When You Look Back on This Moment in 2030, You Might Wish You’d Bought This Trillion-Dollar Artificial Intelligence (AI) Stock

Wall Street and industry experts are unquestionably bullish on artificial intelligence (AI). Here are just some of the forecasts floating around:

-

Cathie Wood’s Ark Investment Management predicts AI will add $200 trillion to the global economy by 2030.

-

Consulting firm PwC places that number at a more modest — but still substantial — $15.7 trillion by the same year.

-

Goldman Sachs says AI will add around $7 trillion to the global economy over the next 10 years.

-

Nvidia CEO Jensen Huang recently said $1 trillion will be spent upgrading data center infrastructure to meet demand from AI developers over the next five years alone.

If those forecasts come to fruition, I think one company has the potential to benefit more than any other. Amazon (NASDAQ: AMZN) has a fast-growing presence in AI hardware, large language models (LLMs), and AI software applications through its cloud computing platform. As an added bonus, the tech giant is using AI to enhance its legacy e-commerce business.

When 2030 rolls around and investors are reflecting on this moment, here’s why they might wish they had bought Amazon stock.

The three layers of AI

Developing AI is complex and expensive, but businesses want the technology to boost productivity and create new revenue opportunities. Amazon Web Services (AWS) is the world’s largest cloud computing platform, and it’s becoming a destination of choice for AI developers because of its infrastructure and broad portfolio of AI services.

Amazon CEO Andy Jassy refers to hardware as the bottom layer of AI, which includes data centers and the chips within them. Like most cloud providers, AWS uses Nvidia‘s industry-leading graphics processors (GPUs) in its data centers, but Jassy says developers are constantly demanding better price performance. That’s why Amazon designed its own chips called Trainium (for AI training) and Inferentia (for AI inference).

Trainium, for example, offers up to 50% cost-to-train savings over Amazon’s other infrastructure, which means developers can stretch their funding to create more advanced models. That brings us to the middle layer of AI, which features ready-made LLMs for businesses seeking a turnkey solution instead. Bedrock on AWS has the largest selection of third-party LLMs in the industry, including Anthropic’s Claude 3.5 lineup, which are the best-performing models in the world. Businesses can use these in combination with their own data to accelerate the development of AI software.

Software is the third and final layer, and Amazon has that covered, too. Amazon Q is a new virtual assistant embedded in AWS, and Jassy says it’s the most capable AI-powered tool of its kind for software development. It has the highest known acceptance rate for code suggestions, and it also outranks all competing products in catching security vulnerabilities.

AWS delivered a record $26.2 billion in revenue during the recent second quarter of 2024 (ended June 30), which represented 19% growth from the year-ago period. That result marked the third consecutive quarter of accelerating revenue growth for the platform, and AI is a key reason why.

AI is enhancing Amazon’s e-commerce business

E-commerce remains Amazon’s largest source of revenue, so the company is constantly searching for new ways to make the segment more efficient. Last year, Amazon broke its national fulfillment network into eight distinct regions to reduce logistics costs and deliver products to customers more quickly. Plus, it already relies upon hundreds of thousands of AI-powered autonomous robots to streamline its fulfillment processes.

Now, Amazon is rolling out Project Private Investigator, which uses AI and computer vision to identify defective products before they are shipped to customers. That should reduce the rate of returns, which, in turn, will lower costs and boost customer satisfaction.

It adds to a number of other AI tools that are already active on amazon.com. AI powers the recommendation engine to show shoppers the most relevant products, which helps drive sales. Additionally, customers can use a virtual shopping assistant called Rufus, which is trained on Amazon’s entire product catalog, enabling it to answer questions and help with comparisons.

Amazon also offers a suite of AI software to sellers, which empowers them to create more engaging product pages and ads to increase their conversions.

Why now could be a great time to buy Amazon stock

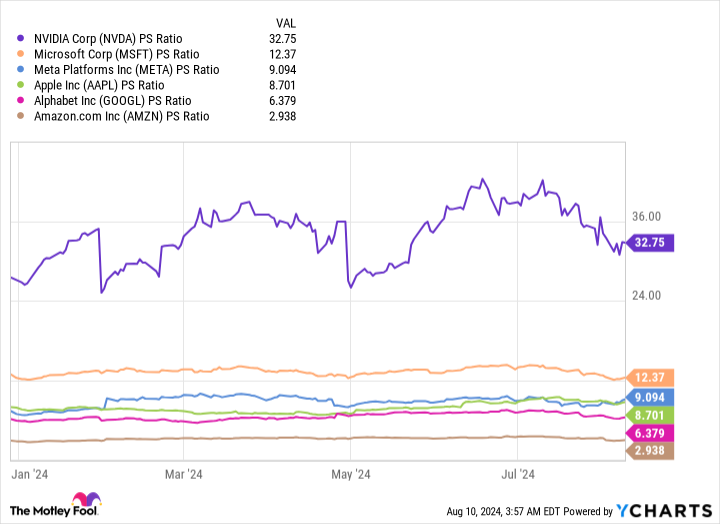

Amazon generated $148 billion in revenue across all of its businesses during Q2, a 10% increase from the year-ago quarter. That takes its trailing 12-month revenue to $604.4 billion. Based on the company’s market capitalization of $1.7 trillion, its stock trades at a price-to-sales ratio (P/S) of just 2.9, making it cheaper than every other tech giant valued at $1 trillion or more:

Amazon has struggled to convert its revenue into profitability in the past, which is why investors assigned it such a low P/S ratio. In simple terms, they are saying Amazon’s revenue isn’t as valuable as the revenue generated by Nvidia, for example, because more of Nvidia’s revenue flows to the bottom line as profit.

However, Amazon has improved its bottom line dramatically over the last few quarters. It generated $13.5 billion in net income during Q2, a whopping 101% increase from the year-ago period. That followed three straight quarters of at least triple-digit percentage growth in net income, so there is clear momentum. AWS is the profit engine of the entire organization, but Amazon’s e-commerce business is also benefiting from its AI and efficiency initiatives, which are boosting margins.

Wall Street expects Amazon’s profitability to continue climbing into 2025, when earnings per share could potentially come in at $5.85. That places its stock at a forward price-to-earnings ratio (P/E) of 28.5, which is cheaper than the current 29.6 P/E ratio of the Nasdaq-100 index. So, Amazon looks attractive from that perspective too.

Ultimately, this could be a great entry point for investors who are willing to hold the stock while the AI revolution builds momentum into the end of this decade, as many forecasts suggest.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $711,657!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Goldman Sachs Group, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

When You Look Back on This Moment in 2030, You Might Wish You’d Bought This Trillion-Dollar Artificial Intelligence (AI) Stock was originally published by The Motley Fool