Stocks Edge Higher in Run-Up to US Inflation Data: Markets Wrap

(Bloomberg) — Stocks struggled to gain traction as traders awaited key inflation data that will help shape the outlook for the Federal Reserve’s next steps.

Most Read from Bloomberg

Equities edged mildly lower after a rebound from Monday’s market meltdown that rattled trading around the world. While the consumer price index probably picked up modestly in July, the annual metrics should continue to rise at a slow pace. The recent easing of price pressures has bolstered Fed officials’ confidence that they can start cutting rates and refocus their attention on the labor market that’s shown greater signs of slowing.

To Chris Larkin at E*Trade from Morgan Stanley, the data will arrive at a key moment for market. In the span of just a few weeks, the discussion has shifted from whether the economy has slowed enough to concerns it may be “getting stuck in the mud,” he said.

“Investors will be looking for the numbers to land in a sweet spot — cool enough that no one will be second-guessing the likelihood of a September rate cut, but warm enough to push aside the recession concerns that have rattled the markets recently,” Larkin said.

During the most-recent turmoil, investors slashed equity allocations at the sharpest pace since the onset of the pandemic, according to Deutsche Bank AG. An analysis of previous growth scares suggests that stock correlations and volatility will “will only gradually recede back to ‘normal,’” said Goldman Sachs Group Inc.’s David Kostin.

“If economic worries abate, “then the recent sell-off represents an opportunity to buy stocks with healthy fundamentals at valuation discounts,” he wrote.

