My Top 4 Stocks to Buy in August

With August arriving, investors should assess whether their portfolios are missing any stocks. Despite the market’s strong year, there are still plenty of stocks that are worth buying at today’s prices.

If you want to grow your portfolio in August, I’ve got four names that investors should consider.

1. Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM) is probably one of the top five most vital companies in the world. Its cutting-edge technology allows it to manufacture microscopic chips at a scale nobody else can match. Because it is a contract manufacturer, it makes chips for nearly every company involved with advanced technology, like Apple and Nvidia.

It’s also a long-term growth story, as management predicts revenue will grow at a 15% to 20% compound annual growth rate (CAGR) over the next several years. Second-quarter results were slightly outside of that prediction, with revenue rising 33% in U.S. dollars, but that’s making up for a few weaker quarters before this.

TSMC is a top growth investment in today’s market, and with its excellent positioning as a market leader, it is a smart buy in August.

2. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is one of the most dominant companies in today’s market and the undisputed leader in the search engine sector. There have been several attempts to dethrone Google (an Alphabet subsidiary), but none have worked out so far. While OpenAI (makers of ChatGPT) will try, I’m not confident they can rewire the habits of millions of consumers.

This challenge has caused weakness in the stock and a poor reaction to Q2 earnings despite them being quite strong. In Q2, Alphabet’s revenue rose by 14%, and earnings per share (EPS) rose 31%. Alphabet is still the king of search, and it will take a monumental effort to unseat it.

After its pullback, Alphabet’s stock is more than 10% off its all-time highs and trades for 22.4 times forward earnings. Considering that the S&P 500 trades for 22.1 times forward earnings, Alphabet is essentially priced at the market average.

Do you think Alphabet is the same as the average stock in the S&P 500? I don’t. Which is why I think it’s an excellent buy right now.

3. UiPath

UiPath (NYSE: PATH) has had a rough year. The company didn’t execute during the first quarter and lost out on some sales, which caused it to cut Q2 and full-year guidance. This caused an extreme reaction in the stock, resulting in it dropping 50% in value in 2024.

However, that’s a complete overreaction, and investors should take the time to load up UiPath’s stock. Despite cutting its annual recurring revenue (ARR) targets, they’re still strong overall. In Q2, UiPath expects 18% ARR growth and 13% ARR growth in fiscal year 2025. It’s not uncommon for management to lowball guidance after adjusting down to avoid multiple disappointments, so I’d be surprised if UiPath doesn’t exceed these levels.

There’s still a high demand for RPA (robotic process automation) software, and UiPath remains a top option in this space. At a dirt-cheap 5.2 times sales, it’s a fantastic stock to add more of in August.

4. Procore

Procore (NYSE: PCOR) may be the most obscure company on this list, but it’s well worth your time. Procore provides construction management software to its clients, and it has become a hit. Because of the lack of internet connectivity, construction is one of the last industries to modernize and deploy time-saving software. By investing in Procore now, investors can turn back the clock and buy companies like Salesforce or Adobe before they take off.

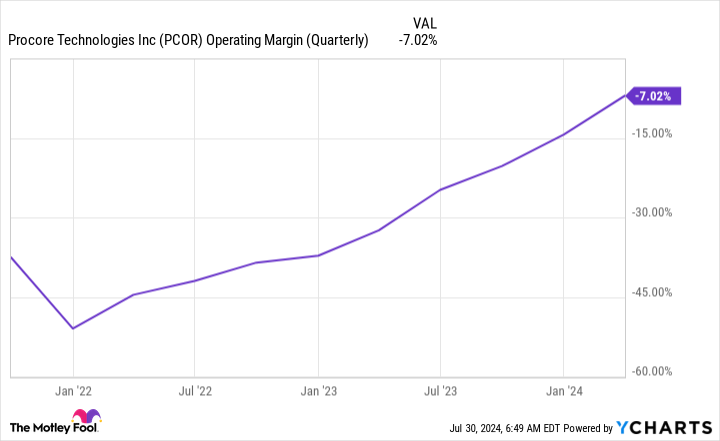

Procore has continuously delivered strong results, with revenue growth of 26% year over year to $269 million in Q1. Its operating margins have also steadily improved.

It won’t be long before Procore starts turning a profit and has a massive growth runway. Despite that, the stock trades for around 10 times sales, far less than other software companies with an artificial intelligence (AI) offering.

If you’re looking for a great software company that isn’t associated with AI and has a nearly guaranteed growth tailwind, Procore is an excellent stock pick.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $717,050!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Adobe, Alphabet, Procore Technologies, Salesforce, Taiwan Semiconductor Manufacturing, and UiPath. The Motley Fool has positions in and recommends Adobe, Alphabet, Apple, Nvidia, Procore Technologies, Salesforce, Taiwan Semiconductor Manufacturing, and UiPath. The Motley Fool has a disclosure policy.

My Top 4 Stocks to Buy in August was originally published by The Motley Fool