Palantir Stock (NYSE:PLTR): Best to Wait for a Better Valuation

Palantir (PLTR) is well-regarded as one of the most innovative SaaS and AI companies in the world at the moment. It is well structured, with diversification across government defense and commercial contracts, which provides a lot of room for growth. Management has also been pivotal in developing AI defense technologies, which are vital for Western leadership capacity. Despite these strengths, the valuation is very high at the moment. Therefore, I am neutral on PLTR stock.

Palantir Is Transforming Big Data Analytics

The company is well known for Palantir Gotham, which caters to defense and intelligence agencies, such as the United States Intelligence Community and the Department of Defense. It also operates Foundry — used in commercial sectors like healthcare, finance, and manufacturing — and Apollo for software deployment and management.

More recently, Palantir has developed its Artificial Intelligence Platform for AI decision-making across government and commercial applications. I believe Palantir is going to grow this significantly, especially as the nature of warfare is transforming from physical toward information warfare. Palantir is well-positioned to be a leading security company that offers both national and corporate information-based defense capabilities.

Despite Operational Strengths, The Stock Is Richly Valued

Palantir currently has a non-GAAP P/E ratio of 81x on a forward basis. This is very high, and the potential overvaluation is further evidenced by its P/S ratio, which is also extremely high at 25x. Forward fundamental estimates from Wall Street analysts are also not incredibly high, with 20% indicated in 2025 for annual EPS growth and 21.3% for annual revenue growth.

There is a lot of market enthusiasm surrounding Palantir’s AI capabilities, and the high sentiment is potentially unwarranted and could induce short-term volatility. Despite the company’s strong growth prospects, the valuation is arguably unreasonable, especially considering the sector median non-GAAP P/E ratio is 25x on a forward basis.

It’s a Very Risky Investment Requiring Diversification

Because of the valuation, the downside risk is very high for Palantir. As a result of this analysis, I think that PLTR stock is only worth owning at a small allocation in portfolios as part of a high-risk, high-reward segment. I am refraining from buying PLTR due to the valuation, but in the future, at a more suitable entry price, I think no more than 2.5% of a portfolio is wise.

I am not convinced that PLTR will beat the S&P 500 (SPX) over the long term, as its valuation multiples could contract, even while its growth estimates expand. The market’s bullish sentiment about Palantir depends largely on expectations of future growth related to expanding AI defense capabilities and evolving advanced data and analytics software capabilities.

However, much of this is a narrative that may not be grounded in fundamental growth rate expansion. To achieve alpha, Palantir would need to continue to iterate toward a form of defense-oriented artificial general intelligence. I do not think it is inconceivable that PLTR achieves this, but it is also not guaranteed. The valuation is relatively speculative as a result of this uncertainty.

Palantir Has a Unique Moat in SaaS

Palantir’s position with the DoD and CIA is formidable, and these contacts are very hard to establish. As a result, Palantir is one of the only companies with unique and advanced AI-led big data analytics operating in highly sensitive, high-barrier-to-entry fields.

The company also operates a Forward Deployed Engineer model, which involves deploying engineers to operate on-site with its clients. It is this kind of nuanced and involved approach from PLTR that makes it a special company. In other words, Palantir is high-quality, well-managed, and uniquely positioned. This helps explain why the valuation is so high.

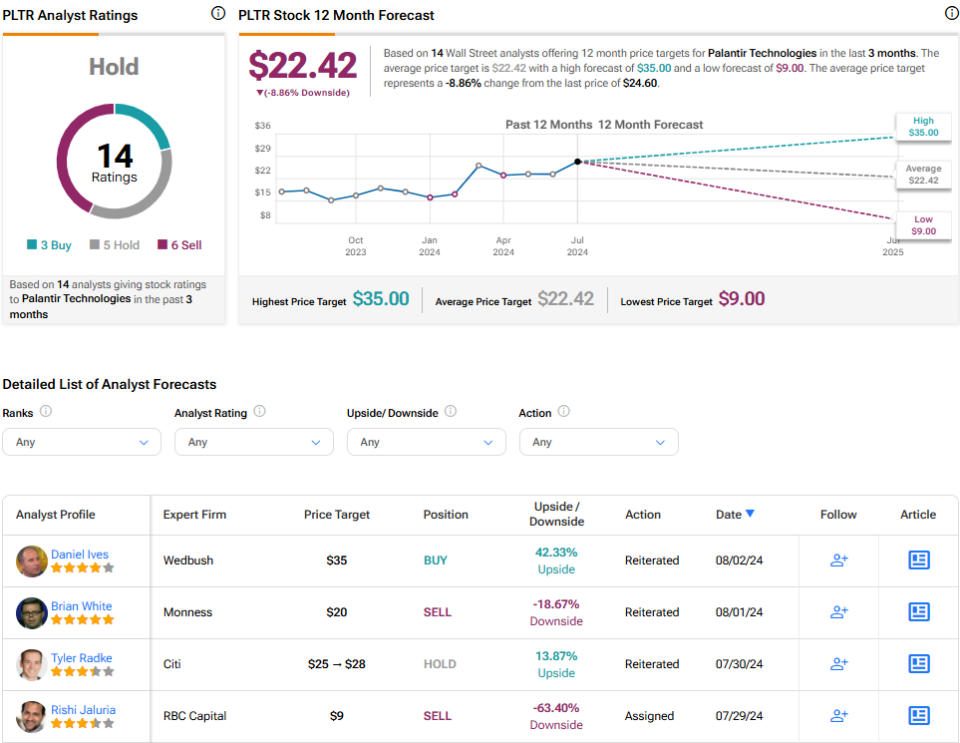

Is PLTR Stock a Buy, According to Analysts?

According to Wall Street analysts, Palantir is a Hold, based on three Buys, five Holds, and six Sell ratings. The average PLTR stock price target is $22.42, indicating 8.9% downside potential. Much of this potential downside is related to the valuation, as I have outlined.

If Palantir does decline below $20 per share, this could present a buying opportunity. Personally, I would consider buying a small stake at around $18 per share.

Takeaway: Palantir Is Too Richly Valued to Invest In

PLTR is one of my favorite stocks on the market at the moment. However, as all great investors will tell you, a company’s valuation is one of the most important factors in an investment decision. In the case of Palantir, it is too highly-priced to make an investment likely to achieve medium-term alpha.

As a result of my conclusion, I am waiting for the price to drop, which I think is likely to occur over the next 12 months. If the valuation multiples contract by 25%, I think PLTR could be in Buy territory.