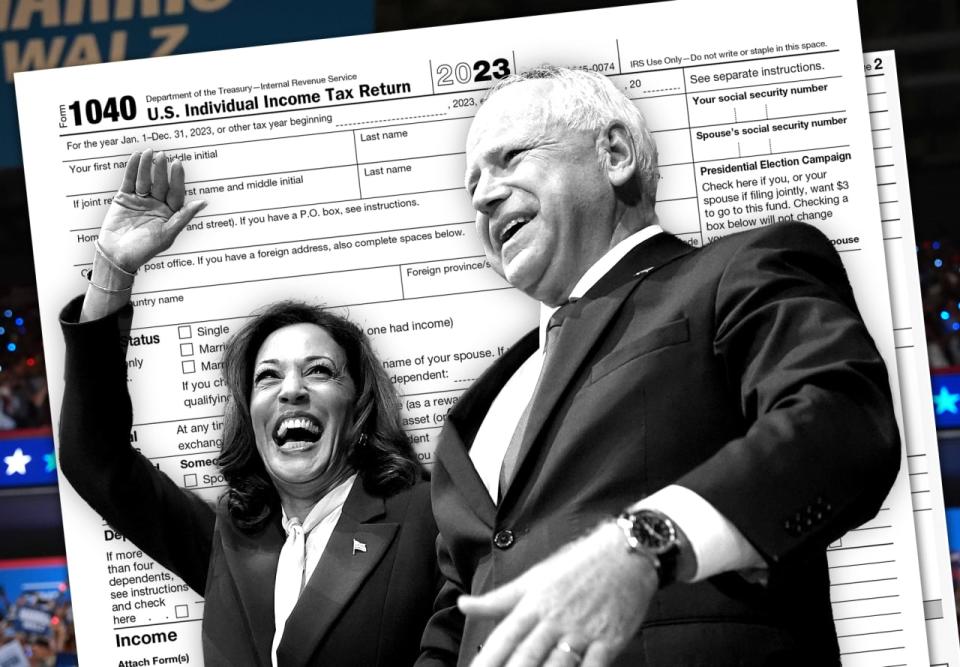

Tim Walz created ‘the most progressive tax system in the country’ as Minnesota governor. Does that hint at Kamala Harris’s 2025 tax plans?

As Minnesota’s governor, Tim Walz has signed off on tax relief for low-income families while increasing state tax bills for rich households and corporations.

Sound familiar? For voters trying to understand where the Democrats on a reshuffled presidential ticket stand on taxes, it may be déjà vu all over again.

Most Read from MarketWatch

While Donald Trump, the former president and Republican candidate for a third straight presidential election, has talked about lowering taxes up and down the income ladder, his onetime rival in the 2024 campaign, President Joe Biden, pledged tax increases only for the well-off, which he defined as people who make more than $400,000 a year.

Vice President Kamala Harris picked up the Biden pledge after he bowed out of the race, though questions remain about the remainder of her tax-policy views. Now the newly minted Democratic nominee has chosen Walz as her running mate in an election that will happen one year before key provisions of the Republican tax-code overhaul of 2017 expire.

A presidential candidate’s pick for vice president is widely seen as a campaign’s first major decision — and, when it comes to taxes, the Walz selection may cement the view that Harris is poised to dial up taxes on wealthy taxpayers and businesses.

But if a Harris White House needed to hatch a tax deal with congressional Republicans, some analysts say, Walz, a House lawmaker from 2007 to 2019, could help with the across-the-aisle pitch.

At the very least, there’s a lot of overlap in the ways Harris and Walz talk about taxes. “I think they are very symbiotic on those issues,” said Henrietta Treyz, managing partner and director of economic policy at Veda Partners, a policy-research firm for institutional investors.

The pair have voiced campaign-trail zingers suggesting the tax code is too lenient at the top.

Trump “sat at his country club up in Mar-a-Lago, wondering how he can cut taxes for his rich friends,” Walz said in a Philadelphia speech, his first as Harris’s running-mate pick. A day later in Detroit, Harris said Trump “intends to give tax breaks to billionaires and big corporations.”

Trump has said he wants to extend the 2017 tax cuts — which Democrats and other critics say heavily favored big business and rich households — and has promised “massive tax cuts for workers.” As for his opponents, Trump said at a Thursday press conference at Mar-a-Lago, his membership club and personal residence in Florida: “Between her and him, there’s never been anything like this,” Trump said, according to the Associated Press. “There’s certainly never been anybody so liberal like these two.”

Where does Tim Walz stand on taxes?

Labels like “liberal” and “progressive” may get tossed around in politics, but “progressive” has a precise meaning for taxes: It means that tax rates become progressively higher as one moves up the income scale.

Here, both supporters and critics of Walz say he’s been progressive as Minnesota’s governor.

“As governor, Walz had one of the most progressive tax records in the country,” said Jared Walczak, vice president of state projects at the Tax Foundation, a right-leaning think tank. That’s also in comparison with fellow vice-presidential contenders including Pennsylvania Gov. Josh Shapiro, he added.

“Gov. Walz stands out for his willingness to raise taxes multiple times when most states were cutting them,” Walczak said, pointing to increases like a 1% tax on net investment income of high earners, an upcoming 2026 payroll tax to fund the state’s paid family- and medical-leave program and rules raking in more corporate tax dollars from foreign earnings.

