Want to Get Richer? 2 Best Stocks to Buy Now and Hold Forever

Recent market volatility has highlighted the importance of investing in stable growth stocks. Companies with reliable businesses and roles in consistently expanding industries can offer considerable stock growth over the long term. And tech is one of the best sectors to find such companies. It is known for its ever-expanding nature and benefits from consistent demand for upgrades to various software and hardware offerings.

The tech-rich Nasdaq Composite has risen around 110% over the last five years and 280% over the last decade. Lucrative markets like consumer tech, digital advertising, cloud computing, and AI have driven growth and will likely continue to do so for decades.

The Nasdaq has dipped 10% over the last month due to a tech sell-off, as disappointing economic reports have concerned Wall Street. However, past trends suggest current headwinds are only temporary. Tech remains a high-growth industry that has much to offer long-term-minded investors.

So, want to get richer? Here are two of the best stocks to buy now and hold forever.

1. Advanced Micro Devices

Advanced Micro Devices (NASDAQ: AMD) is a compelling investment as the second-largest name in graphics processing units (GPUs) after market leader Nvidia. GPUs can run the intense workloads necessary for training artificial intelligence (AI) models, making them crucial to the development of the industry.

As a result, a recent boom in AI has seen AMD and Nvidia’s GPU sales soar in recent months. Meanwhile, their market caps have hit record heights, with Nvidia becoming the first chipmaker to achieve a market cap above $2 trillion and AMD’s reaching $215 billion. However, the significant difference in their market caps illustrates the vast potential of AMD as it expands in AI.

Now could be an excellent opportunity to invest in a company that could be worth at least $1 trillion by the end of the decade. AMD’s stock would need to rise 374% to hit that. Considering its share price has increased 500% over the last five years, that kind of growth is not out of the realm of possibility.

Meanwhile, recent earnings show AMD is making promising headway in AI. The company posted its earnings results for the second quarter of 2024 on July 30. Revenue increased 9% year over year, outperforming expectations by $120 million. Growth was primarily driven by increased sales in its AI-focused data center segment, with revenue rising by a record 115% year over year to nearly $3 billion.

AMD’s client segment, which includes income from central processing unit (CPU) sales, also saw revenue spike 49%.

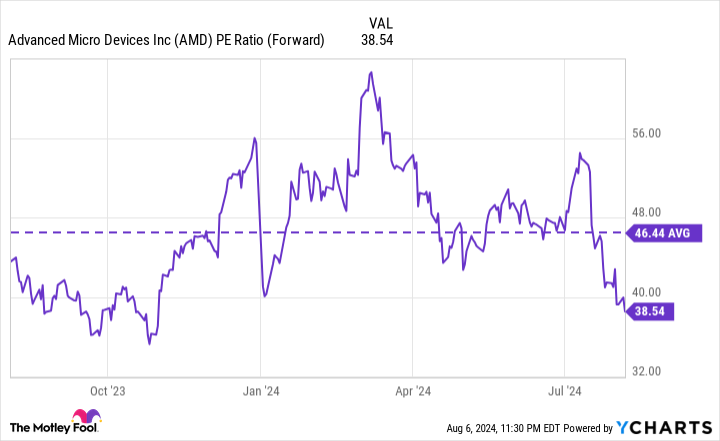

AMD’s forward price-to-earnings (P/E) ratio of 38 doesn’t exactly scream “bargain.” However, that figure is well below the company’s average forward P/E for the last year, indicating it is trading at one of its best values in months.

Given its massive potential in AI chips, AMD is an excellent stock to buy now and hold indefinitely.

2. Microsoft

Microsoft‘s (NASDAQ: MSFT) share price has tumbled 5% over the last month amid a sell-off affecting countless tech stocks. However, the company remains one of the best long-term plays. As the home of potent brands like Windows, Office, Xbox, Azure, and LinkedIn, Microsoft has become a behemoth in tech with lucrative positions in multiple markets. The company’s success is mainly thanks to consistent reinvestment in its business and a constant eye on the future.

Microsoft’s success has made it a cash cow, with its operating income and free cash flow skyrocketing 288% and 212% over the last decade. In fact, the tech giant hit $74 billion in free cash flow this year, proving it has the funds to continue expanding its business and keep up with its competitors.

Significant cash reserves allowed Microsoft to get a head start in the budding AI market, investing $1 billion in ChatGPT developer OpenAI in 2019. That figure has since grown to $13 billion, granting the company access to some of the most advanced AI models available.

The partnership has boosted Microsoft’s business as it has integrated AI into its productivity software and cloud services. Recent earnings reflect the company’s success in the industry, with revenue rising 16% year over year in fiscal 2024 and operating income up 24%. The most impressive growth came from its cloud platform, Azure, which posted revenue gains of 20% for the year while operating income soared 31%.

In addition to AI, Microsoft has a solid position in personal computers, gaming, and digital advertising. The company’s diverse business model makes it less vulnerable to macroeconomic headwinds than many of its peers, proven by consistent growth over the last decade and annual revenue that has increased by 162% since 2014.

Microsoft’s forward P/E of 30, along with its expanding cash hoard and potent position in tech, make its stock worth its price for anyone willing to hold long into the future.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Want to Get Richer? 2 Best Stocks to Buy Now and Hold Forever was originally published by The Motley Fool