Why 2030 is seen as ‘a particularly disruptive year for lithium’

Investing.com — In a research note this week, analysts at Bernstein highlighted 2030 as a pivotal year for the lithium market, indicating that significant changes may disrupt the industry as global demand for electric vehicles (EVs) skyrockets.

This year is projected to be a turning point, with forecasts suggesting that “global EV sales will exceed 50%,” marking a critical threshold for adoption.

Several key events are expected to shape the lithium landscape by 2030.

Bernstein notes, “It marks the year when recycling will break 1%,” a milestone that, while trivial, will provide insights into the supply chain dynamics.

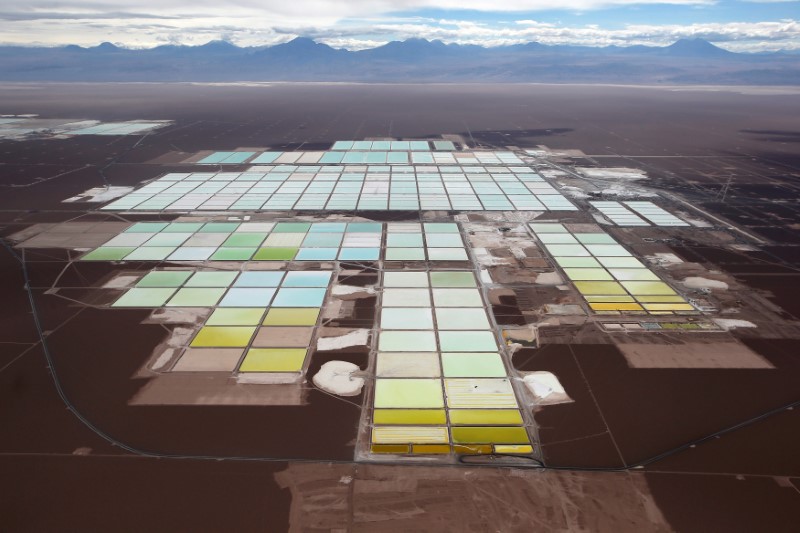

Additionally, major players like ExxonMobil (NYSE:) plan to sell “1 million EVs worth [of] lithium,” which will impact the cost structure of lithium extraction from oilfield brine.

The note emphasizes that 2030 will witness critical developments in the lithium supply-demand equation.

Currently, the industry is experiencing “care & maintenance economics,” with significant supply capacity shut in and awaiting clearer price signals.

Bernstein suggests that “prices have much downside risk from here,” forecasting a moderate rebound to approximately $13-15/kg, the levels seen at the start of the year.

Between now and 2030, Bernstein expects that marginal cash costs will dictate pricing, with occasional spikes towards mid-cycle EBITDA margins.

They underline the importance of the Chilean royalty regime in shaping this pricing environment. The firm advises against exposure to lithium market volatility for all but long-term investors, cautioning that the industry may not see a boom cycle before 2030