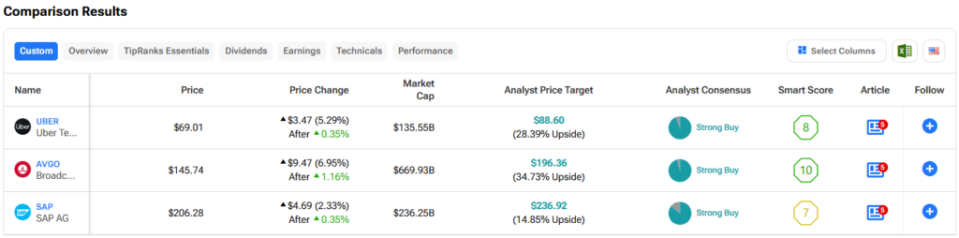

UBER, AVGO, SAP: Which “Strong Buy” Tech Stock Has Most Upside?

As the technology sector takes on “extra” damage as the broader markets roll over for August, growth-hungry bargain hunters may wish to consider the following bruised high-tech names—UBER, AVGO, and SAP—while they’re markedly cheaper than they were just two weeks ago. Undoubtedly, the summer market sell-off seems to have arrived a month or so early (typically, September is usually the ugliest month for stocks).

Therefore, perhaps the following Strong Buy-rated tech names are worthy of your attention. Let’s check with TipRanks’ Comparison Tool to compare the names as the market choppiness drags on.

Last week’s weak jobs data was quite terrible, and it’s been causing pressure on markets. However, there may be nothing more to fear about renewed recession worries than the fear itself. Sure, consumer sentiment, preferences, and habits have changed in sudden and mysterious ways in recent years in response to inflation and other pressures.

However, Uber’s latest quarter seems to suggest the consumer is just fine. In light of Uber’s incredibly strong results and return to profitability, I can’t help but stay bullish on the stock.

Uber’s latest quarter caught many by surprise. After all, a sluggish economy should mean that fewer people are willing to splurge on ride-hailing services, right? In a prior piece, I noted that the ride-hailers were actually more economically resilient than many gave them credit for.

Have Uber Eats and rides gotten pricier of late after all this inflation? Definitely. However, it’s still cheaper to “Uber” a ride than to own a car. With all the insurance, parking, gas money, maintenance, and other hidden costs, there should be no mystery why Uber stock has been doing well, even if the economy seems to be running on empty.

With trips and food delivery up 23% and 8%, respectively, and profits back in the books, Uber stock looks like a buy on the way up. Whether or not the consumer is in for relief or more pain, Uber stands out as a service that consumers still value highly in this challenging environment.

