Warren Buffett Took Profits in Bank of America. TD Bank Looks Like a Good Place for the Cash.

Warren Buffett is a Wall Street icon who runs Berkshire Hathaway. The stock picks that this conglomerate makes are, basically, Buffett’s stock picks. Right now Berkshire Hathaway is selling down its position in large U.S. bank Bank of America (NYSE: BAC). But the longer-term story here helps explain why you might want to invest in Toronto-Dominion Bank (NYSE: TD) today.

A quick Bank of America history lesson

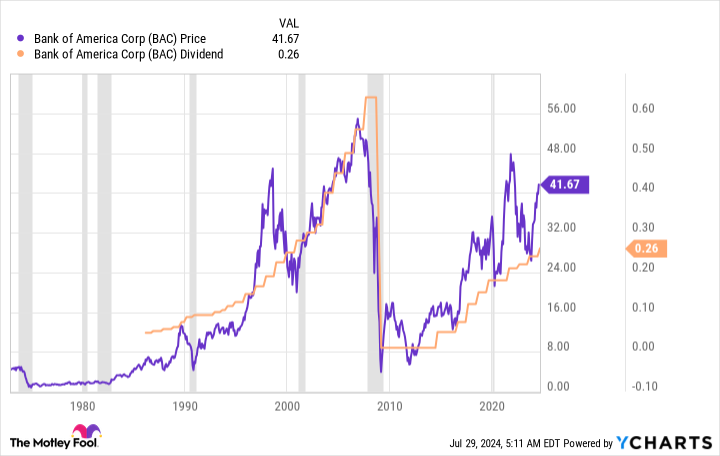

Like most U.S. banks, Bank of America got caught up in the mortgage crisis during the Great Recession. In fairness, the bank itself seemed to be weathering the situation in relative stride; it was the company’s efforts to use the downturn to expand that really caused it the most trouble. Specifically, it bought Countrywide Financial, which was a subprime mortgage lender.

That decision saddled Bank of America with a deeply troubled business and resulted in a massive dividend cut. It also pushed the bank to seek out cash from Buffett and Berkshire Hathaway. While it is impossible to know exactly what Buffett was thinking when he stepped in to help, it is likely that he saw a great core business in the Bank of America franchise. And, assuming the bank could weather the economic downturn, that would support an upturn in performance and the stock price.

While the stock hasn’t recovered all of the ground it lost during the Great Recession, it has risen sharply. Its dividend, meanwhile, is back on an upward trajectory. Warren Buffett has been taking the opportunity to cash in some of his gains.

A new bank opportunity with TD Bank

The key here is that Buffett, as he often does, stepped in to invest in a good company while it was facing what was likely to be a temporary problem and, thus, was out of favor on Wall Street. That’s pretty much the situation that Toronto-Dominion Bank, more commonly called TD Bank, finds itself in today.

The issue with TD Bank started with an acquisition that was called off because of regulator scrutiny. The problem ended up being TD Bank’s money laundering controls, which weren’t up to snuff. In fact, it appears that some of the company’s employees may have been taking money from drug cartels and, you guessed it, helping to launder drug money through TD Bank. This is bad news and will result in a large fine. TD Bank has already set aside $450 million, but the cost will probably go higher.

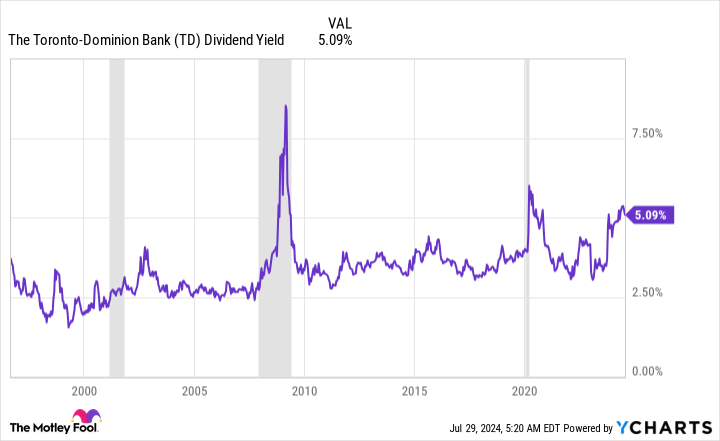

Needless to say, the stock is out of favor right now. It has fallen 30% from its 2022 peak and the dividend yield is near the highest levels in recent history. In fact, the only time the yield was higher was during the Great Recession and the early days of the coronavirus pandemic. TD Bank’s stock looks like it is cheap today.

But here’s the thing — TD Bank is one of the largest banks in North America. It has a solid core business in Canada and has been growing in the U.S. market. Canada’s banking system is highly regulated, which has resulted in large banks like TD Bank having entrenched market positions. It has also created conservative cultures in the country’s banks, which tend to permeate all of their operations. TD Bank is not known for taking big risks. It is far more likely that it works with regulators to fix the problem, regain trust, and then starts to grow again.

TD Bank will pay you well to wait

All of that said, TD Bank is not going to fix this problem quickly or easily. It will take time and cost a lot of money. But it should be able to muddle through in relative stride while continuing to support its hefty 5.1% dividend yield. The average yield for banks is around 2.9% right now. If you are an income investor and can stomach a bit of Buffett’s contrarian investing style, TD Bank could be the Bank of America-like investment you are looking for.

Should you invest $1,000 in Toronto-Dominion Bank right now?

Before you buy stock in Toronto-Dominion Bank, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Toronto-Dominion Bank wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $669,193!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Reuben Gregg Brewer has positions in Toronto-Dominion Bank. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Took Profits in Bank of America. TD Bank Looks Like a Good Place for the Cash. was originally published by The Motley Fool