Stock See Choppy Trading as Nerves Still Run High: Markets Wrap

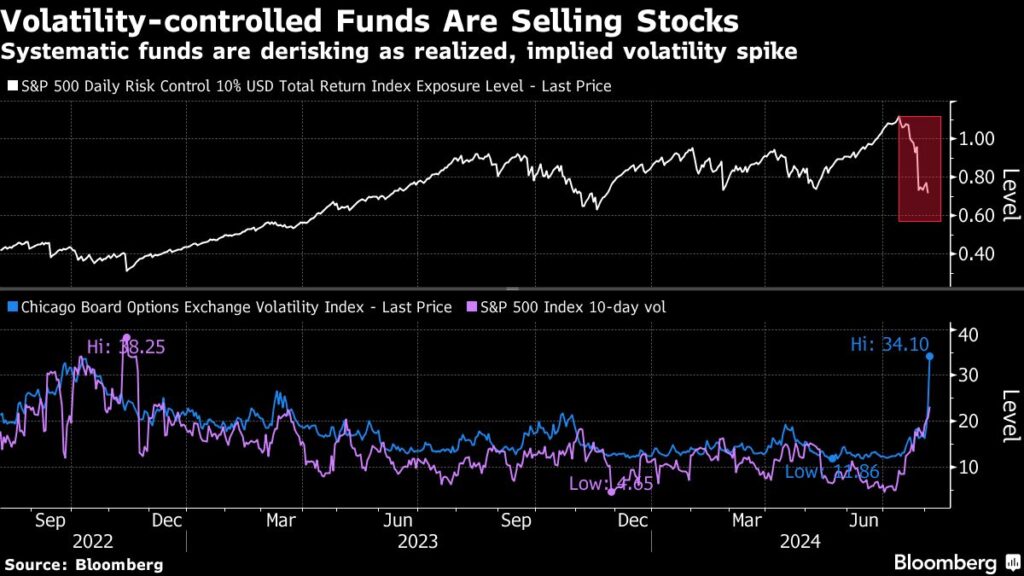

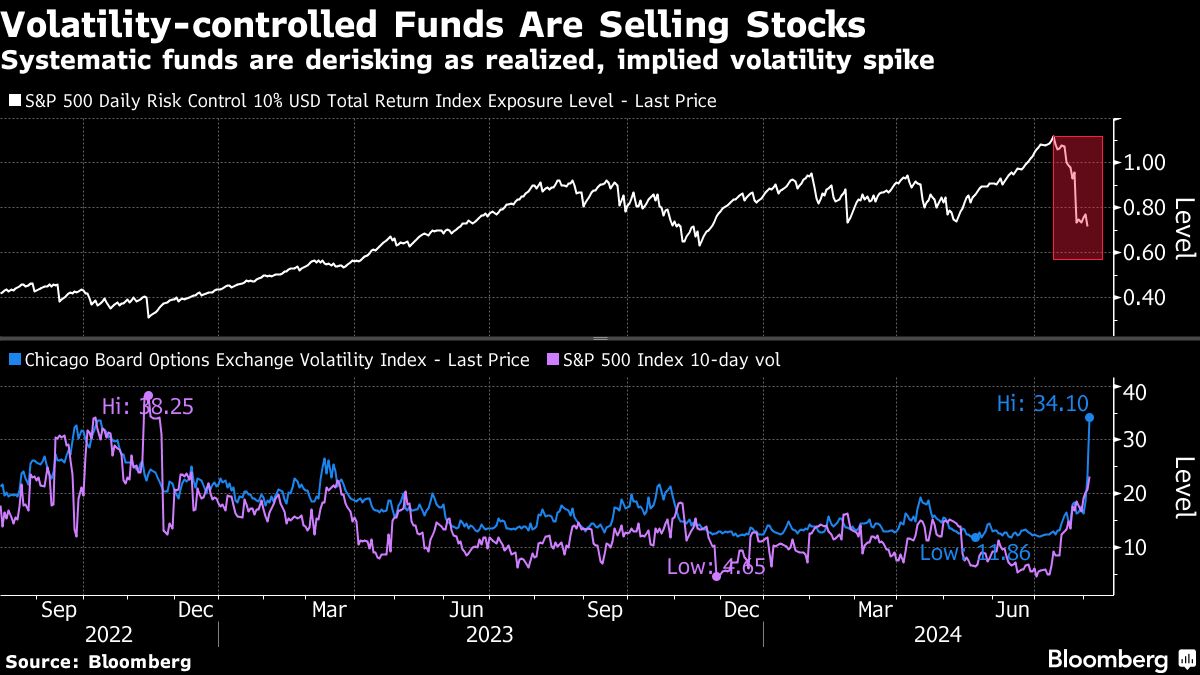

(Bloomberg) — Stocks whipsawed in early trading, with investors braced for more volatility in the aftermath of Monday’s historic sellof.

Most Read from Bloomberg

US equity futures pared gains and European stocks sank into the red. Treasuries retreated, with the 10-year yield heading for the first increase in almost two weeks. Traders curbed bets that the Federal Reserve will step in to support markets with early interest rate cuts.

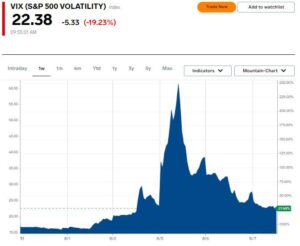

Underscoring the broad market angst, investors are rushing to insure their portfolios against an extreme market crash. And Wall Street’s “fear gauge,” the VIX index, remains at the highest level in almost two years.

Japan continued to be the epicenter of volatility. The Topix index surged 9.3% after plunging 12% on Monday. According to JPMorgan Chase & Co., the unwinding of the yen carry trade is only about 50% complete.

“We don’t expect a lull in the coming days,” said Christopher Dembik, senior investment adviser at Pictet Asset Management. The unraveling of the yen carry trade will continue to trigger margin calls and losses, while a sustained recovery in stocks hinges on central banks measures and big-tech earnings, he said. “I’m expecting the month of August to be red-tainted.”

Even so, the small moves suggested some calm is returning to markets. Buying the S&P 500 after a decline of 5% has usually been profitable in the past four decades, according to Goldman Sachs Group Inc. strategists.

