Rouble plunges after Ukraine takes Russian territory

The rouble weakened to its lowest level since late May after Kyiv launched its biggest incursion into Russian territory since the start of the war in 2022.

The rouble was 1.9pc weaker on the day at 90.30 to the dollar, according to LSEG data, having lost 6pc over five consecutive sessions since the start of the attack.

Russia today evacuated civilians from parts of a second region next to Ukraine after Kyiv increased military activity near the border.

Ukrainian forces have swept across some Western parts of Russia’s Kursk region since Tuesday in a surprise attack that may be aimed at gaining leverage in possible ceasefire talks after the US election in November.

Kyiv broke its silence on the attacks on Saturday when President Volodymyr Zelenskiy said Ukraine had launched the drive into Russian territory to “restore justice” and pressure Moscow’s forces.

Read the latest updates below.

06:39 PM BST

Signing off…

Thanks for joining us today. Chris Price will be back in the morning, with the latest from the markets and, we expect, some new UK employment figures.

06:37 PM BST

Argentina’s inflation rate slowing further, say analysts

Argentina’s inflation rate slowed to around 4pc in July after speeding up in June, according to a Reuters poll of analysts.

A survey of 18 local and foreign analysts showed a average of 3.9pc inflation for July.

Since the inauguration of libertarian President Javier Milei in December, inflation steadily slowed from 25.5pc that month to 4.2pc in May but ticked up to 4.6pc in June.

July’s inflation was driven by seasonal factors such as tourism during the South American nation’s winter and frost that affected fruit and vegetables at the beginning of the month, analysts said.

06:17 PM BST

US will experience ‘soft landing’, suggests S&P

The world’s largest economy will implement a “steady, spaced-out series of rate cuts” that will help the Federal Reserve achieve a so-called “soft landing”, according to S&P.

Satyam Panday, chief US & Canada economist at S&P Global Ratings, said:

Last week brought a reassuring drop in initial jobless claims, to 233,000 from 250,000 a week earlier (Hurricane Beryl and bigger-than-normal retooling in the auto sector were to blame for a temporary spike).It eased fears that the economy is in a slump. We now believe that the rate-cutting cycle in the US will begin with a 25-basis-point [quarter percentage point] cut at the Federal Open Market Committee’s next meeting, in September.Our baseline outlook envisions a steady, spaced-out series of rate cuts that will help the Federal Reserve engineer a soft landing – where demand stays close to potential while the last bit of excess inflation evaporates.

05:51 PM BST

FTSE 100 ends higher supported by commodity-linked stocks

London stocks kicked off the week on a positive note on Monday, supported by resources-linked shares amid rising oil and metal prices, while BT Group shares surged after India’s Bharti took a stake in the telecoms firm.

The blue-chip FTSE 100 index was up 0.5pc at close, while the mid-cap FTSE 250 index gained 0.3pc.

Both indexes clocked a second straight week of declines on Friday amid volatility in global equities triggered by fears of an American recession following a weak US labour market data.

Precious metal miners led gains amongst the major FTSE 350 sectors, climbing about 2pc, tracking an advance in gold prices.

Energy shares gained 1pc as oil prices firmed for the fifth trading day in a row, on easing US recession fears and growing anxiety of a broader conflict in the Middle East.

05:49 PM BST

Coffee prices jump on Brazil crop fears

Arabica coffee bean prices jumped today by as much as 6.6pc after a frost in Brazil hightened fears of a shortage.

While there were reportedly isolated cases of frost hitting Brazilian coffee crops at the weekend, meteorologists have flagged that a more widespread frost could hit crops as soon as tomorrow.

Thiago Cazarini, president of Cazarini Trading Co, told Bloomberg:

The minimal frost occurrence in parts of Cerrado/High Mogiana was enough to spark new fears of supply. We are already in an environment that can see no errors in production.

Arabica bean prices have rised by almost 30pc since January.

05:33 PM BST

European shares muted as investors brace for fresh data

Europe’s benchmark stock index was subdued on Monday, with investors bracing for key US inflation numbers to gauge the US Federal Reserve’s monetary policy plans.

The pan-European Stoxx 600 index closed on a flat note, down 0.02pc.

05:06 PM BST

Stocks waver in lead up to data deluge

American stocks struggled for direction this afternoon as investors braced for a slew of economic data this week.

A majority of the Magnificent Seven stocks were lower, with Tesla leading the losses, falling as much as 2pc. Nvidia rose 3.9pc and was on track to add nearly $100bn in market value.

Real estate shares and industrials were the top losers among S&P 500 sub-sectors, down 1.0pc and 0.6pc respectively.

Investors are likely to be on edge until Wednesday’s US consumer price index (CPI) data is release. It is expected to show headline inflation accelerated 0.2pc in July on a monthly basis, but remain unchanged at 3pc on a year-on-year basis.

Money markets are evenly split between a half and a quarter point cut in US interest rates in September, expecting a total easing of a full percentage point by the end 2024, according to CME’s FedWatch Tool.