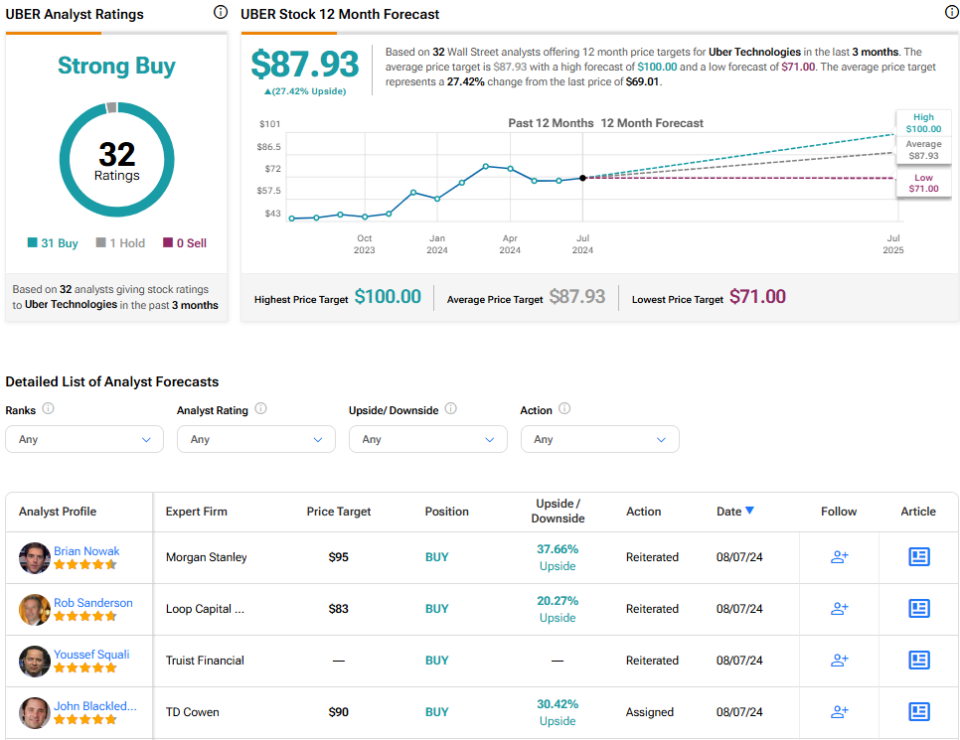

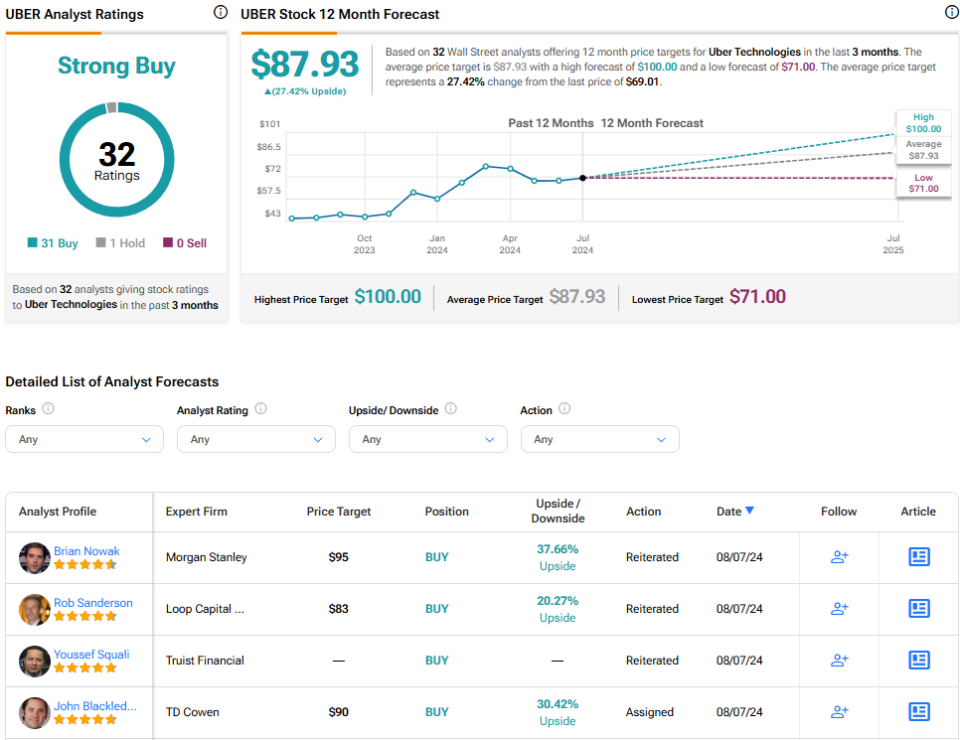

What Is the Price Target for UBER Stock?

UBER stock is a Strong Buy, according to analysts, with 31 Buys and one Holds assigned in the past three months. The average UBER stock price target of $87.93 implies 27.4% upside potential.

Broadcom was caught at the center of the blast zone amid the latest market-wide sell-off and likely soon-to-be correction. The biggest semiconductor winners are giving back a huge chunk of the gains enjoyed in recent months. Where some see an AI bubble, I see nothing more than a correction. In fact, it’s a healthy one when it comes to AVGO, which spiked upward back in June. Even after the 22% plunge, AVGO stock is still up around 10% since the start of June. There’s nothing fundamentally wrong with the Broadcom story or the stock. As such, I’m staying bullish.

