Schwab Debuts First Active Fixed Income ETF (SCUS)

Schwab Asset Management, the fifth-largest ETF provider, introduced its first actively managed fixed income ETF on Tuesday, entering a competitive field dominated by established players.

The Schwab Ultra-Short Income ETF (SCUS) began trading on the NYSE Arca, targeting investors seeking income with lower risk.

With an expense ratio of 0.14%, SCUS is priced below the industry average of 0.18% for actively managed ETFs in the ultrashort bond category, according to Bloomberg data. The fund invests in investment-grade, short-term, U.S. dollar-denominated debt securities issued by U.S. and foreign issues, maintaining a portfolio duration of one year or less.

“With every product we launch, our first consideration is our clients and the portfolio building blocks they desire,” a Charles Schwab spokesperson told etf.com. “We are less focused on short-term market factors and more so on building out the core products our clients need to achieve their goals over the long term.”

Ultra-Short Duration ETFs Gain Traction

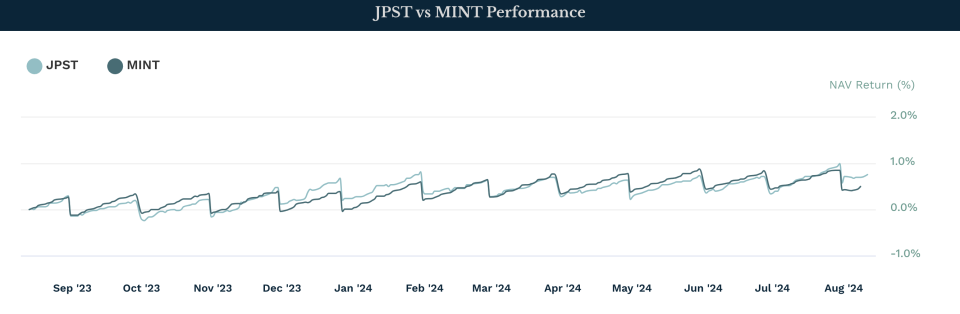

The launch comes as ultra-short ETFs have gained popularity among investors seeing cash alternatives in a rising interest rate environment. SCUS will compete with established funds like the $25 billion JPMorgan Ultra-Short Income ETF (JPST) and the $12 billion PIMCO Enhanced Short Maturity Active ETF (MINT).

When asked about balancing competitive pricing with active management, the Schwab spokesperson stated, “We are focused on delivering value and [designing] our products to be amongst the lowest cost offerings.”

The new ETF is part of Schwab’s broader effort to expand its fixed income ETF lineup, an asset class that has received increased client interest. With this launch, Schwab now manages 31 ETFs with nearly $354 billion in assets, with its largest fund being the Schwab U.S. Dividend Equity ETF (SCHD). That ETF, which debuted in 2011 and tracks an index of 100 dividend-paying U.S. equities, has $57 billion in assets.