Figures for July US retail sales on Thursday are likely to show marginal growth, and investors expect that any weakness in the data could reignite fears of a consumer slowdown and a potential recession.

Earnings reports from Walmart and Home Depot, due later this week, will also be crucial for clues on consumer spending in the world’s largest economy.

05:03 PM BST

US inflation figures could spark renewed volatility, warns analyst

New data on US inflation could spark renewed volatility on stock markets, an analyst has warned.

David Morrison at Trade Nation said:

It feels that any number that falls outside of expectation could be the catalyst for an outsized move, in either direction.It is worth considering that US Treasuries remain in demand, suggesting that investors are wary of taking on too much additional exposure to equities.

Traders are seeking clues over the number of likely US interest-rate cuts this year as inflation slows.

Expectations are that the US Federal Reserve will lower borrowing costs by a quarter point points next month, and at least once more before January, thanks to a string of data suggesting price rises have been brought under control.

04:54 PM BST

The FTSE 100 rose 0.5pc today. Topping the index was BT, which rose 8.4pc, followed by gambling giant Entain, up 4pc. The biggest faller was JD Sports, down 4pc, followed by retailer B&M, down 2.2pc

Meanwhile, the FTSE 250 rose 0.3pc. The top riser was insurer Lancashire Holdings, up 4.5pc, followed by food manufacturer Bakkavor, up 4.4pc. The biggest faller was Auction Technology, down 7pc, followed by engineering group Goodwin, down 3.7pc.

04:38 PM BST

Boris Johnson in talks over Telegraph bid

Boris Johnson has held talks about a role at The Telegraph as part of former Tory chancellor Nadhim Zahawi’s takeover bid. James Warrington reports:

The former prime minister had informal discussions with Mr Zahawi, who is assembling a consortium to buy The Telegraph as part of an auction process, about a possible job if he is successful.A source close to Mr Johnson downplayed the talks, saying that no substantial discussions had taken place. That is despite speculation that Mr Johnson could be made the Telegraph’s global editor-in-chief.The former prime minister has close ties to the newspaper, having served as its Brussels correspondent before becoming a columnist.

04:12 PM BST

Small caps suffer as talk of US stock market ‘rotation’ fade

The Russell 2000 index of small-cap US businesses has dropped 0.4pc in trading this afternoon, bringing its losses over the past month to 3.5pc.

Small caps were supposed to be the new, big hope for investors wanting something to invest in after mounting worries that Big Tech firms were overpriced.

The talk was that investors in America would ‘rotate’ their investments from Big Tech companies into these smaller companies.

But, according to Eric Balchunas at Bloomberg Intelligence: “The trading crowd is getting the hell out of small caps … It was fun while it lasted (for like two weeks).”

The trading crowd is getting the hell out of small caps, $3.5b out of $IWM in the past week, no ETF has seen more outflows. It was fun while it lasted (for like two weeks) I guess. pic.twitter.com/n4JRtLgnOh

— Eric Balchunas (@EricBalchunas) August 9, 2024

04:06 PM BST

Oil surgest to highest level in over a week

Oil prices have risen 1.1pc today to their highest level in well over a week as traders worry about the effects of an Iranian attack on Israel.

Chris Beauchamp, Chief Market Analyst at online trading platform IG, said:

Oil has surged to its highest level in over a week as expectations of an Iranian strike on Israel rise once more.The risk had appeared to recede last week, or at least had been pushed back, but an attack is on the cards once more, powering oil’s move higher from last week’s two-month low.

Brent Crude, the international benchmark, is $80.86 a barrel.

03:58 PM BST

The ‘risk taking’ Indian billionaire with big plans for BT

What does Sunil Mitall’s acquisition of a 24.5pc stake means for BT – and Britain? Matt Oliver and James Warrington report:

A young Sunil Mittal had every reason to be delighted as he posed obligingly for photographers next to BT’s then-chairman Sir Iain Vallance.The Indian tycoon had just signed a deal in which the British telecoms giant would take a 21pc stake in his upstart business, Bharti Cellular, and gain exposure to the Indian market. At that point in 1997, the Anglophile Mittal and his siblings seemed content to be junior partners. But today it is the 66-year-old – now one of the world’s richest men, and an investor in UK assets including the luxury Gleneagles Hotel – who is returning as the benevolent shareholder, ready to dispense pearls of wisdom to a much smaller BT. His business empire, Bharti Global, revealed on Monday that it was acquiring a 24.5pc stake in the British company from embattled French tycoon Patrick Drahi – making Mittal its new top shareholder at the stroke of a pen. The deal marked a “significant milestone” for Bharti, a statement from Mr Mittal said, while underscoring the billionaire’s confidence “in BT and in the UK”. Insiders say it is also viewed as a significant coup within BT’s London headquarters after Allison Kirkby, BT’s chief executive, personally led a months-long charm offensive to secure Mr Mittal’s support.

03:44 PM BST

Stocks mostly rise as investors await new US inflation data

Global stock markets have mostly risen today as investors try to move on from the upheaval fuelled by US recession worries.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said:

The stabilisation of sentiment is continuing, following the sell off a week ago, as concerns about an American recession ease off a little.The latest inflation data in the US will be in sharp focus this week.