Back in early August, Rosenblatt analyst Hans Mosesmann hiked his price target in the name by a whopping 45% (to $2,400 from $1,650), praising the firm for its AI infrastructure and networking businesses. Projecting out to Fiscal Year 2026, Mr. Mosesmann thinks high-teens growth will be in the cards. I think he’s spot-on to pound the table on the name. That said, the upgrade came right before AVGO stock plunged into a nasty bear market.

So, what has changed since the notable upgrade? Other than the price of admission and investors’ newfound distaste for AI stocks, not a heck of a lot. Once investors fall back in love with AI stocks, I don’t think a rebound won’t be too far off for AVGO. At 22.6 times forward price-to-earnings (P/E), the stock trades in line with the semiconductor industry average of 22.3 times, making it reasonably valued.

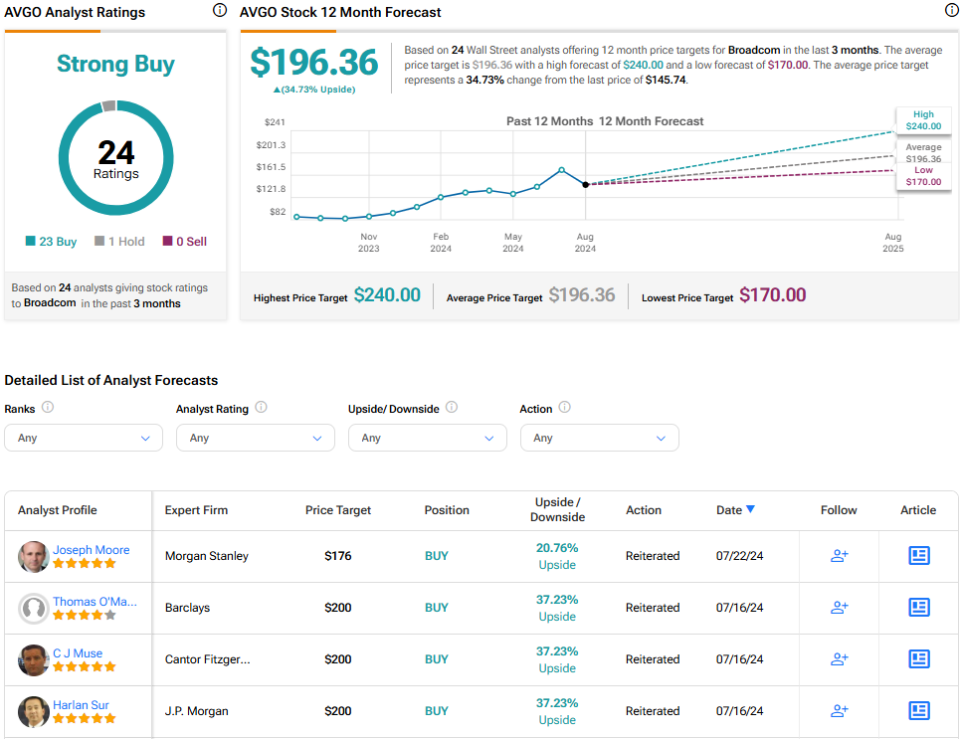

What Is the Price Target for AVGO Stock?

AVGO stock is a Strong Buy, according to analysts, with 23 Buys and one Holds assigned in the past three months. The average AVGO stock price target of $196.36 implies 34.7% upside potential.

Shares of German enterprise software firm SAP have been one of the resilient tech firms amid the brutal correction in the tech-heavy Nasdaq 100 (NDX). At writing, the stock is down just 5% from its all-time high, while the S&P 500 (SPX) is one bad day away from falling into a correction itself. As a recently discovered AI winner who’s seemingly achieving a strong balance between savings and investment, I view SAP as one of the AI stocks that can dodge and weave past punches thrown in the Tech sector’s way. As such, I’m staying bullish on the name.

