Starbucks looks like a shell of its former glory: Morning Brief

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

“Fixable, but it will take time,” a Starbucks (SBUX) insider with knowledge of the company’s many troubles recently told me.

The comment left an impression, especially in the wake of Starbucks’ earnings results this past week.

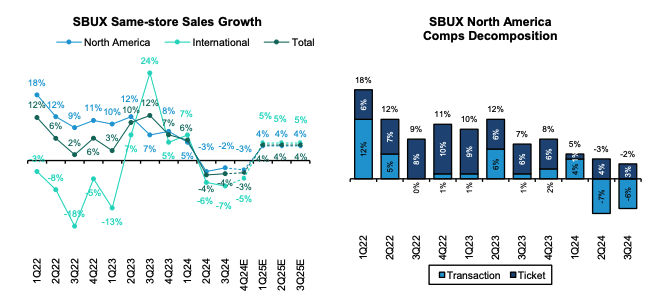

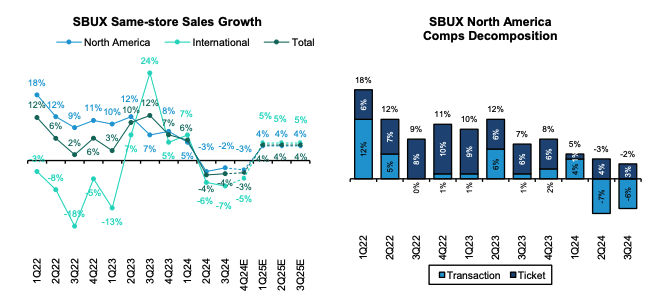

Shares of Starbucks popped briefly following a quarter that could only be described as abysmal:

-

6% transaction drop in North America.

-

International comparable sales tanked 7%.

-

Comparable store sales in China plunged 14%.

-

Non-GAAP operating profit margins fell to 16.7% from 17.4% a year ago.

The market response was befuddling, and likely stemmed from management hyping up a few green shoots in the business on the earnings call (though, to be fair, cold espresso sales were up a sizzling 4%…) — or what they perceive as green shoots.

The Street — having been burned by Starbucks for most of the past two years (the stock is down 9% versus a 35% gain for the S&P 500 during that stretch) — largely didn’t buy in.

“Macro, boycotts, pricing resistance, or in-store operations are the root cause of the North America slowdown? We have not found a unique answer to this question yet, suggesting that all (or none?) of the reasons above are causing the pullback in North America. While Starbucks points to transitory nature of the challenges, we believe that some structural (yet not insurmountable) demand headwinds are also playing a role (e.g., store saturation, increased competition, fading appeal to younger and occasional consumers and declining store experiences),” Bernstein restaurant analyst Danilo Gargiulo said in a client note.

The bigger picture: The one-time iconic company and growth stock has tanked 21% in the past five years, according to Yahoo Finance data.

And this venti-sized black eye isn’t out of the blue. Consider what we’ve seen from Starbucks over the last 12 months.

Howard Schultz — a meddling billionaire founder turned failed presidential candidate — not so covertly ripped his hand-picked successor Laxman Narasimhan in a LinkedIn post, all but undermining his authority.

Talk about a kick in the butt for a new CEO who trained in stores for months with Schultz before officially taking over. Narasimhan is also an accomplished C-suite executive with a successful track record.

But also a reminder on how Schultz just can’t seem to relinquish the limelight and the ingrained desire to lurk over the company like a hungry aging lion.

Then Narasimhan got publicly embarrassed on live TV in an expert interview by my friend and former boss Jim Cramer.

I encourage everyone to watch how Jim conducted this interview; it’s how investors should scrutinize a company’s fundamentals and leadership. Hat tip to Jim for holding “Lax’s” feet to the fire and seeking honesty.

Restaurant CEOs I have talked to privately since this interview still can’t believe how terrible and ill-prepared Narasimhan appeared to be — a few have quipped he may not be around deep into 2025 after these public stumbles.

So there’s all of that, from TV and internet embarrassments to dreadful financials.

Then there is the percolating battle between Starbucks and feared activist investor Elliott Management.

A source familiar with the situation tells me Elliott — which has amassed a sizable stake in Starbucks — put forth a settlement with the company three weeks ago. Elliott is seeking more people added to the 10-member board (Microsoft CEO Satya Nadella resigned in May), plus corporate governance enhancements.

Starbucks has not responded to Elliott’s offer, the source says.

A spokesperson for Elliott declined to comment to Yahoo Finance on the situation.

Narasimhan told analysts on the earnings call this week the talks have been “constructive.”

Bottom line: Starbucks looks like a shell of its former self right now.

And a lot of this could be traced back to 71-year-old Howard Schultz and the fundamental problems of Starbucks I posted on X a few weeks ago (see below), which aren’t easily fixable.

Schultz needs to exit Starbucks once and for all so the executive team can be free to make mistakes and grow, the board can assess management outside of a founder’s gaze, and new talent can ascend to the upper rungs of the corporation.

No more chairman emeritus status. No more being allowed to attend board meetings and having a parking spot at HQ, as the FT reports. No more olive oil deal, as the FT also reports. No more stuff like this in the company’s proxy filings:

“Starbucks and entities owned by Mr. Schultz previously entered into a management services agreement and a hangar space lease for Mr. Schultz’s aircraft. Pursuant to the management services agreement, an entity owned by Mr. Schultz operates his aircraft using services provided by Starbucks and pays Starbucks fees for such services, the amounts of which were set at market rates. Under the terms of the hangar space lease, an entity owned by Mr. Schultz pays Starbucks rent based on its pro-rata portion of the maintenance, utilities and other expenses paid by Starbucks for the hangar.”

And let Schultz — with an estimated net worth of $3.1 billion, according to Forbes — pay for his own security services rather than Starbucks (per the company’s proxy filings).

A clean break and a thank you for your service, Howard. We only wish you the best, thank you for changing the coffee and restaurant landscape forever.

Elliott stake in Starbucks is not a shock, it’s a shock it took this long.

10 Things Wrong With Starbucks

1. Leadership culture of believing the company does everything perfectly.

2. Rushes product innovation.

3. Crazy complex menu.

4. Poor quality food.

5. HQ disconnect…

— Brian Sozzi (@BrianSozzi) July 19, 2024

Then, to fix this hot mess, Starbucks needs a cultural and mindset reset.

Its C-suite needs to recognize the world doesn’t revolve around its Seattle headquarters. There are a lot of places selling better and faster coffee (see Yahoo Finance’s Brooke DiPalma’s awesome profile of up-and-coming rival Dutch Bros).

It needs to realize that unions will not put Starbucks out of business and these are workers just trying to live a better life. The brand perception among a new generation of consumers is not as favorable as the prior one.

And they have to acknowledge Starbucks is a mature entity and fixing its many problems won’t happen overnight — so stop serving up whipped cream and syrup on these earnings calls. Give it to investors straight; the numbers and the stock price don’t lie.

Until then, this former high flier’s stock will probably be as cold as a freshly poured nitro cold brew.

Starbucks declined to make CEO Laxman Narasimhan available for an interview.

Three times each week, I field insight-filled conversations with the biggest names in business and markets on my Opening Bid podcast. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

In the below Opening Bid episode, investor and retail expert Jeff Macke dives into the numerous challenges retailers are facing right now.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email [email protected].