The data could spark renewed volatility.

Traders are seeking clues over the number of likely US interest rate cuts this year as inflation slows.

Expectations are that the bank will lower borrowing costs a quarter point next month, and at least once more before January, thanks to a string of data suggesting price rises have been brought under control.

03:32 PM BST

Markets tread water ahead of inflation data

Stock markets lack direction ahead of the latest inflation figures from both the UK and US later this week which will indicate how many interest rate cuts there will be from the Bank of England and Federal Reserve before the end of the year.

Wall Street is mixed, while the UK’s FTSE 250 has given up most of its gains today.

The FTSE 100 in London remains up 0.4pc but the main indexes in Paris and Frankfurt have turned negative.

The so-called “fear gauge” on Wall Street – known as the Vix – edged lower today from its four-year highs last week.

Yet other indicators imply investors remain uneasy:

CNN’s Fear & Greed Index is still pushing an ‘Extreme Fear’ reading despite the volatility moderation the final few days last week and into today pic.twitter.com/uE90U3kqbW

— John Kicklighter (@JohnKicklighter) August 12, 2024

With that, I’m heading off. Alex Singleton is back in the hotseat today and will send you live updates as you head towards the evening.

03:14 PM BST

Universal strikes licencing deal with Meta amid threat from AI

Taylor Swift’s record label has struck a major new licensing deal with Meta amid concerns about the threat artificial intelligence (AI) poses to artists.

Our reporter James Warrington has the details:

Universal Music Group, the world’s largest record label, today unveiled a multi-year partnership with Meta to license songs on its platforms, including Facebook, Instagram and WhatsApp.Universal said the deal will help to ensure that artists and songwriters are compensated fairly for their work. The two companies also pledged to tackle the spread of unauthorised AI-generated content.The record label has been one of the most vocal campaigners over the threat of AI, warning the nascent technology threatened “widespread and lasting harm” to artists without appropriate copyright protections.It was also embroiled in a high-profile licensing dispute with TikTok that saw millions of songs by artists including Taylor Swift and Drake removed from the Chinese video-sharing app earlier this year.Michael Nash, chief digital officer at Universal Music Group, said: “Since our landmark 2017 agreement, Meta has consistently demonstrated its commitment to artists and songwriters by helping to amplify the importance music holds across its global network of engaged communities and platforms, creating new opportunities and applications where music amplifies and leads engagement and conversations.“We are delighted that Meta shares our artist-centric vision for respecting human creativity and compensating artists and songwriters fairly. We look forward to continuing to work together to address unauthorised AI-generated content that could affect artists and songwriters, so that UMG can continue to protect their rights both now and in the future.”

03:11 PM BST

Wall Street mixed ahead of inflation data

US stocks were mixed to start the week as investors turn their attention to US inflation data due out on Wednesday.

The Dow Jones Industrial Average slipped 0.4pc to 39,334.13, while the broad-based S&P 500 ticked up 0.2pc to 5,331.74.

The tech-heavy Nasdaq Composite Index rose 0.3pc to 16,789.90.

Art Hogan of B Riley Wealth said: “Wall Street’s attention this week will shift to inflation from the labour market, with the producer price index and consumer price index readings for July due on Tuesday and Wednesday, respectively.”

The hope is that inflation will cool gradually, paving the way to the first Federal Reserve interest rate cuts since the pandemic.

02:28 PM BST

Pubs and restaurant sales hit by rioting across Britain

Pubs, restaurants and other hospitality businesses suffered a 10pc drop in sales as a result of the wave of rioting across Britain’s streets last week, industry figures show.

Sales fell by up to 40pc in some areas, UK Hospitality said, as businesses closed and consumers stayed at home amid predictions of widescale disorder last week.

Footfall was down by as much as 75pc amid the disorder that gripped Britain last Wednesday.

Coastal towns were particularly affected by the cancellation of coach and day trips, while city centres also saw significant disruption, with many employees advised to work from home.

Business Secretary Jonathan Reynolds has backed UK Hospitality’s calls for insurance companies to act swiftly to help businesses recover.

UK Hospitality chief executive Kate Nicholls said:

These figures are startling and show the enormous impact the riots, and threat of further disorder, have had on our high streets and communities.Bustling, vibrant city centres were turned into ghost towns as the public stayed at home and businesses shut.