After its latest earnings, SAP announced mass layoffs as part of its restructuring plans. With 9,000-10,000 jobs to be cut, investors have the right to be nervous. After all, Intel’s (INTC) latest layoff was met with a historic meltdown in the stock. While layoffs will always be unfortunate and disappointing to hear about, investors seem somewhat enthused that such cuts will cost €3 billion ($3.26 billion) but increase 2025 estimated profits from €10 billion to €10.2 billion.

And unlike Intel, things seem to be going well over at SAP, with a cloud migration moving along and AI bets (think its enterprise AI copilot named Joule) that could pay off long term.

Berenberg’s Nay Soe Naing believes SAP “will be one of the most resilient software names in the second half,” and he’ll probably be proven right. SAP stock has already been resilient in the first month of the year. And as the firm takes a cost-conscious approach while continuing to innovate on AI, it’s giving investors exactly what they want: deliberate AI investment that won’t break the balance sheet.

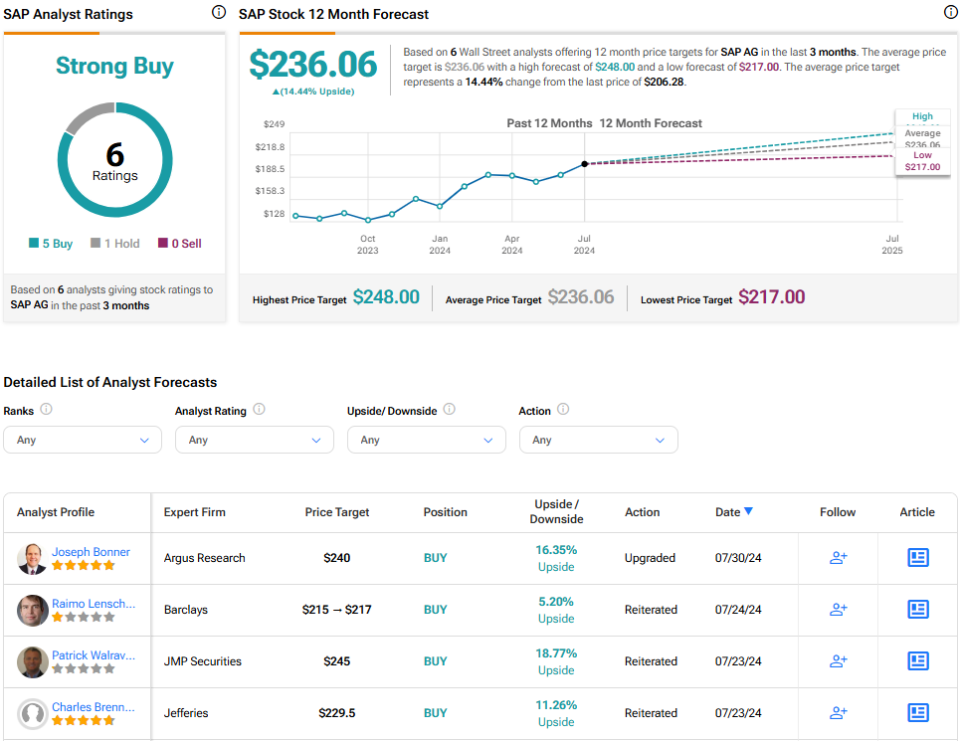

What Is the Price Target for SAP Stock?

SAP stock is a Strong Buy, according to analysts, with five Buys and one Hold assigned in the past three months. The average SAP stock price target of $236.06 implies 14.4% upside potential.

Conclusion

Don’t let the tech correction scare you out of high-quality growth stocks that have what it takes to keep on gaining. Whether we’re talking about Uber and its return to growth and profits in a tough environment, Broadcom and its still-hot AI tailwinds, or SAP and its resilience in software, the following trio seem more than worthy of their Strong Buy recommendations.

Of the three, analysts see AVGO stock as having the most room to run, with a whopping 34.7% in implied upside from current levels. I’m inclined to agree that AVGO is the best bet while AI stocks are out of favor.