“The violent market moves over the last few sessions, in our view, present a buying opportunity,” said Mohit Kumar, chief economist for Europe at Jefferies International Ltd.

Among individual movers in premarket trading, Palantir Technologies Inc.’s stock jumped as much as 13% after the company raised its annual outlook, citing continuing demand for its artificial intelligence software.

In commodities, oil held near a seven-month low as a halt in production at Libya’s biggest field refocused attention on the Middle East. Gold steadied after being pulled into Monday’s global rout, when it slumped as some traders cut holdings to cover potential margin calls.

Key events this week:

-

China trade, forex reserves, Wednesday

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.6% as of 6:29 a.m. New York time

-

Nasdaq 100 futures rose 0.7%

-

Futures on the Dow Jones Industrial Average rose 0.3%

-

The Stoxx Europe 600 was little changed

-

The MSCI World Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.4%

-

The euro fell 0.4% to $1.0910

-

The British pound fell 0.6% to $1.2703

-

The Japanese yen fell 0.5% to 144.86 per dollar

Cryptocurrencies

-

Bitcoin rose 1.5% to $55,234.51

-

Ether rose 1.1% to $2,464.95

Bonds

-

The yield on 10-year Treasuries advanced five basis points to 3.84%

-

Germany’s 10-year yield declined three basis points to 2.16%

-

Britain’s 10-year yield advanced one basis point to 3.88%

Commodities

-

West Texas Intermediate crude rose 0.5% to $73.33 a barrel

-

Spot gold rose 0.1% to $2,413.85 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Aya Wagatsuma and Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.