02:13 PM BST

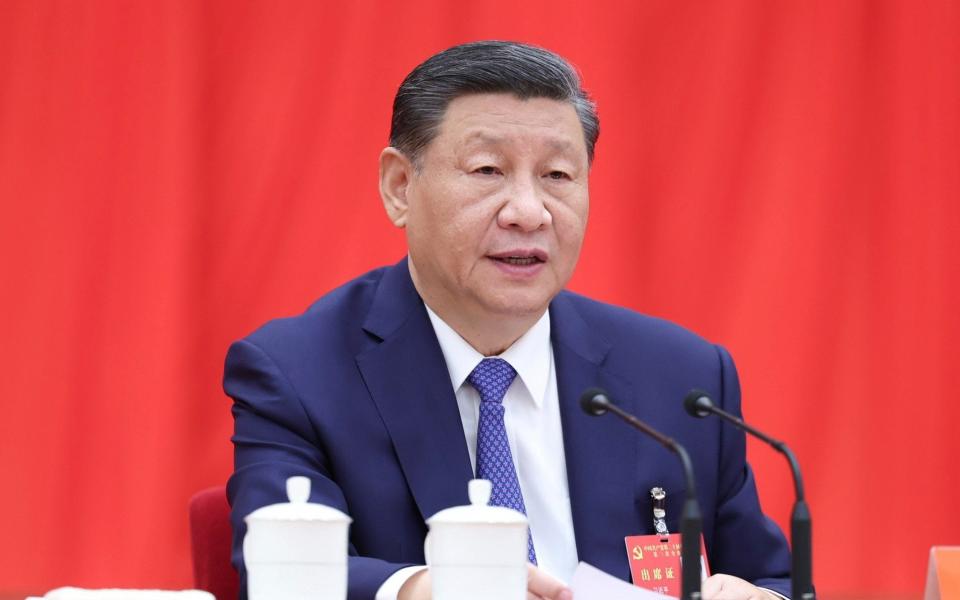

Foreign investors pull money out of China

Foreign investors have pulled a record amount of money out of China, official data show, amid doubts about the health of the world’s second largest economy.

China’s direct investment liabilities in its balance of payments dropped almost $15bn (£11.8bn) in the three months to June, according to data from the State Administration of Foreign Exchange.

It is only the second time this figure has turned negative. It was down about $5bn for the first six months of the year.

Foreign investment into China has slumped in recent years after hitting a record $344bn in 2021.

The fall would be the first annual net outflow since at least 1990 if it holds until the end of the year.

02:00 PM BST

Harland & Wolff delays annual accounts as it battle to secure possible sale

The Titanic shipbuilder Harland & Wolff has suspended work on its annual accounts as it battles to secure a possible sale to rescue the business.

The Belfast-based company said it does not believe it can finalise its 2023 accounts “on a going concern basis and, therefore, work to complete its unpublished accounts has also been suspended”.

It will instead focus its resources on work by Rothschild, who have been hired to “assess strategic options” for the troubled business – with a potential sale likely to be one of them.

The London-listed company was plunged deeper into crisis earlier this month after the Falkland Islands withdrew from £120m contract talks.

As it cancelled its accounts, it formally announced the appointment of Russell Downs, a turnaround expert, to be interim executive chairman.

Its chief executive, John Wood, departed at the end of last month after the Government declined to provide a £200m loan guarantee.

Mr Downs said: “We remain focused on working with interested parties and key stakeholders to ensure that we can navigate through this uncertainty preserving the underlying value in the yards and the FSS contract for its employees and other stakeholders.”

01:34 PM BST

HSBC promises no new branch closures until 2026

HSBC has promised it will not announce any new closures of its bank branches until at least 2026, extending a commitment to face-to-face banking amid a wider cull of branches on UK high streets.

The banking group also said it was planning to spend more than £50m this year on updating and improving its branch network.

The pledge means the bank must keep its 327 branches running for the next year-and-a-half, and possibly longer. It previously committed to announcing no new closures in 2024.

Meanwhile, thousands of bank branches across the UK have been shut in recent years, leaving many towns without any local services.

Consumer group Which? said in May that more than 6,000 had closed since 2015, with Lloyds, NatWest, and Barclays among those drastically slimming down their nationwide network. HSBC closed more than 700 in that time.

Major banks say there are far fewer customers who are using in-person services, with more people preferring to use mobile and online banking.

HSBC admitted that the number of regular customers visiting branches has dropped by an average of 65pc over the last five years.

Christopher Dean, HSBC’s head of UK customer channels, said: “We know that our 327 branches play an important role in serving our customers, which is why we are investing more than £50m in refurbishing and remodelling works across our network this year.”

01:13 PM BST

Gas prices rise amid fighting around key Russian transit point

Gas prices are rising after the Ukrainian assault on Russian territory where the Kremlin’s natural gas flows into Europe.

Sudzha, just over the border from Ukraine, is the focus of intense battles between Ukrainian and Russian forces. It is unclear who controls the town.

The Soviet-era Urengoy-Pomary-Uzhgorod pipeline brings gas from western Siberia via Sudzha in Russia’s Kursk region. It then flows through Ukraine in the direction of Slovakia.

In Slovakia, the gas pipeline is divided, one of the branches goes to the Czech Republic, the other to Austria. The main buyers of gas are Hungary, Slovakia and Austria.

About half of Russian natural gas exports to Europe were supplied via Sudzha in 2023.

Dutch front-month futures were last up 5.5pc at more than €42 per megawatt hour amid concerns about the supply.

12:49 PM BST

Opec cuts forecast for oil demand

The Opec oil cartel has reduced its forecasts for global demand this year amid signs of weaker demand from China.

