. However, Ecopetrol opted out of that deal.

Despite that sale falling through, Occidental has made solid progress on its overall debt-reduction target. It had already retired $400 million in debt earlier this year. Meanwhile, it plans to make $1.9 billion of debt repayments by the end of this month, most of which it has funded with excess cash flow. The Permian Resources deal will give it another roughly $800 million to repay debt, which it expects to complete by the end of the third quarter. That would push its total debt reduction to $3.1 billion, leaving it about $1.4 billion away from its near-term target.

Trimming a little off the top

With the Ecopetrol deal falling through, Occidental Petroleum is pivoting by selling some of its stake in Western Midstream. Occidental is the largest unitholder of Western Midstream Partners, and until recently, the oil company owned 49.8% of the MLP’s outstanding units. In addition, it has a 2% interest in Western Midstream Operating (the company that owns the operating assets). Occidental initially acquired its stake in Western Midstream when it bought Anadarko Petroleum in 2019, which had formed the midstream company to help support its operations.

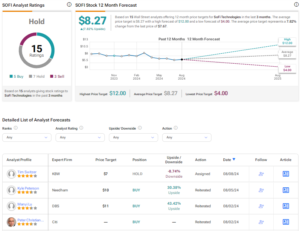

The oil company has benefited from its relationship with Western Midstream over the years. The MLP has supported Occidental’s growth by building additional infrastructure to handle the company’s rising production volumes. The MLP has also supplied the oil company with a steady stream of cash flow via its lucrative cash distributions. Western Midstream has increased its base distribution by 52% this year, boosting its current yield to around 9.5%.

Occidental is now using the MLP as an additional source of cash. It recently launched a secondary offering to sell 19 million units. The sale has raised over $658 million in gross proceeds. That will put it even closer to achieving its near-term debt-reduction target.

The company could continue selling down its stake in Western Midstream if it needs additional cash to repay debt. It had reportedly shopped its entire stake in the company earlier this year. It could still sell its remaining interest to another midstream company or a private equity fund. Alternatively, Occidental could launch additional secondary offerings to raise cash when it wants to pay off more debt.

Almost there

Occidental Petroleum borrowed a lot of money to buy CrownRock, which is a concern given the oil sector’s volatility (and what happened when it used that approach to buy Anadarko a few years ago). Because of that, the company planned to repay a big chunk of that debt by selling assets. It’s now well on its way toward achieving its goals after selling some non-core assets and an interest in its MLP. With the company making progress, it’s whittling away at a risk that could have weighed on its stock price if oil prices fall unexpectedly in the future.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $668,029!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Why Occidental Petroleum Is Selling Shares of This 9.5%-Yielding Dividend Stock was originally published by The Motley Fool