The classic signs of a stock-market bottom aren’t yet in. Here’s what to watch, says JPMorgan

U.S. stock index futures are higher early Tuesday after the ugliness on Monday that sent the S&P 500 SPX to its worst single-day performance in nearly two years. Over three sessions, the S&P 500 index lost 6%, the Nasdaq Composite slumped 8%, and the Russell 2000 dropped 10%.

That’s what fears of a U.S. recession as well as the Bank of Japan raising interest rates and smashing the yen carry trade can do. So the question now is whether the worst is behind the market.

Most Read from MarketWatch

Thomas Salopek, head of cross-asset strategy at JPMorgan, says the answer to that million-dollar question is no. He says the full ingredients for a market bottom are not in yet.

First, he says, it is a “legitimate” pullback, which is confirmed by widening credit spreads, the Treasury yield curve steepening and the outperformance of utilities XLU over the broader market. The same things that hurt other sectors — such as a slowdown in economic growth or disinflation cutting into margins — help utilities and other defensive sectors, which benefit from lower interest rates. “The growth outperformance of the second quarter suggested an economic slowdown while the third-quarter defensive leadership suggests growth risk,” says Salopek.

Salopek also dismisses the more upbeat view of labor market data that suggests the rise in the unemployment rate reflects labor supply increasing. “If so, one would expect unemployment to flatten and not keep ticking up as it has,” he says, though Hurricane Beryl complicated the most recent number.

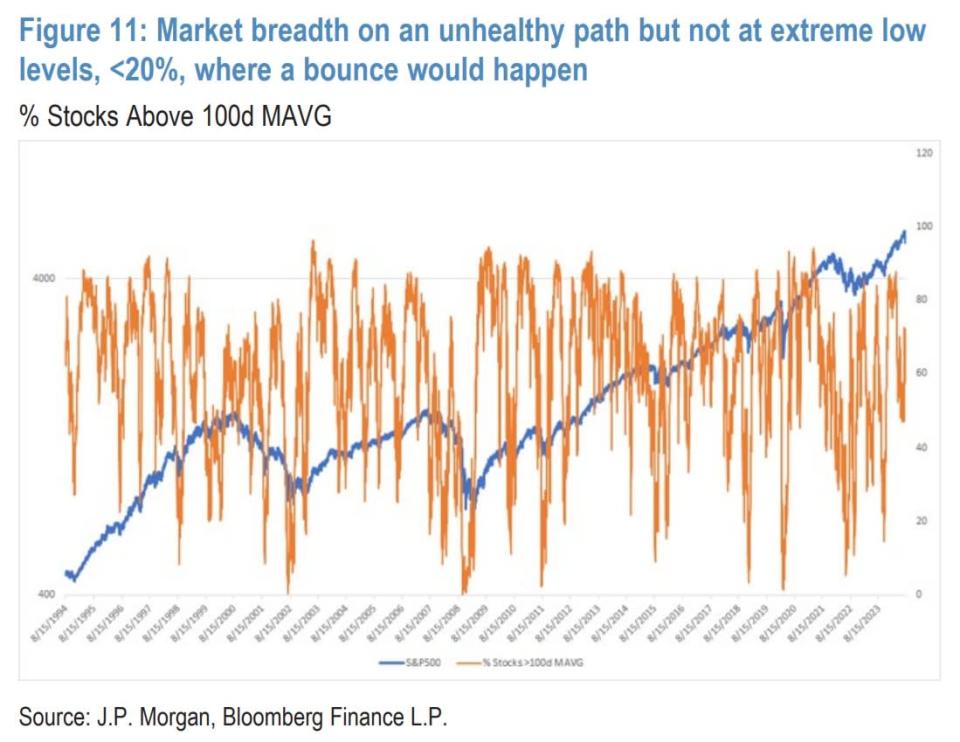

Since the next jobs number is a month away, investors have to turn to technical and risk-based signals — and they’re not flashing a bottoming signal, he says.

For one, stocks don’t bottom while the VIX VIX is closing at highs, though it should be said the fear gauge has dropped sharply in the early hours of Tuesday.

The slope of the 20-day moving average also does not offer reassurance, and he said getting above that is “a minimum starting point.” Also, the put/call ratio often hits highs at market lows, he says.