Opec said in its monthly report that it expects world oil demand to be lower by 135,000 barrels a day, although it insists this will still expand this year by a “healthy” 2.1m barrels a day, to average 104.3m a day.

Its forecast remains higher than the rest of the oil industry and comes as the Saudi-led group decided whether to press ahead with plans to ramp up production from October.

It said the “slight revision reflects actual data” for the first and second quarters, “as well as softening expectations for China’s oil demand growth in 2024”.

Brent crude, the global benchmark, was last up 0.9pc at more than $80 a barrel amid concerns about a wider conflict between Israel and Iran in the Middle East.

12:36 PM BST

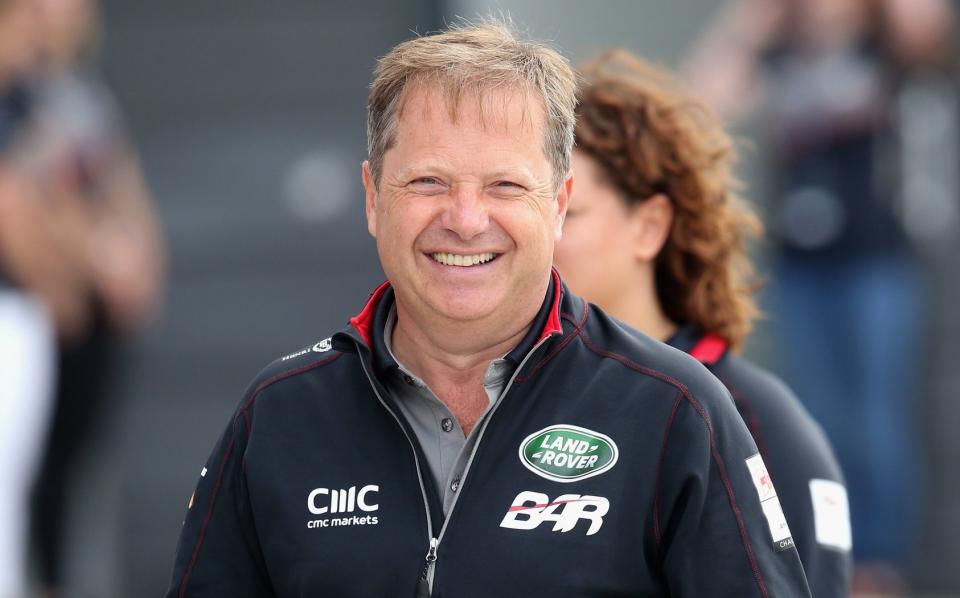

TalkTalk secures emergency lifeline from billionaire founder

TalkTalk has avoided collapse after securing an emergency lifeline from its billionaire founder.

Our reporter James Warrington has the details:

Sir Charles Dunstone and other shareholders have agreed to inject £65m into the struggling broadband business immediately to avoid a looming debt default.The initial investment will be followed by a further £170m, while assets including the Virtual1 subsidiary and Ovo and Shell internet brands will also be rolled into the group to strengthen its finances.Shareholders Toscafund and Ares Management also took part in the refinancing, which is worth more than £400m in total.

Read how lenders and bondholders have also helped Talk Talk’s bid to avoid a looming debt default.

12:04 PM BST

US stocks on track to edge higher ahead of inflation figures

Wall Street looks on track for a relatively subdued start to the week ahead of US inflation data which will indicate the Federal Reserve’s next move on interest rates.

It is in sharp contrast to the sell-off last MOnday after weaker-than-expected July jobs figured sparked recession fears, and investors unwound currency carry trade positions involving the Japanese yen.

Investors may stay on the sidelines this week until Wednesday’s US consumer price index (CPI) reading, which is expected to show inflation in July remained unchanged at 3pc.

Money markets are evenly split between the Fed announcing a half a percentage point or a quarter of a point cut in US interest rates in September.

Traders expected a whole percentage point of cuts by the end 2024.

In premarket trading, the Dow Jones Industrial Average was up 0.1pc, the S&P 500 had gained 0.2pc and the Nasdaq 100 was up 0.3pc.

11:44 AM BST

Customers left in limbo by collapse of John Lewis-based carpet seller

A carpet seller based in John Lewis stores has collapsed into administration, leaving customers across Britain unable to get their deliveries.

Our retail editor Hannah Boland has the details:

The Floor Room said it had been left with no option but to appoint administrators, resulting in the loss of around 200 jobs, after sister company Carpetright failed last month.The business, which had 34 concessions across John Lewis stores as well as one dedicated store in central London, said it had been dependent on Carpetright for support services.While Carpetright was later rescued by its founding family via their rival company Tapi, the deal only covered a small number of its stores, logistics hubs and its intellectual property.

It is the latest sign of pressure on the homeware market.

11:28 AM BST

Borrowing costs rise ahead of inflation figures

Government bond yields have edged higher after a volatile week of trading amid worries around the US economy.