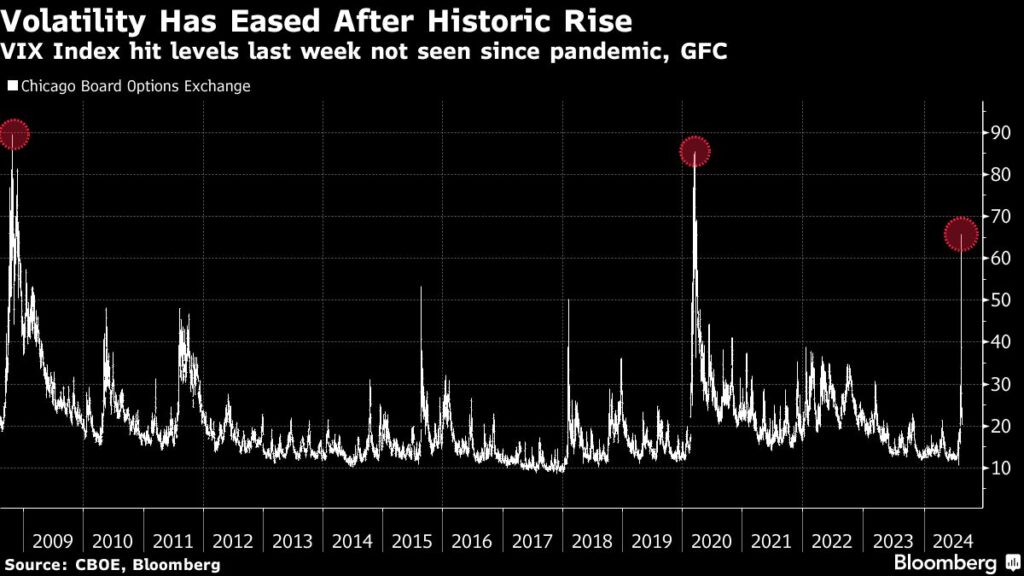

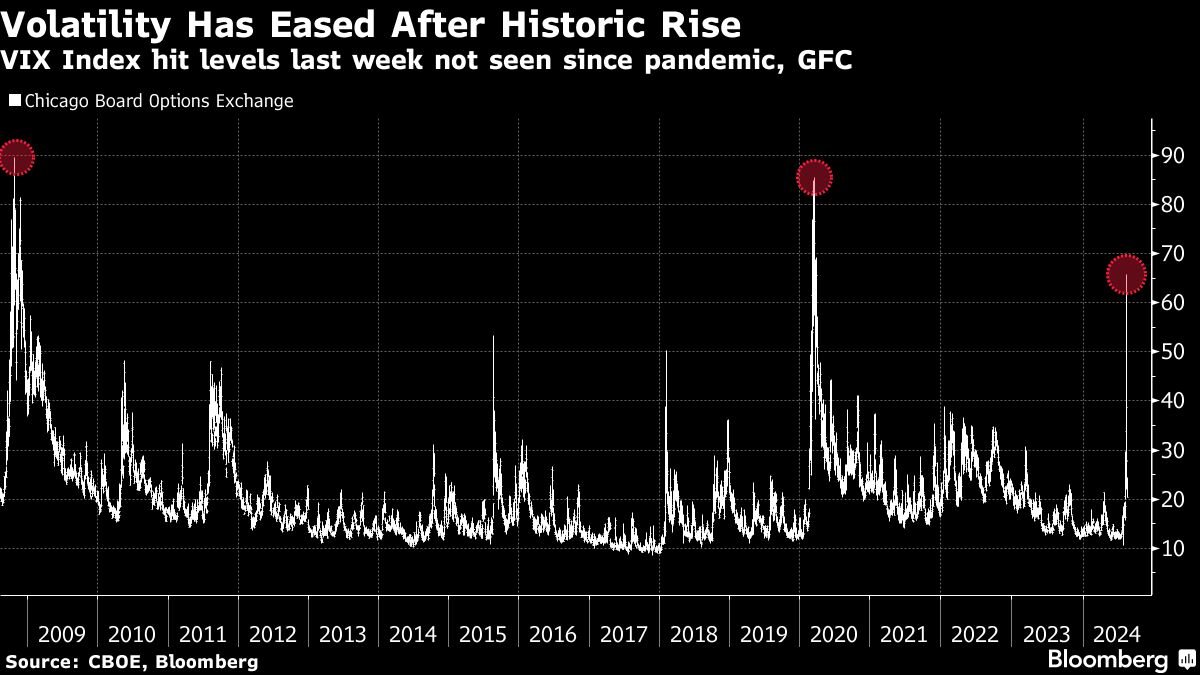

The S&P 500 hovered around 5,335. The Cboe Volatility Index — the VIX — was fairly stable around 20. That’s after an unprecedented spike last week that has raised some questions on whether the index was actually “overstating” all the stress.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

Treasury 10-year yields were little changed at 3.93%.

A double whammy of economic uncertainty and a weak period for corporate earnings forecasts is likely to cap stock market gains, according to Morgan Stanley’s Michael Wilson.

The strategist — among the most notable bearish voices on US equities until last year — said he expects the S&P 500 to trade in a range of 5,000 to 5,400 points as macroeconomic data flash no clear signals over the short term.

The risk-reward for stock markets remains mixed over the summer months against the backdrop of weakening business activity and negative earnings revisions, according to JPMorgan Chase & Co. strategists led by Mislav Matejka.

“Fed will start cutting, but this might not drive a sustained leg higher, as the cuts might be seen as reactive, and behind the curve,” they wrote.

Investors will have a brief window to buy the dip in US stocks at the end of this month as selling pressure from systematic funds eases while companies boost share buybacks, according to Scott Rubner at Goldman Sachs Group Inc.

“This will be my last bearish equity markets call for August as we are ending the worst of the equity supply and demand mismatch for August,” Rubner wrote in a note to clients.

At least one indicator suggests that last Monday’s drama looks more like a minor meltdown than a harbinger of worse things to come.

Consider the Cboe Volatility Index and the option-adjusted spread on the Bloomberg US Corporate Bond Index. Based on a long-term relationship between the two, the VIX’s close near 39 a week ago was supposed to correspond to a reading of 3.5% in corporate bond spreads. Yet they ended much lower, near 1.32%.

The mismatch between the two suggests the recent downdraft was technical and not indicative of economic doom, according to Bloomberg Intelligence strategists Christopher Cain and Michael Casper. In fact, such abnormal disconnects in the past have led to above-average returns for stocks over the next three-to-six months.

Tom Essaye at The Sevens Report says he doesn’t think fundamentals have deteriorated enough to warrant de-risking and reducing equity or risk exposure — but he also wants to caution against dismissing the recent uptick in volatility.

“Much of what I read over the weekend characterized this recent volatility as just a typical pullback in an upward-trending market,” Essaye. “Because of that, I continue to advocate for defensive sector exposure and and minimum volatility funds.”

Corporate Highlights:

-

B. Riley Financial Inc. faces a widening US investigation into whether it gave investors an accurate picture of its financial health amid a string of losses and a sagging stock price.

-

JetBlue Airways Corp. has kicked off a $2.75 billion bond-and-loan sale backed by its loyalty program as the carrier seeks to raise reserves and fund general corporate purposes.

-

Vestas Wind Systems A/S issued a profit warning for its full-year results in a blow to the company’s effort to turnaround steep losses in recent years.

-

Starboard Value, an investment firm with a history of taking activist positions in companies, has a stake in Starbucks Corp., according to a report.

-

Hawaiian Electric Industries Inc. pegged losses from estimated accrual of liabilities stemming from one of the worst wildfires in US history at $1.7 billion and issued a going-concern warning.

Key events this week:

-

Germany ZEW survey expectations, Tuesday

-

US PPI, Tuesday

-

Fed’s Raphael Bostic speaks, Tuesday

-

Eurozone GDP, industrial production, Wednesday

-

US CPI, Wednesday

-

China home prices, retail sales, industrial production, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.1% as of 11:25 a.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average fell 0.5%

-

The Stoxx Europe 600 was little changed

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.2% to $1.0937

-

The British pound rose 0.2% to $1.2781

-

The Japanese yen fell 0.5% to 147.36 per dollar

Cryptocurrencies

-

Bitcoin rose 1.7% to $59,510.33

-

Ether rose 3.9% to $2,657.83

Bonds

-

The yield on 10-year Treasuries declined two basis points to 3.92%

-

Germany’s 10-year yield was little changed at 2.22%

-

Britain’s 10-year yield declined three basis points to 3.92%

Commodities

-

West Texas Intermediate crude rose 1.8% to $78.24 a barrel

-

Spot gold rose 1.1% to $2,458.98 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Viljoen and Matthew Burgess.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.