Nvidia Stock Sell-Off: Is It Time to Buy This Artificial Intelligence (AI) Stalwart?

Amidst a market sell-off centered around big tech stocks, Nvidia (NASDAQ: NVDA) has had a rough month. Since it hit $135 per share in early July, the stock has sold off heavily and now sits at just shy of $100 per share. That’s a near-30% decline from its high, indicating that Nvidia stock is in its own bear market.

While this may cause some investors to panic, it may provide other investors a chance to buy the stock at a discount after missing the initial rise. So, is Nvidia stock a buy here? Or is this a reasonable price correction?

Two long-term non-factors are influencing Nvidia’s stock

The broader stock market sell-off is loosely attributed to a trading strategy that caused investors to borrow the Japanese Yen at low interest rates and then use that money to invest in some of the most dominant tech stocks in the U.S. market (like Nvidia). Now that Japan has signaled it is tightening interest rates, anyone doing this is selling their shares to return the money before higher interest rates kick in.

Additionally, there is some fear that the U.S. Federal Reserve is asleep at the wheel and that it should be cutting interest rates. With unemployment rising steadily, many are concerned that we’re actually in the beginning phases of a recession.

These prevailing headwinds aren’t doing Nvidia investors any favors, but they allow long-term investors to add more at a great price. These factors won’t stop artificial intelligence (AI) proliferation, so it doesn’t make sense to factor them into the long-term investment thesis.

Because Nvidia is the top supplier of graphics processing units (GPUs) that provide the computing power necessary to train AI models, it has benefited greatly over the past year and a half as the AI arms race heats up. This isn’t projected to slow anytime soon, and investors should focus on the AI infrastructure buildout.

However, is the sell-off deep enough to warrant buying Nvidia stock?

Nvidia’s stock is now in the buy zone

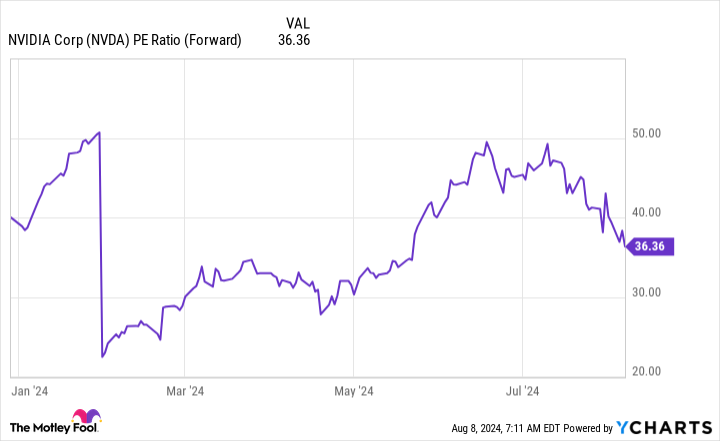

Valuing Nvidia stock is incredibly difficult because of its rapid growth and transformation. The best way to value it is by using the forward price-to-earnings (P/E) method, which uses analyst earnings projections over the next 12 months to assess the stock. While this method isn’t perfect, it’s the best way to assess Nvidia.

Thanks to the sell-off, Nvidia trades for an expensive but much more reasonable 36 times forward earnings.

While this only resets the valuation to late May levels (before its first-quarter earnings report), it’s still not a bad price. Since its big tech peers like Amazon, Apple, and Microsoft aren’t that much cheaper than Nvidia, trading respectively for 35, 31, and 30 times forward earnings. Plus, they don’t have nearly the growth potential, it’s starting to look like Nvidia may be worth buying.

If you’re going to buy Nvidia stock, it’s probably best to do it before Aug. 28. That’s when Nvidia reports Q2 earnings for its fiscal 2025, and Nvidia’s stock has popped after almost every earnings report dating back to Q1 FY 2024. I’d be surprised if anything Nvidia says in that earnings report sends the stock lower, as all of the language from the cloud computing providers and any other company investing heavily in AI servers has stated they will only spend more over the next year.

This is great news for Nvidia and is a fantastic reason to buy the stock now amid the market sell-off.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Stock Sell-Off: Is It Time to Buy This Artificial Intelligence (AI) Stalwart? was originally published by The Motley Fool