Only 2.5% of workers would benefit from no taxes on tips—and in the long term, it could hurt them

“A tax exemption for tips violates every rule of tax equity.”

Vice President Kamala Harris and former President Donald Trump don’t see eye to eye on many policies, but both have called for nixing taxes on tips. Harris came out in support of the policy this week, while Trump has been floating the idea since June. In both cases, though, the details are foggy, as neither camp has explained to whom exactly the policy would apply or what specific taxes they are talking about eliminating.

One aspect of “no tips on taxes” that is confirmed: Economists generally consider the move a bad idea. Such a policy would apply to around just 2.5% of workers who are traditionally considered tipped workers. This figure is based on including the likes of servers and hairdressers, according to recent analysis from Yale University’s Budget Lab, and would apply to around 4 million people.

Trump and Harris are framing the tip change as a pro-worker policy, and in the short run, it could help boost take-home pay for employees in the service industry. But it’s in the long term where the workers will run into problems, experts say. Not paying tax on the income means that their earned income will be lower. That affects Social Security and Medicare, and also means they have less to show when trying to qualify for a mortgage or other loan where income is considered.

“This is a short-term boost that will have a long-term affect on employees,” says Karla Dennis, a tax strategist. “When it comes time to draw Social Security, these employees will be at a disadvantage as they will have less benefit in future years.”

And it’s not clear how many would even benefit in the short term. Even among lower-income workers, not taxing tips isn’t likely to help much, economists say. “Many tipped workers make so little income that they already pay little or no income tax,” writes Howard Gleckman, senior analyst at the Urban-Brookings Tax Policy Center. While waitstaff at high-end restaurants might see a much bigger benefit, the typical waiter or waitress—who makes $32,000 or less annually, according to the Bureau of Labor Statistics—would not.

There’s also nothing stopping employees in other industries from changing their compensation structure so that they receive more tips, says Ganesh Pandit, a professor of accounting and law at Adelphi University.

“What will happen if employees in department stores or grocery stores start ‘working for tips” in return for reduced ‘taxable salaries’? That will make things really complicated,” says Pandit. “And what if some salespeople start receiving some portion of their commission as ‘tips’ which will make that amount not taxable?”

But even if the policies ended up restricting what professions the policy could apply to, as Harris’s campaign has indicated, from a tax fairness standpoint, there’s no reason tipped workers should be treated so differently.

“A tax exemption for tips violates every rule of tax equity,” says Gleckman. “Why should a service worker avoid tax on tips while a warehouse employee earning exactly the same income must pay tax on wages?”

The big business boost

Overall, such a policy would end up being more of a boost to business than a populist way to help lower-income Americans. There’s nothing stopping businesses who want to pay employees less from moving toward the tipped economy. Doing so allows employers to move to a subminimum wage, with the assumption employees will make up the difference with tips.

“It is a win for the business owner,” says Dennis. “They may have more of their employees wanting to work the jobs that earn tips, and it may also help to get more people in these service-oriented jobs.”

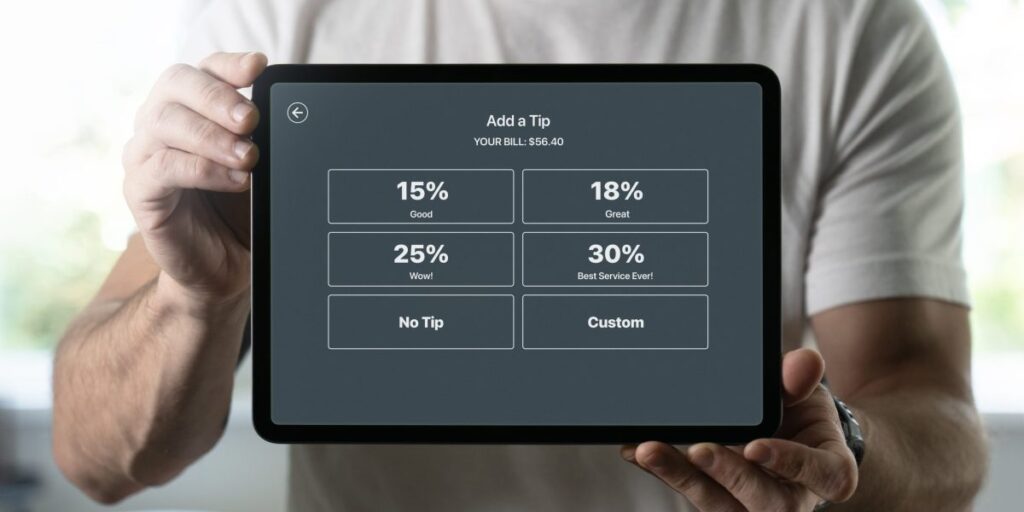

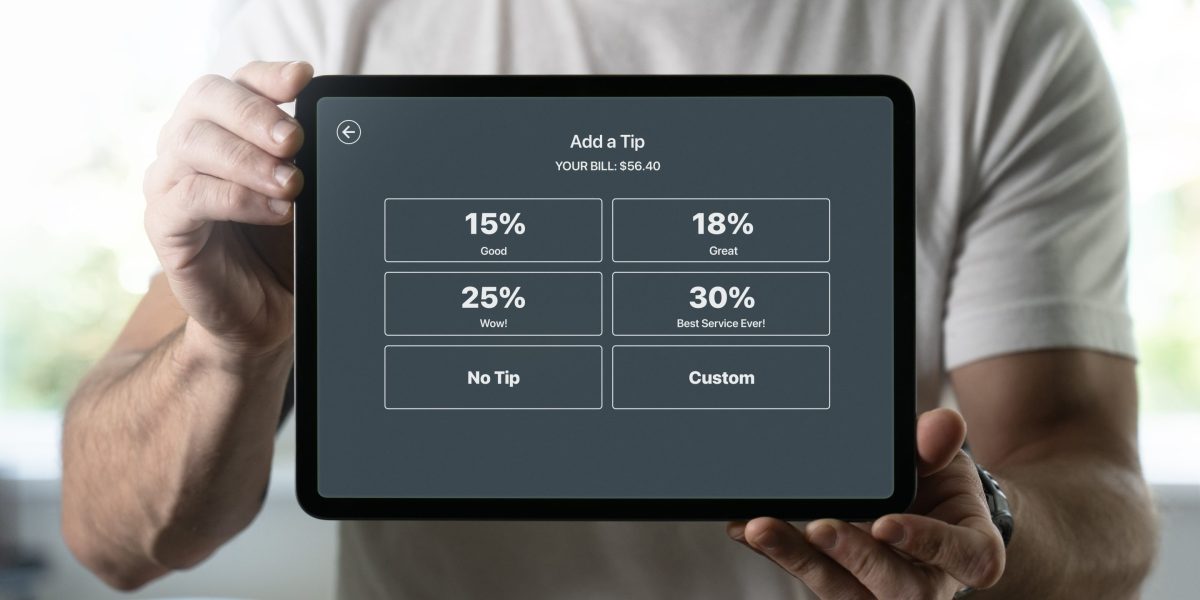

Given that consumers are already more than fed up with tipping culture in the U.S., there could be even more blowback from even more workers asking for tips. And the policy could harm movements to raise the minimum wage, says Gleckman, which would help workers more than not taxing tips; “back-of-house workers” like dishwashers would be particularly vulnerable.