Stocks See Choppy Trading as Nerves Still Run High: Markets Wrap

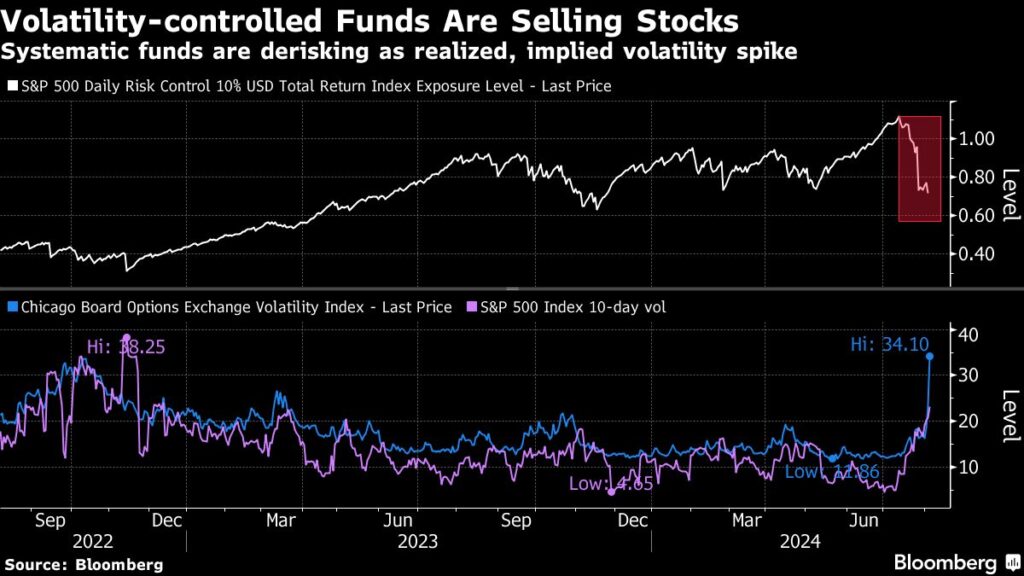

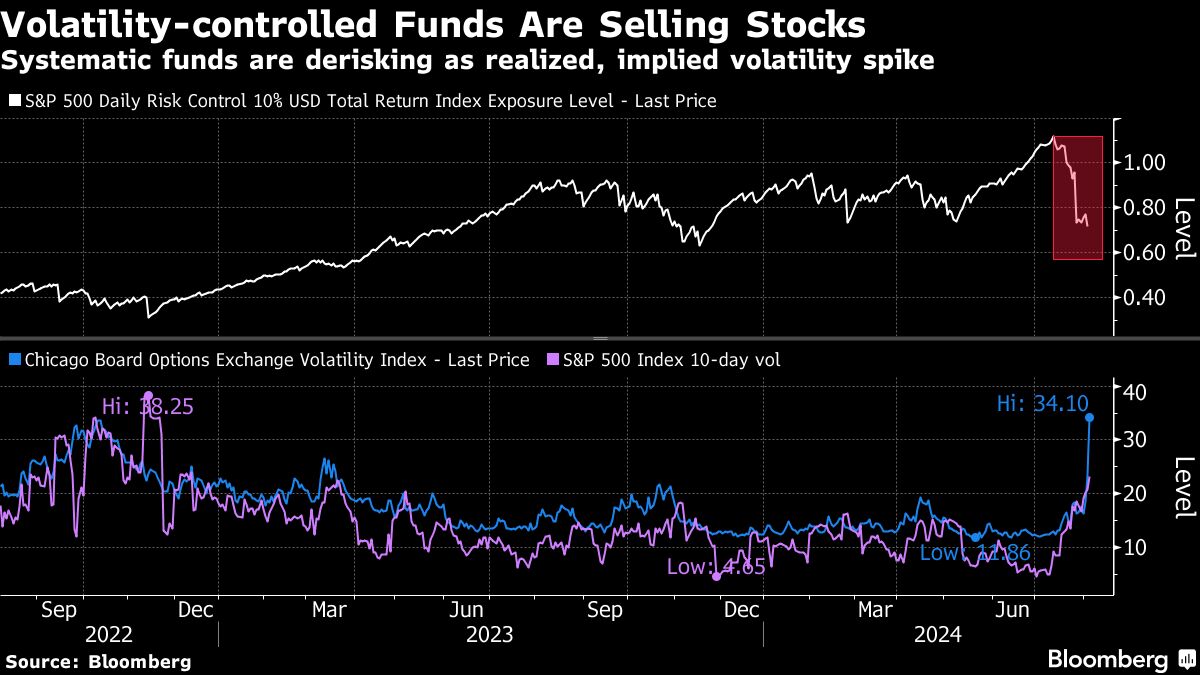

(Bloomberg) — Stocks bounced back after selloff that erased about $6.5 trillion from global markets in the past few weeks.

Most Read from Bloomberg

Equity futures pointed to a higher Wall Street open after the worst rout in almost two years. Institutional investors bought the dip on Monday, while retail were aggressive sellers, JPMorgan Chase & Co. said. Buying US stocks after a slump of the scale witnessed over the past month has usually been profitable, according to Goldman Sachs Group Inc.’s. Since 1980, the S&P 500 has generated a median return of 6% in the three months that followed a 5% decline from a recent high.

US Treasuries fell as demand for haven assets waned globally, with the market now turning to a $58 billion auction as the next test of investor appetite. Traders are also rowing back on expectations of deep cuts from the Fed this year. Swaps point to about 110 basis points of easing through this year, compared to as much as 150 basis points on Monday. An emergency cut as soon as this month has now been ruled out by money markets.

S&P 500 futures rose 0.4%. Caterpillar Inc. said it expects its annual profit will be higher than previously expected, despite seeing slightly lower sales for the full year. Uber Technologies Inc. reported better-than-expected orders in the second quarter, underscoring the continued strength in demand for rideshare and delivery services. Yum! Brands Inc. posted weaker-than-anticipated sales in the second quarter, mirroring trends at major competitors as consumers worldwide cut back on fast food.

The yield on 10-year Treasuries advanced three basis points to 3.82%. The Bloomberg Dollar Spot Index rose 0.4%.

Key events this week:

-

China trade, forex reserves, Wednesday

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.4% as of 8:55 a.m. New York time

-

Nasdaq 100 futures rose 0.4%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The Stoxx Europe 600 fell 0.5%

-

The MSCI World Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.4%

-

The euro fell 0.4% to $1.0911

-

The British pound fell 0.7% to $1.2682

-

The Japanese yen fell 0.3% to 144.63 per dollar

Cryptocurrencies

-

Bitcoin rose 0.7% to $54,764.96

-

Ether was little changed at $2,437.54

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 3.82%

-

Germany’s 10-year yield declined four basis points to 2.15%

-

Britain’s 10-year yield was little changed at 3.87%

Commodities

-

West Texas Intermediate crude fell 0.9% to $72.29 a barrel

-

Spot gold fell 0.7% to $2,393.73 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Robert Brand and Aya Wagatsuma.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.