This 7%-Yielding Dividend Stock Continues to Grow Stronger

Enterprise Products Partners (NYSE: EPD) offers investors a lucrative passive income stream. The master limited partnership’s (MLP) distribution currently yields around 7%. That’s several times higher than the S&P 500’s 1.3% dividend yield.

That high-yielding payout is on an increasingly strong foundation, which was clear in the MLP’s second-quarter report.

Strength all around

“Enterprise reported a solid second quarter in terms of both volumes and cash flow generated by our integrated midstream system,” stated CEO Jim Teague in the earnings press release. He noted that the company handled near-record volumes across its systems in the second quarter, which is typically a seasonally weak period. Its total volumes rose 5% compared to the second quarter of last year.

The company’s rising volumes helped fuel an 11% increase in its adjusted cash flow from operations, which rose to $2.1 billion. That was enough cash to cover the company’s high-yielding payout by a comfy 1.6 times, even after increasing it by 5% over the past year (the 26th straight year of growing the distribution). This healthy coverage level enabled the MLP to retain $661 million in cash, which it used to fund organic expansion projects while maintaining a strong balance sheet. The company ended the period with a 3.0 times leverage ratio, putting it in the middle of its conservative target range. That low leverage ratio is one of the reasons why it has one of the highest credit ratings in the midstream sector.

Enterprise Products Partners’ financial flexibility enabled it to fund $1 billion of growth capital projects in the period. Its investments in expanding its operations helped contribute to its higher results in the second quarter. It has added four new natural gas processing plants in the Permian Basin and its 12th natural gas liquids fractionator at its Mont Belvieu complex over the past year.

More growth is coming down the pipeline

Enterprise Products Partners’ cash flow should continue growing in the coming years. In the first quarter, the company completed a comprehensive turnaround at one of its petrochemical plants, which should enhance its reliability and improve its utilization rates. It opted to complete similar maintenance projects at another plant to capitalize on scheduling efficiencies. Once completed, these projects should boost its volumes, margins, and cash flow.

Meanwhile, the company has about $6.7 billion of major capital projects currently under construction, including new natural gas processing plants, pipeline expansions, and export capacity additions. They should come online through 2026. These commercially secured, fee-based projects “provide visibility to future earnings and cash flow growth,” stated Teague in the earnings press release.

The company plans to invest $3.5 billion to $3.75 billion on growth capital projects this year, another $3.25 billion to $3.75 billion in 2025, and $2 billion to $2.5 billion in 2026. It can easily afford those spending levels while covering its lucrative cash distributions to investors. Enterprise Products Partners has generated $8.4 billion of adjusted cash flow from operations over the past year, amply covering its $4.1 billion investment level in that period. With its cash distributions running at a $4.4 billion annualized rate, the company can easily handle its current investment and distribution outlays, given the flexibility afforded by its fortress-like balance sheet.

With its expansion projects on track to grow its cash flow for the next few years, Enterprise Products Partners should have no trouble continuing to increase its payout. It has raised its distribution twice already this year by a 5% annual rate, driving its growth streak past the quarter-century mark.

A top-notch passive income investment

Enterprise Products Partners continues to deliver solid operating and financial results, further enhancing the long-term sustainability of its high-yielding distribution. With more growth coming down the pipeline, the MLP remains a rock-solid option for those seeking a growing passive income stream (and are comfortable receiving a Schedule K-1 Federal tax form each year).

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

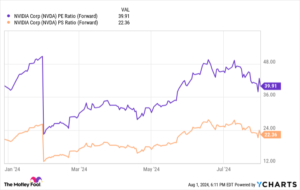

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $683,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Matt DiLallo has positions in Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

This 7%-Yielding Dividend Stock Continues to Grow Stronger was originally published by The Motley Fool