Stocks Waver With Mideast Risk, US Data in Focus: Markets Wrap

(Bloomberg) — European stocks struggled for traction as investors awaited US price data for guidance on the Federal Reserve’s policy path, while rising tension in the Middle East weighed on risk appetite.

Most Read from Bloomberg

The Stoxx Europe 600 erased its early advance, with travel and leisure shares leading declines. US equity-index futures pared gains after a flat day on Wall Street. Brent crude oil hovered near the $82 level it hit on Monday, as the US sees an Iranian attack against Israel as increasingly likely.

The British pound gained and the FTSE 100 index underperformed Europe’s benchmark after data showed UK unemployment unexpectedly fell in the second quarter, complicating the Bank of England’s shift to lower interest rates. US Treasuries and the dollar were steady.

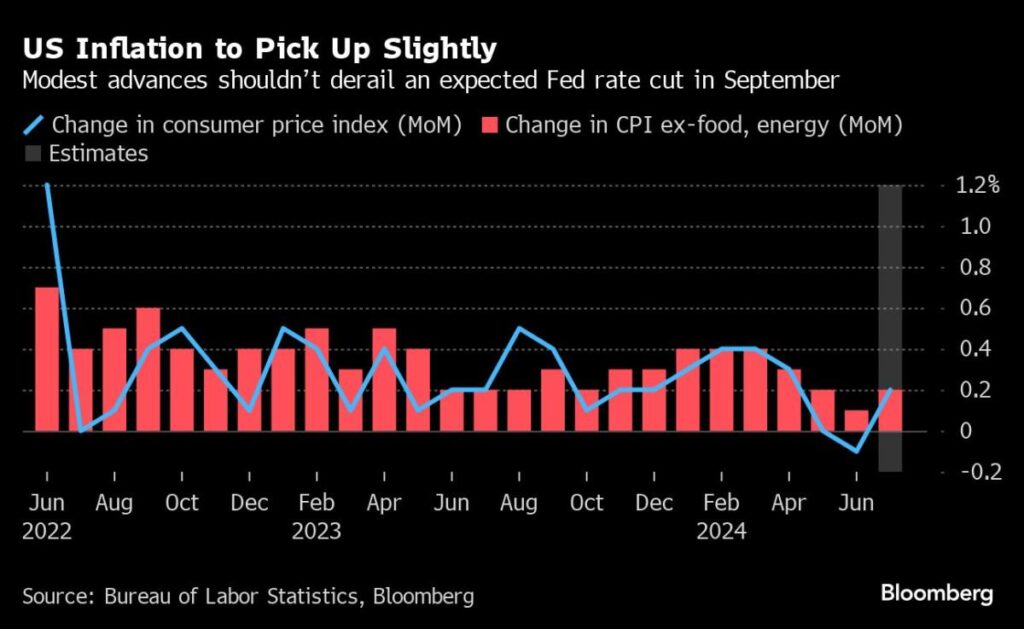

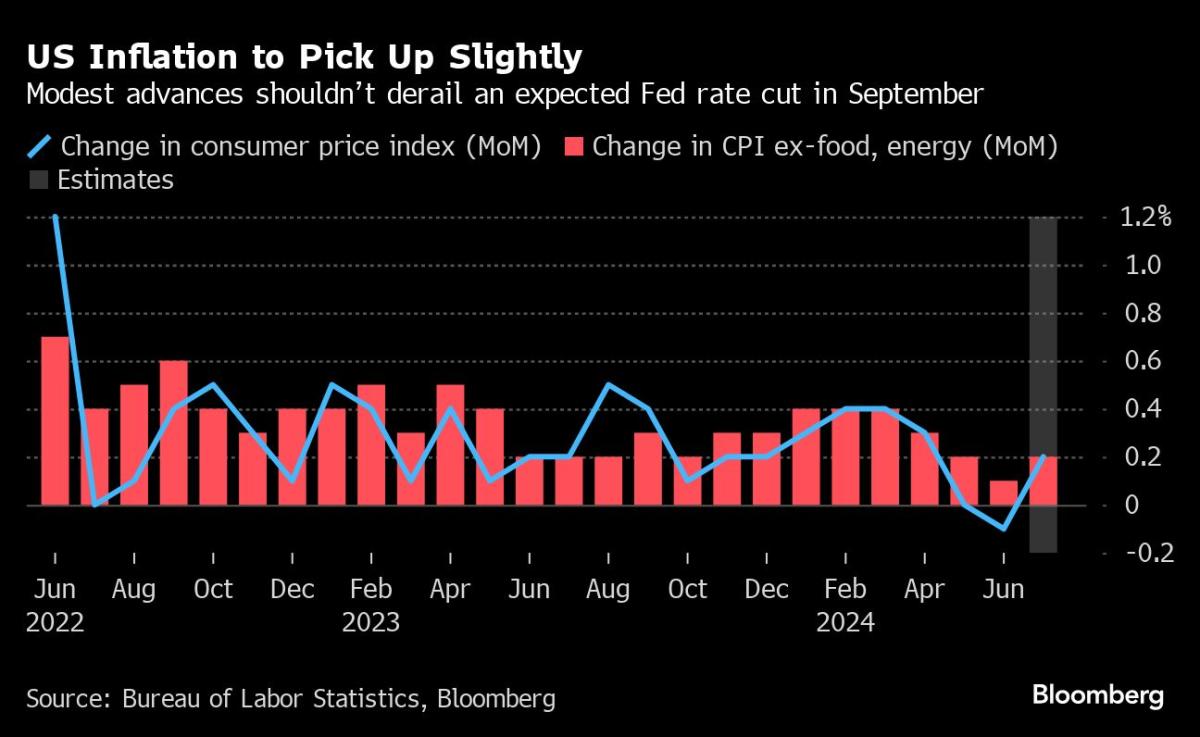

After last week’s turmoil, markets are focusing on Wednesday’s US consumer price index, which may help determine whether the Fed has room secure a soft landing for the economy. The recent rally in crude oil prices also puts the spotlight producer-price numbers later Tuesday, as an indicator of pipeline inflationary risks.

“One could argue that equity is still in recovery mode after last week’s shakeout, and holding out from really putting money to work until we get the key US data this week,” said Chris Weston, head of research at Pepperstone Group Ltd. “Pricing US growth is still the main game in town.”

Traders are monitoring events in the Middle East after the US said an Iranian attack on Israel could be immenent. The implications were underscored by Fitch Ratings’ move to downgrade Israel’s sovereign debt by one notch, to A from A+, while keeping a negative outlook and citing “continued war” and geopolitical risks.

