Nvidia stock sees weekly loss as Wall Street sees ‘urgent demand’ keeping the chip trade intact

Nvidia stock (NVDA) closed on Friday with a weekly loss of 2% as investors continue to sort through what’s been a challenging last several weeks for the year’s hottest trade.

But Wall Street analysts this week remained confident in the long-term prospects for Nvidia, which is now down about 20% over the last month and off more than 25% from its record closing high.

Earlier this week, Piper Sandler analysts called out a “tremendous opportunity” to buy Nvidia, AMD (AMD), and ON Semiconductor (ON) following the sector’s recent sell-off.

Some analysts also took the opportunity to upgrade the stock during this sell-off.

“I think that for 2025 … things are fairly well set,” New Street Research technology infrastructure analyst Antoine Chkaiban told Yahoo Finance on Thursday. “We know roughly how much [hyperscalers] expect to grow capex. Plans are already set.” New Street upgraded Nvidia to a Buy this week with a $120 price target.

On Friday, chip manufacturer TSMC (TSM), a supplier to Nvidia, posted a 45% year-over-year increase in sales in July — a sign that AI demand remains strong.

“We still sense an urgent demand across the board, and that mitigates the risk in a pause in shipments as customers wait for the next generation of chips to be available in volumes,” said Chkaiban.

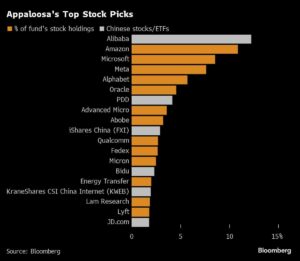

The so-called hyperscalers — Microsoft (MSFT), Meta (META), Amazon (AMZN), and Alphabet (GOOG, GOOGL) — each remained consistent during recent earnings reports in their commitment to AI investment. And much of this investment flows right to Nvidia.

“Investors will likely revisit the AI-levered names because that within [semiconductors] is still the one area spending is flowing in terms of customer spending as evidenced by increases in capex by multiple hyperscalers this earnings period,” Jefferies analyst Blayne Curtis told Yahoo Finance on Friday.

Talk of a possible delay for Nvidia’s Blackwell next-generation chip put added pressure on the stock earlier this week. A two-month wait for the chips wouldn’t be inconsequential, analysts say, but it would still not be enough to move the needle on Wall Street expectations.

Curtis’s team stated in a recent note the Nvidia delays “are real, but not a thesis changer.” The company is set to report quarterly results at the end of August.

Analysts and strategists looking at markets more broadly also see the recent cooling in the AI trade as an opportunity.

Truist Advisory’s chief marketing strategist Keith Lerner upgraded the tech sector to Overweight on Thursday after a 12% decline from its mid-July peak with semiconductors down almost 20%. Lerner noted that despite the drop in the price of these stocks, tech’s forward earnings estimates continue to rise.

“This suggests the recent setback was due more to crowded positioning as opposed to a shift in fundamentals,” Lerner wrote in a note to clients.

“Moreover, in a cooling economic environment, we expect investors to come back to tech given some of the secular tailwinds stemming from artificial intelligence (AI) and its premium growth prospects. Moreover, during the current earnings season, we have seen capital spending trends toward AI continue to rise.”

But recent sentiment shifts don’t necessarily resolve the looming question, which investors will in time want answered — how do these massive AI investments eventually pay off?

“When it comes to technology, what’s very apparent is not just the macroeconomic picture but also the fact that people want to see … evidence that that GenAI trade is actually driving positive outcomes,” Luke Barrs, managing director at Goldman Sachs Asset Management, told Yahoo Finance on Friday.

“We have to just be cautious and let it play out over the next year or two.”

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance