Why I’m Not Touching This Artificial Intelligence (AI) Chip Stock With a 10-Foot Pole in 2024

Soaring interest in artificial intelligence (AI) has spotlighted chip stocks since the start of last year. These companies develop the hardware that makes the generative technology possible, indicating they have much to gain as the AI market develops.

Market leader Nvidia (NASDAQ: NVDA) has highlighted the significant potential of these companies, delivering stock growth of 674% since January 2023 alongside soaring earnings. The company’s business has exploded thanks to the domination of its AI graphics processing units (GPUs). As a result, Advanced Micro Devices‘ (NASDAQ: AMD) second-largest market share in GPUs and prominent role in chip designs have rallied investors.

The company has caught the eye of Wall Street, with many analysts just waiting for it to follow in Nvidia’s footsteps. Bulls have pumped up AMD’s stock price by 116% since the start of 2023.

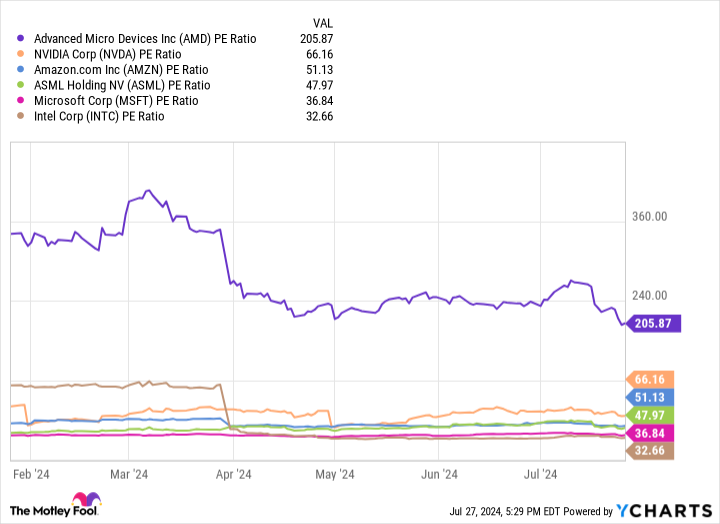

However, AMD’s performance over the past year makes it a hard sell. Its stock is trading at 206 times its earnings, as its financials haven’t kept up with its stock growth. Meanwhile, Nvidia’s overwhelming dominance in AI and other competitors could make it challenging for AMD to gain traction in the industry.

So, here’s why I’m not touching this AI chip stock with a 10-foot pole in 2024.

AMD has yet to find a niche to dominate in AI

AMD has made some encouraging inroads in artificial intelligence over the last year, unveiling a range of new AI-capable chips to better compete with Nvidia, attracting prominent customers like Microsoft and Meta Platforms to its latest offerings. However, rising competition in the market suggests AMD will need to find its own niche in AI to see big gains over the long term. Nvidia has likely secured years of dominance in AI GPUs, with its chips accounting for about 85% of the industry and the company supplying its hardware to the companies above.

Meanwhile, fellow chipmaker Intel (NASDAQ: INTC) is in a similar position to AMD as it strives to steal market share from Nvidia with new chips. Intel has also unveiled multiple chips since last year to challenge Nvidia. However, Intel has seemingly recognized the challenge Nvidia’s dominance poses and is simultaneously seeking to lead other areas of AI to diversify its position.

Over the last year, Intel has invested billions into expanding its manufacturing capacity, announcing plans to build at least four chip plants in the U.S. as it seeks to become the world’s biggest AI chip manufacturer.

So, while Nvidia is ruling AI GPUs and Intel strives to become a leading chip fabricator, AMD is almost in no man’s land until it finds a way to differentiate itself from its competitors and lead its own subsector of the industry.

Less financial resources than its biggest rival

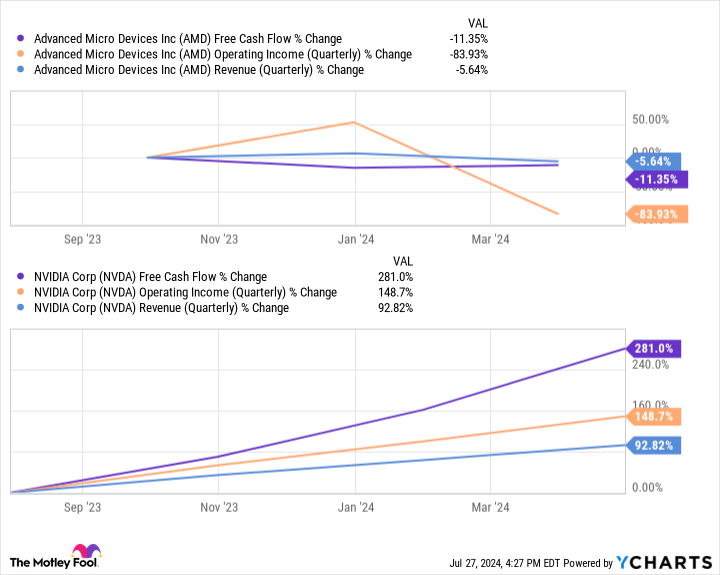

Nvidia’s headstart in AI has done more than allow it to gain market share. It has also massively expanded the company’s financial resources and ability to reinvest in its business. Meanwhile, declines in AMD’s earnings over the last year could make it harder for the chipmaker to compete in AI.

This chart shows AMD’s free cash flow, quarterly revenue, and operating income have been hit hard over the last 12 months. Meanwhile, Nvidia has become a more formidable opponent, extending its financial lead. The difference saw AMD’s free cash flow reach just over $1 billion this year, while Nvidia’s hit more than $39 billion.

AMD has actually delivered some impressive growth in its AI-focused division, with data-center revenue rising 80% year over year and client sales increasing by 85% in the first quarter of 2024. However, declines in other segments meant total revenue for the quarter increased just 2% year over year. For reference, Nvidia’s revenue rose 262% for the same period.

Since 2014, AMD’s desktop GPU market share has fallen from 35% to 12%, while Nvidia’s climbed from 65% to 88%. Both companies include desktop GPU sales in their respective gaming segments, as consumers mainly use these chips to build high-performance gaming PCs. AMD saw its gaming revenue plunge 52% in Q1 2024, but Nvidia’s soared 45% higher.

AMD’s soft performance over the last year has allowed its biggest rival to pull further ahead. With more extensive cash reserves, Nvidia’s leading position in AI could be more challenging for AMD to compete against.

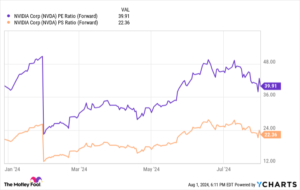

One of the worst-valued stocks in tech

Despite the above concerns, AMD’s one saving grace would be if its stock traded at a ridiculously great value. However, the unfortunate reality is that its shares offer some of the worst value in tech, as its stock growth hasn’t aligned with rising earnings.

This chart shows AMD’s price-to-earnings (P/E) ratio running significantly higher than many of the most prominent names in AI and tech. The figures indicate that AMD’s stock offers the least value among these companies. Meanwhile, the stock’s P/E value is considerably higher than its 10-year average P/E of 154, only strengthing the case against owning AMD shares.

Due to its lack of market dominance in AI and less-than-stellar earnings, I would steer clear of AMD’s stock in 2024 and consider one of its rivals instead.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $635,614!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Why I’m Not Touching This Artificial Intelligence (AI) Chip Stock With a 10-Foot Pole in 2024 was originally published by The Motley Fool