Borrowing costs edged up as investors await UK and US inflation data to gauge the extent of interest rate cuts by the Bank of England and the Federal Reserve this year.

The UK 10-year gilt yield inched up to 3.95pc, while the German 10-year bund yield, the benchmark for the eurozone, rose 2.6 basis points to 2.25pc.

Both had sunk to seven-month lows last Monday when worries about a global markets sell-off.

Euro zone bond yields have steadily rebounded since then, with better-than-expected US data easing concerns about an economic downturn and traders paring back bets of rate cuts from the Fed this year. US Treasury yields were up to 3.95pc.

Rufaro Chiriseri, head of fixed income for the British Isles at RBC Wealth Management, said: “It was a combination of overreaction but also data has shifted a little bit but that shouldn’t necessarily warrant moves as big as that.”

Bond markets will be influenced by a glut of economic data this week, including UK wage growth, inflation and GDP.

11:14 AM BST

Rouble hits three-month low after Ukraine assault

The rouble weakened to its lowest level since late May after Kyiv launched its biggest incursion into Russian territory since the start of the war in 2022.

The rouble was 1.9pc weaker on the day at 90.30 to the dollar, according to LSEG data, having lost 6pc over five consecutive sessions since the start of the attack.

Russia today evacuated civilians from parts of a second region next to Ukraine after Kyiv increased military activity near the border.

Ukrainian forces have swept across some Western parts of Russia’s Kursk region since Tuesday in a surprise attack that may be aimed at gaining leverage in possible ceasefire talks after the US election in November.

Kyiv broke its silence on the attacks on Saturday when President Volodymyr Zelenskiy said Ukraine had launched the drive into Russian territory to “restore justice” and pressure Moscow’s forces.

10:48 AM BST

Oil prices edge higher as tensions linger in Middle East

Oil prices have edged higher amid the looming threat of a response by Iran to the assassination of Hamas and Hezbollah leaders.

Brent traded was up 0.8pc to more than $80 a barrel after rising almost 4pc last week, while West Texas Intermediate was up 1.1pc towards $78.

Tehran reiterated over the weekend its determination to punish Israel for the killing of Hamas’ political chief.

Vivek Dhar, an analyst with Commonwealth Bank of Australia said:

The immediate market concern will be attacks on Iran’s oil supply and infrastructure.We see Brent oil futures trading between $75 and $85 a barrel in the short term.

10:32 AM BST

Marshalls sales hit by weak new-build housing market

Building materials supplier Marshalls has revealed a slump in sales amid “challenging” trading in landscaping.

The FTSE 250 company reported that revenues declined to £306.7m for the six months to June 30, down by 13pc compared with the same period a year earlier.

It follows low levels of new-build housing and reduced spending on private housing improvements.

However, bosses were “cautiously optimistic of a modest recovery” over the rest of the year, as the business held its financial guidance.

Bosses said they hope to see new work supported by the “new Government’s commitment to increase housebuilding significantly”.

Marshalls also revealed pre-tax profits grew by 29pc to £21.5m for the half-year, after cost reductions over the past year.

Shares were down as much as 5.3pc.

10:07 AM BST

Gas prices rise to fresh eight-month highs

Wholesale gas prices rose to their highest level since December amid concerns over pipeline flows from Russia.

Europe’s benchmark contract lifted above €41 a megawatt-hour, after posting a second-consecutive double digit weekly advance.

The latest rise comes after Ukrainian troops made a surprise cross-border attack last week around the Sudzha intake point, which is a crucial transit point for gas heading through pipelines from Russia to Europe via Ukraine.

Most of Europe is competing with Asia for liquefied natural gas as it turns its back on pipeline supplies from Russia.

Tom Roberts, chief executive officer of London-based Xterna Group, said:

The elephant in the room is this upcoming winter.The focus seems to be on geopolitics in general at the moment, yet these gas intensive countries are consuming record levels of gas.

Dutch front-month futures were last up 2.1pc at €41 per megawatt hour. The UK equivalent gained 2.1pc.

09:48 AM BST

Pound edges higher as inflation expected to rise

The pound inched upwards at the start of the week ahead of inflation figures which could dampen hopes of imminent interest rate cuts by the Bank of England.

Sterling was up 0.1pc against the dollar at $1.276 and was flat against the euro at 85.5p.

09:31 AM BST

Bosses ‘plan to reduce pay rises’ amid falling inflation

Although policymakers at the Bank of England are concerned about wage growth, the latest evidence shows bosses have slashed pay rise plans in response to falling inflation.

Our deputy economics editor Tim Wallace has the details:

Employers expect to give workers pay rises of 3pc over the next year, according to a survey from the Chartered Institute of Personnel and Development (CIPD), which is the smallest increase since 2022.That is down from 4pc in the previous survey three months ago, and from 5pc last year.James Cockett, economist at the CIPD, said it reflects the fall in inflation back to the Bank of England’s 2pc target, which means workers are not demanding the same big pay rises as they were at the height of the cost of living crisis.“Falls in expected pay rises were anticipated now inflation is within a tolerable range for employees,” he said.There are also more signs the jobs market is slowing. One employer in every five expects to make redundancies over the next three months, the highest since the Covid lockdown of late 2020 and early 2021.Slower pay growth will cheer the Bank of England, where policymakers, led by Andrew Bailey, want to see wage rises come down to relieve inflationary pressures in the economy.