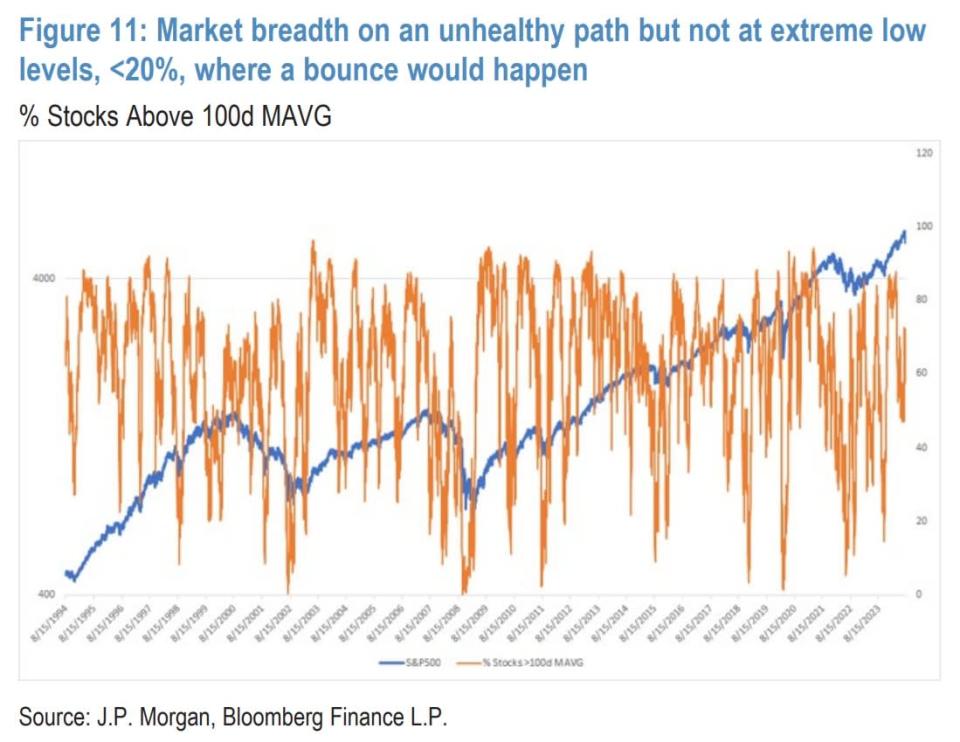

The percent of stocks above their 100-day moving average for the Nasdaq is 34%, “and we would look for this to get to 20% before watching it closely,” he says. The percent of stocks at four-week lows similarly is nowhere near the 60% in earlier corrections. He adds he’ll closely watch the American Association of Individual Investors sentiment survey, which sent a strong signal in the fall 2022 when sentiment was worse than the trough of the COVID crisis.

“Looking at the longer run history of these bottoming signals during market corrections, we find that a number of the indicators mentioned show up together, and seeing a confluence of these help pinpoint the best time to re-enter,” he says. For now, he said to remain underweight stocks and wait for things to get bad enough to signal capitulation.

The market

Stock index futures ES00 NQ00 are higher early Tuesday, though not nearly by enough to offset Monday’s decline. The yield on the 10-year Treasury BX:TMUBMUSD10Y ticked up by 7 basis points. Cryptocurrencies, and crypto plays including MicroStrategy MSTR and Coinbase Global COIN, rallied.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5186.33 |

-5.07% |

-6.94% |

8.73% |

14.78% |

|

Nasdaq Composite |

16,200.08 |

-6.74% |

-11.97% |

7.92% |

15.76% |

|

10-year Treasury |

3.849 |

-29.00 |

-45.20 |

-3.19 |

-18.41 |

|

Gold |

2453.4 |

3.02% |

3.68% |

18.42% |

24.43% |

|

Oil |

73.09 |

-3.73% |

-11.10% |

2.47% |

-11.37% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

Uber Technologies UBER shares rose 4% as the ride-hailing company reported stronger-than-forecast earnings on a slight revenue beat. Construction equipment maker Caterpillar CAT also beat earnings estimates.

Palantir Technologies shares PLTR jumped after the company surpassed revenue expectations.

Lucid Group stock LCID jumped as the electric vehicle maker got a $1.5 billion commitment from Saudi Arabia’s sovereign wealth fund.

After the close, Super Micro Computer SMCI and Airbnb ABNB report results. U.S. international trade data highlights a thin economics calendar, and there’s a $58 billion auction of 3-year notes.

Best of the web

It doesn’t look like a recession, but here’s how one could happen.

Google monopoly ruling is just one of many antitrust cases now facing Big Tech.

South Korean firms tell managers to work six days a week .

