Super Micro Computer Stock (NASDAQ:SMCI): Very Undervalued with a 0.62x PEG Ratio

Super Micro Computer (SMCI), which specializes in high-performance computing and server solutions, is among the many victims of the tech sell-off. However, with the stock falling, the company’s valuation metrics are starting to look even more attractive, with the price-to-earnings-to-growth (PEG) ratio falling to 0.62x (1.0x or less is generally considered to be undervalued), inferring that the stock is deeply discounted.

Despite the rotation out of tech stock, the supportive trends in artificial intelligence (AI) are set to be sustained. That’s why I’m bullish on this AI enabler.

Super Micro Computer’s Expanding Market

The global AI infrastructure market is set to be one of the fastest-growing sectors in the coming years, and there’s a host of research and forecasts to support this. See below:

-

According to Grand View Research, the global AI infrastructure market will surge from $35.42 billion in 2023 to $227 billion by 2030, representing a compound annual growth rate (CAGR) of 30.4%.

-

A report by ClearML and the AI Research Alliance forecasts the market to reach $309.4 billion by 2031, growing at a CAGR of 29.8% from $23.5 billion in 2021.

-

Precedence Research estimates the market will grow to $421.44 billion by 2033, at a CAGR of 27.53%.

-

Statista data suggests that the broader AI market surpassed $184 billion in 2024 and is expected to exceed $826 billion by 2030.

The rapid growth is driven by several factors, including increased adoption of AI technologies across industries, advancements in machine learning and deep learning, and the rising demand for cloud-based AI services. The hardware segment, particularly specialized chips and processors for complex AI computations, is expected to play a crucial role in this expansion.

How Does Super Micro Fit In?

Super Micro plays a crucial role in the AI industry by providing high-performance, energy-efficient server solutions tailored for AI workloads. The company has strategically positioned itself as a leader in AI infrastructure, leveraging its strong partnerships with key players like Nvidia (NVDA) to deliver cutting-edge technology faster than many competitors. It’s very much an innovation-focused firm with a first-to-market strategy.

Super Micro’s offerings include AI-optimized servers equipped with powerful GPUs (Graphics Processing Units) and specialized AI accelerators, which are essential for handling the complex computations required by AI applications. This focus on AI has resulted in more than 50% of Super Micro’s revenue now being AI-related.

One of the company’s strongest offerings is its liquid cooling technology. This allows servers to handle the intense heat generated by high-performance AI workloads more efficiently than traditional air cooling. The liquid cooling solutions can reduce electricity costs for cooling infrastructure by up to 92% and overall data center electricity costs by up to 51%. It also means servers can work at optimum temperatures.

Why Is Super Micro Stock Down?

Super Micro stock is actually down more than $530 per share since peaking in March — that’s a 43% decline. Essentially, the market is unsure just how big this AI tailwind is, and the steady decline in April has been exacerbated by a rotation away from technology stocks in July.

One significant trigger for the rotation was the disappointing earnings reports from major tech companies like Alphabet (GOOGL) and Tesla (TSLA), which caused a ripple effect across the sector. These results led to a broader market correction as investors reassessed the high valuations that tech stocks had reached amid the AI boom

Regarding Super Micro specifically, the lack of preliminary results for its fiscal third quarter was a major catalyst for its stock’s decline. The company’s Q4 results are due on August 6, and to date, there have been no preliminary results. Since the AI boom started almost 24 months ago, Super Micro has provided early insights into its financial performance — and they’ve been positive — and the absence of such information may be contributing to the sell-off.

Super Micro’s Unmissable Valuation

Super Micro’s valuation metrics have become more attractive as the share price has come down. For context, there have been no downward revisions of expected earnings in the last 90 days, and there have been 12 upward revisions during that period.

The stock is currently trading at 29 times forward earnings. That’s obviously more than we’d expect to pay for your average S&P 500 (SPX) stock, but not by much. However, the company’s expected earnings growth is significant, and this takes the price-to-earnings (P/E) ratio down to 20.5x for 2025 and 16.4x for 2026.

Moreover, analysts are forecasting an annualized growth rate of 47.9% over the medium term. In turn, this leads to a PEG ratio of just 0.62x. This infers that the stock is deeply undervalued.

Is Super Micro Stock a Buy, According To Analysts?

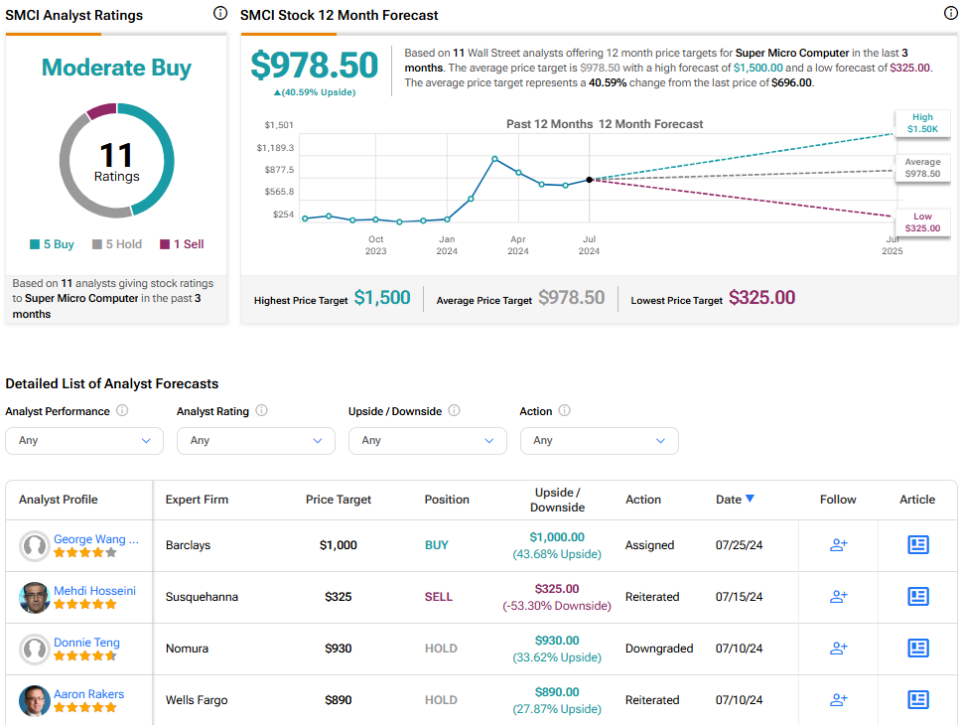

On TipRanks, SMCI comes in as a Moderate Buy based on five Buys, five Holds, and one Sell rating assigned by analysts in the past three months. The average Super Micro Computer stock price target is $978.50, implying 40.6% upside potential.

The Bottom Line on Super Micro Computer Stock

The average share price target for SMCI stock, coupled with the PEG ratio, infers that the sell-off has been too severe. With supportive long-term trends in the sector and a track record for innovation, I’m bullish on Super Micro Computer and expect to see the stock recover in the coming quarters.