09:13 AM BST

Inflation expected to rise for first time this year

Inflation is expected to have increased for the first time this year in a blow to Sir Keir Starmer after his first month in power.

The Office for National Statistics will reveal its latest consumer prices index for July on Wednesday, which economists expect will show that prices grew at an annual pace of 2.3pc.

Inflation has held at the Bank of England’s target of 2pc since May, giving the Bank of England confidence to cut interest rates for the first time in four years earlier this month.

However, the next inflation data could throw hopes of future cuts in doubt, particularly if services inflation is stronger than expected, with money markets currently pricing in at least one more rate reduction by the end of the year.

Catherine Mann, an external member of the Monetary Policy Committee which sets interest rates, said the UK should not be “seduced” into thinking inflation will stay low over the coming year.

Ms Mann, a former OECD chief economist, was one of four policymakers who voted to leave rates unchanged at the last meeting, at 5.25pc, a 16-year high.

“Inflation has come down but… we shouldn’t be seduced by headline inflation because of the role of energy and external aspects working through,” she told the Financial Times.

She said survey evidence suggests companies expect to increase wages and prices, which indicates she will be “looking at a problem for next year”.

Elizabeth Martins, UK economist at HSBC, said: “We see no urgent case for a follow up rate cut.”

08:52 AM BST

FTSE 100 climbs after turbulent week

UK stocks moved higher after rounding off a turbulent week with declines.

The blue-chip FTSE 100 index was up 0.4pc, while the mid-cap FTSE 250 index was up 0.3pc.

Most sub-sectors were trading upwards, with personal goods rising 1.6pc after a pulled up by a jump of as much as 1.8pc in top player Burberry.

Energy shares gained 1pc as oil prices rose for the fifth straight session amid easing US recession fears and geopolitical tensions in the Middle East.

Precious metal miners climbed 1.2pc as gold prices edged higher.

UK stocks will be impacted this week by data on inflation and GDP, as well as the consumer prices index in the US on Wednesday.

Among individual stocks, BT Group jumped 6.5pc after India’s Bharti Enterprises said it would acquire a 24.5pc stake in the telecom giant, buying out its top shareholder Altice. The stock topped the FTSE 100 index.

Landscaping and roofing products supplier Marshalls that fell 3.5pc after a 19pc slump in its half-yearly profit.

08:27 AM BST

European markets rise as sell-off abates

Europe’s main stock markets rose at the open after mixed performances in Asia and last week’s volatility for global equities.

In the eurozone, the Paris Cac 40 index was up 0.4pc at 7,297.50 points and Frankfurt’s Dax rose 0.4pc to 17,795.93.

08:21 AM BST

BT shares jump as Indian billionaire takes near-25pc stake

BT shares have jumped to the top of the FTSE 100 after it was announced Indian billionaire Sunil Mittal is to buy a 25pc stake in BT from embattled tycoon Patrick Drahi.

Bharti Global, the investment arm of the Mittal family’s telecoms giant Bharti Enterprises, said on Monday it had agreed to buy 24.5pc of BT’s share capital from Mr Drahi’s firm Altice.

BT’s share price surged as much as 7.6pc in early trading.

Our reporter Daniel Woolfson has the background on the deal.

08:03 AM BST

UK markets open higher as calm returns

The FTSE 100 has risen as calm returned to global stock markets following the turmoil of last week.

The UK’s blue chip share index gained 0.4pc to 8,203.90 while the midcap FTSE 250 rose 0.2pc to 20,665.90.

07:57 AM BST

Burger King expansion leads to ‘resilient’ sales

Burger King UK has said it witnessed “resilient” sales over the first half of 2024 as it continued to benefit from expansion across the UK.

It came as the fast food business, which operates 561 restaurants in the UK, revealed it returned to profit last year in freshly filed accounts.

Alasdair Murdoch, chief executive of Burger King UK, said:

We have seen a resilient trading performance in the first half of 2024, with total sales growth of 5pc split equally between the existing estate and contribution from new site openings.This was also supported by a significant improvement in profitability from a strong operational cost focus.Looking ahead, we are excited about our ambitious expansion plans and the continued growth of our digital and delivery services, supported by good cost management and a robust pipeline of new openings.

07:49 AM BST

Heathrow loses 90,000 passengers on routes facing £10 charge

Heathrow Airport said it has suffered a 90,000 decline in passenger numbers on routes where passengers are charged an extra £10 per person to come to Britain.

The airport described the electronic travel authorisation (ETA) system as “devastating for our hub competitiveness”.

The Conservative government introduced ETAs in November 2023 for people entering or transiting through the UK without legal residence or a visa.

ETAs, which cost £10, are required for nationals of Qatar, Bahrain, Kuwait, Oman, the United Arab Emirates, Saudi Arabia and Jordan.