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

AAPL |

Apple |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AMZN |

Amazon.com |

|

AMD |

Advanced Micro Devices |

|

AMC |

AMC Entertainment |

|

INTC |

Intel |

The chart

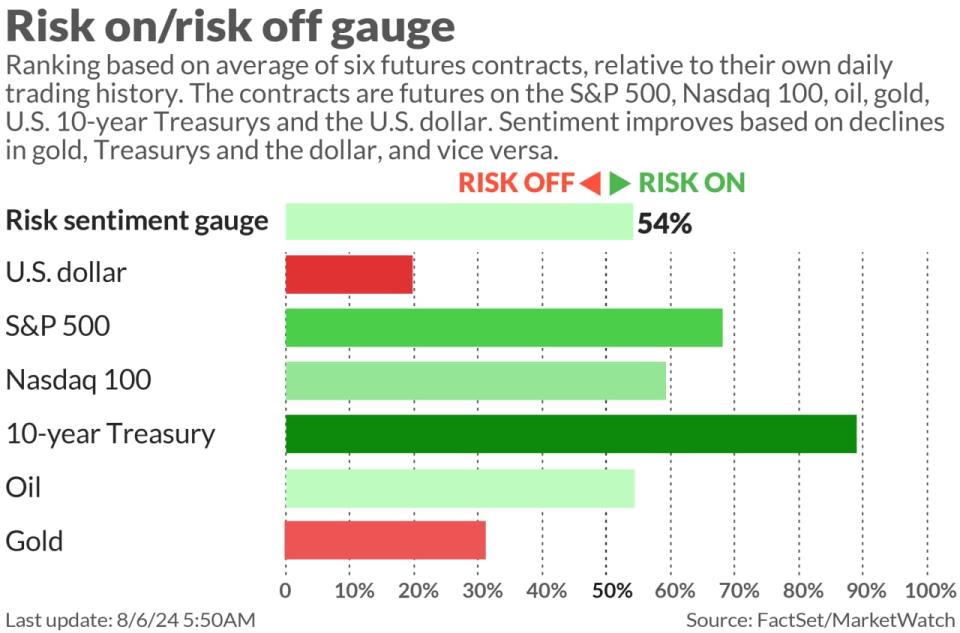

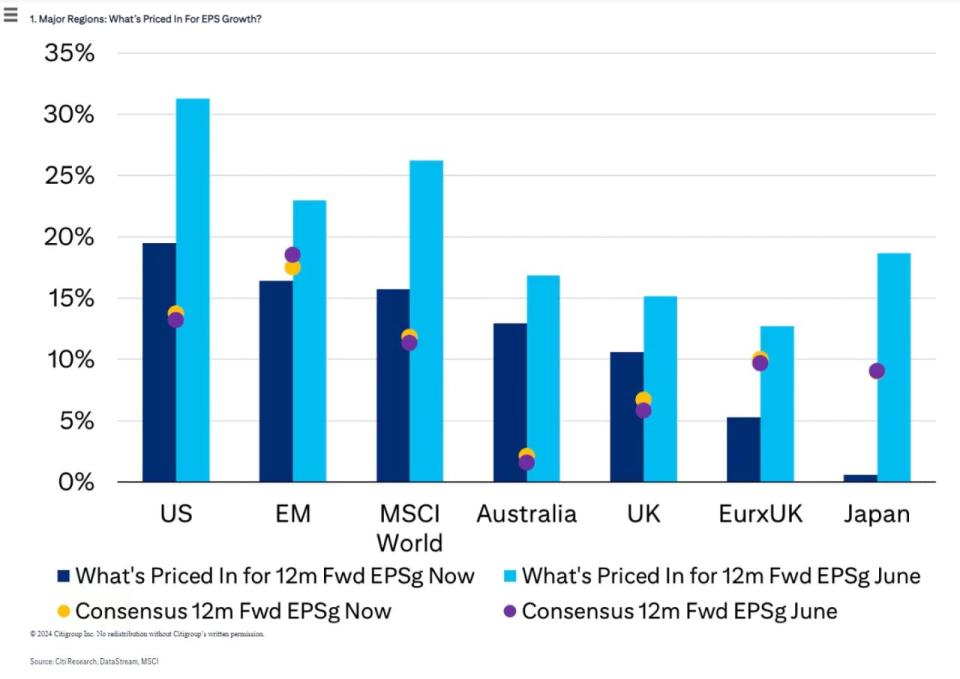

Citi has a model for teasing out what the market expects for earnings per share, and it shows that in every region, growth expectations are lower than they were two months ago. That said, in the U.S., the market still expects earnings above what analysts are expecting. “This implies the U.S. is no longer priced for significant EPS upgrades but is still reliant on delivery of consensus forecasts,” say the strategists. In Japan by contrast, the market now expects no earnings growth, versus the 10% analysts expect.

Random reads

How timekeepers determined Noah Lyles won the 100-meter sprint.

Chipotle fans are bringing their own scales to stores to measure portion sizes.

Hurricane Debby didn’t just bring winds and rain to Florida, but also 25 packages of cocaine.