In Asia, Japan’s equities gained after a holiday, as a weaker yen was seen providing support for exporters. MSCI’s Asia-Pacific gauge rose as much as 1%. That erased losses from last week’s tumble, when a risk-off move sent indexes around the world plummeting and the VIX US volatility index above 65 at one point, compared with a lifetime average of around 19.5.

Elsewhere in Asia, regulators told commercial banks in China’s Jiangxi province not to settle their purchases of government bonds, taking some of the most extreme measures yet to cool a market rally that has alarmed Beijing.

The crackdown is beginning to take a toll on corporate debt markets, as the average yield for one-year corporate yuan bonds with AA ratings — typically considered junk debt in the onshore market — saw the largest jump since December 2022.

Key events this week:

-

Germany ZEW survey expectations, Tuesday

-

US PPI, Tuesday

-

Fed’s Raphael Bostic speaks, Tuesday

-

Eurozone GDP, industrial production, Wednesday

-

US CPI, Wednesday

-

China home prices, retail sales, industrial production, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 9:38 a.m. London time

-

S&P 500 futures rose 0.3%

-

Nasdaq 100 futures rose 0.5%

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The MSCI Asia Pacific Index rose 1.1%

-

The MSCI Emerging Markets Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0923

-

The Japanese yen fell 0.4% to 147.75 per dollar

-

The offshore yuan was little changed at 7.1716 per dollar

-

The British pound rose 0.2% to $1.2798

Cryptocurrencies

-

Bitcoin rose 0.3% to $59,061.64

-

Ether fell 1.5% to $2,640.28

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 3.92%

-

Germany’s 10-year yield was little changed at 2.23%

-

Britain’s 10-year yield advanced one basis point to 3.93%

Commodities

-

Brent crude fell 0.4% to $81.93 a barrel

-

Spot gold fell 0.5% to $2,460.13 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Jason Scott and Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.