The programme is scheduled to be extended to the rest of the world this autumn, although for travellers from the European Union, the European Economic Area and Swiss nationals it will be introduced early next year.

Heathrow said in a statement:

While Heathrow continues to attract new routes and record passenger numbers, the latest data following the introduction of the ETA shows that Heathrow has lost 90,000 transfer passengers on routes operating to and from the seven countries included in the scheme, since its introduction in 2023.This is devastating for our hub competitiveness. We urge Government to review the inclusion of airside transit passengers.

07:32 AM BST

Bharti has ‘no intention’ of takeover bid for BT after acquiring 24.5pc stake

Indian conglomerate Bharti will buy French media giant Altice’s stake in BT but said it has “no intention of making an offer to acquire the company”.

Altice, which is controlled by French-Israeli billionaire Patrick Drahi, had been upping its stake in BT in recent years and had already faced a national security probe in 2022.

Sunil Bharti Mittal, chair of Bharti Enterprises, said:

This investment demonstrates the confidence we have in BT and in the UK.BT has a strong portfolio of market-leading brands, high-quality assets and an experienced management team with a compelling strategy mandated by the BT board to deliver value over the long term, which we fully support.

07:29 AM BST

Indian telecoms giant Bharti to take near-25pc stake in BT

Indian telecoms group Bharti Enterprises will acquire a near 25pc stake in BT days after it emerged that embattled French tycoon Patrick Drahi has cashed in almost £1bn of shares in the former monopoly.

Bharti will imminently secure a 9.99pc stake in BT from the Franco-Israeli billionaire’s Altice UK, with another 14.51pc to come after it secures regulatory approval.

Bharti said it has no intention of making an offer to acquire BT.

Bharti and BT have enjoyed a longstanding relationship – BT previously owned a 21pc stake along with two board seats in Bharti Airtel from 1997 to 2001.

The deal comes days after it emerged Mr Drahi, who was a major shareholder in BT through his company Altice, is estimated to have sold a 9pc stake worth roughly £980m since February.

BT chief executive Allison Kirkby said: “We welcome investors who recognise the long-term value of our business, and this scale of investment from Bharti Global is a great vote of confidence in the future of BT Group and our strategy.”

07:27 AM BST

Battle with inflation is not over yet, warns Bank of England official

The battle against inflation is not yet over, an interest rate setter at the Bank of England has warned.

Catherine Mann, an external member of the Monetary Policy Committee, she said Britain must not be “seduced” into thinking that the pace of price rises had been contained.

She said she is still concerned that inflation will rise again despite it being brought back down to the Bank of England’s 2pc target over the last two months.

Speaking ahead of the release of data on wage rises this week, Ms Mann said that survey evidence suggested that companies were still expecting to make relatively big increases to both wages and prices, which “says to me right now I’m looking at a problem for next year”.

In the latest round of annual pay deals, “some people at the bottom got quite a bit of an increase, rightfully so, but the ones above them didn’t. Which means next year they will,” she told the Financial Times.

The latest data on wage increases will be published this week by the Office for National Statistics, as well as figures on inflation, growth in the economy and retail sales.

07:10 AM BST

Good morning

Thanks for joining me. We begin the week with a warning from an interest rate setter at the Bank of England, who fears Britain being “seduced” into thinking the battle against inflation has been won.

Catherine Mann, an external member of the Monetary Policy Committee, said she is concerned that inflation will become a problem next year as higher earnings workers are given pay rises.

5 things to start your day

1) The retirement haven with a dire warning for Britain’s future | Repeated political failure has left England’s care bill capital facing ruin

2) Tesco introduces ‘passports’ for clothes as EU clampdown looms | Brussels battles to boost supply chain transparency with new sustainability rules

3) Pensioners to cost Treasury £15bn a year in housing benefit | Concerns grow over ballooning bill to support older renters

4) Miliband urged to save mini-nuke site in Cumbria | Moorside’s hopes of hosting first small modular reactors are in jeopardy, MPs warn

5) Mobile operators resist plan to ensure networks have emergency power during outages | Ofcom piles pressure on providers despite ‘prohibitive’ £1.8bn price tag

What happened overnight

Asian shares were mixed in calm trading ahead of big reports this week on the state of the US economy, most notably its latest inflation figures.

Hong Kong’s Hang Seng edged 0.2pc higher, to 17,120.23 and the Shanghai Composite index was up 0.1pc at 2,863.23.

Markets in Tokyo and Bangkok were closed for holidays.

In Seoul, the Kospi jumped 1.1pc to 2,616.11, as shares in Samsung Electronics gained 1.1pc, tracking advances in Big Tech companies late last week.

Taiwan’s Taiex also gained 1.1pc, while big computer chip maker Taiwan Semiconductor Manufacturing Company only edged 0.1pc higher, electronics maker Hon Hai Precision Electronics, also known as Foxconn, surged 4.5pc.

Australia’s S&P/ASX 200 rose 0.5pc to 7,815.60.