“Vice presidents rarely set policy,” Walczak said. “But it’s notable that Vice President Harris chose a significant outlier on state tax policy.”

If states’ taxes are too high, rich people and businesses may take their money and their jobs elsewhere, Walczak and other right-leaning critics worry.

Seventeen Minnesota-headquartered companies rank among the Fortune 500.

Between 2021 and 2022 — the year before big tax changes in Minnesota’s biannual budget were enacted — the North Star State lost a net 13,455 residents, who took $2.19 billion in adjusted gross income with them, according to a Tax Foundation analysis of Internal Revenue Service records. That migration put Minnesota closer to states like California and New York, which showed the biggest residential outflows.

The argument that taxes cause rich households to flee doesn’t hold water for Amber Wallin, the executive director of the State Revenue Alliance, a network of groups that wants wealthy taxpayers and businesses to pay more in state taxes so families and children can benefit.

“Big picture: Minnesota’s tax system is really one that is leading the way among the states in how to center children and working families,” she said. Minnesota’s child tax credit of $1,750 per child is easily the largest state-level child tax credit in the country, she said.

With Walz, Harris picked a person “who led tax reform in Minnesota that has helped make Minnesota one of the most progressive states in the nation,” according to Wallin.

Minnesota is now one of six states where the lowest-income families pay the lowest state and local taxes as a share of income, according to the Institute on Taxation and Economic Policy, a left-leaning think tank.

Tim Walz’s record on taxes as a congressman and governor

Walz was a six-term member of the U.S. House of Representatives before his 2018 election as Minnesota’s governor. In the House, he voted toward the center on taxes, according to analysts at Bloomberg Intelligence. When he co-sponsored tax bills, 91 were written by Democrats and 78 were written by Republicans, said the note from Andrew Silverman, a senior government analyst.

Walz joined other Democrats in voting against the 2017 Tax Cuts and Jobs Act, records show. The Trump tax cuts lowered most tax rates, doubled the child tax credit to $2,000 and boosted the standard deduction. It also doubled the estate-tax exemption and permanently cut the corporate income-tax rate to 21% from 35%.

Results included a significantly widened federal budget deficit and a surge in corporate stock buybacks, according to critics.

As governor, Walz’s big year for taxes was last year.

Low- and middle-income families wound up with a child tax credit of up to $1,750 per child. The credit gradually phases out for individuals if their income is more than $29,500, and for married couples filing jointly if their income is over $35,000. The credit is “notable for how targeted it is,” Walczak said. “It’s very generous for lower-income earners.”

Walz also lightened the tax burden for retirees by letting them deduct their Social Security benefits from their income for tax purposes. The formula’s threshold applied to single filers making under $78,000 and married couples making less than $100,000.

Other states were already exempting Social Security income, and the move “better aligns Minnesota with most of its peers,” Walczak said.

Trump recently said senior citizens shouldn’t be paying federal income tax on their Social Security benefits.

Under Walz, households now have a 1% tax on net investment income over $1 million. That includes interest, dividends, capital gains, and rental and royalty income. Minnesota tax filers making over $220,650 also now have fewer ways to reduce their taxable income through itemized or standard deductions.

Was Walz pragmatic or partisan? Doug Loon, the Minnesota Chamber of Commerce’s chief executive, said he’s seen both sides.

There was a time, after the pandemic, when the state’s trust fund for unemployment insurance was running low. A dip past a certain point could have triggered tax increases, Loon said. Instead of putting more taxes on businesses, Walz worked in a divided legislature to replenish the fund with leftover COVID-19 federal relief money.

“When that situation arose, he was able to craft a deal. He has shown the ability to do that in a divided political environment,” Loon said.

But in the lead-up to the 2023 budget, when Democrats controlled the state legislature, Loon’s organization and the business community pushed back on tax proposals, particularly the payroll tax, he said. It’s a tax on workers and employers, and a potential drag on productivity in a tight labor market, he said.

“There was no interest to try and find middle ground. It was all about tax increases to follow through on spending increases,” Loon said.

That’s a worry, he said, because it’s a “level of new spending that is unsustainable for the state’s long-term economic interests.”

There are limits to reading the tax tea leaves

Don’t get carried away with scouring Walz’s tax record for hints of Kamala Harris’s potential future policies, said Jon Traub, managing principal at Deloitte Tax.

Yes, the pair “have previously indicated favoring a more progressive tax code,” he said. But “it is likely that taxes played a small role — at most — in why Vice President Harris tapped Gov. Walz to be her running mate.”

It’s not clear what sway Walz would have in a Harris administration, Silverman’s note said. But he could be “a moderating tax force.”

“I would not expect Walz to be a major figure on the tax scene in 2025,” Treyz added.

But if Walz gets to the White House, Treyz said, the former high-school teacher and football coach may be involved in consensus building on parts of the tax code where both parties are willing to play ball. Those include the future of the child tax credit and certain clean-energy credits, where Walz could be “a helpful voice.”

The two have struck harmony already in their willingness to tax wealthy taxpayers and businesses for the aid of families, she said. It’s “something they are firmly in alignment on.”

What personal-finance issues would you like to see covered in MarketWatch? We would like to hear from readers about their financial decisions and money-related questions. You can fill out or write to us at . A reporter may be in touch to learn more. MarketWatch will not attribute your answers to you by name without your permission.