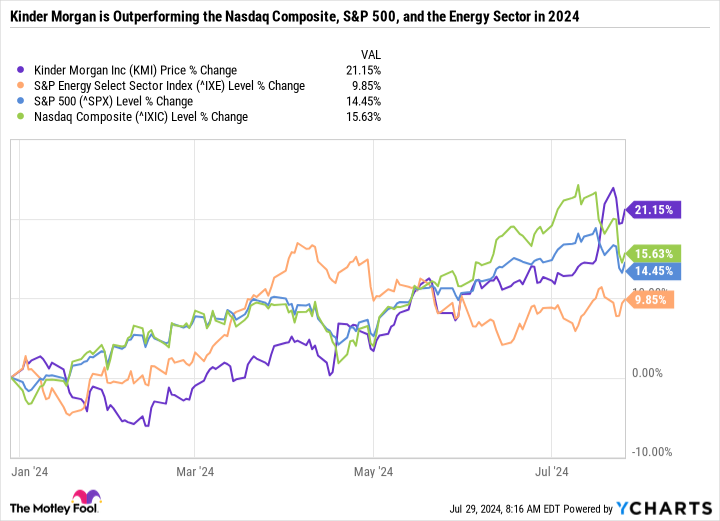

Meet the 5.4%-Yielding Dividend Stock That Is Crushing the S&P 500 and Nasdaq Composite in 2024

After years of underperforming the market, Kinder Morgan (NYSE: KMI) is finally having a breakout year. The stock is up 21% year to date and recently hit a new five-year high despite the energy sector underperforming the S&P 500 so far this year.

Here’s why the future looks bright for the pipeline and infrastructure company and why the dividend stock is worth buying now.

Kinder Morgan continues to deliver

Over the last few years, Kinder Morgan has posted solid results and made multiple small- to medium-sized acquisitions in legacy oil and gas infrastructure assets, liquefied natural gas (LNG), and renewable natural gas (RNG). LNG is natural gas that is cooled and condensed so that it can be shipped overseas. RNG is pipeline-quality gas produced from decomposing organic matter in landfills, cow manure, wastewater, or food waste instead of from fossil fuels.

Kinder Morgan has done a good job of balancing investments and financial discipline. It has continued to reduce its leverage and now plans to finish the year with a net debt-to-adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio of just 3.9. Kinder Morgan has come a long way since the oil and gas crash of 2015. It has decreased its net long-term debt position by 29% — making the business more financially stable so it can use cash flows to pay dividends and reinvest in the business instead of being pressured to pay down debt.

Full-year guidance calls for a 15% increase in earnings per share to $1.22 and $1.15 in dividends per share. At first glance, Kinder Morgan’s dividend looks barely affordable, given that it is nearly as high as earnings estimates. But Kinder Morgan generates plenty of distributable cash flow (DCF) to cover its growing dividend payout — guiding for $2.26 in DCF per share for the full year.

Kinder Morgan uses DCF instead of net income to gauge its asset performance and dividend affordability. Operating expenses and sustaining capital are deducted to determine DCF, whereas generally accepted accounting principles (GAAP) net income is reduced by depreciation.

All told, Kinder Morgan checks all the boxes because it can return capital to shareholders while maintaining a healthy balance sheet and investing in future growth. The rosy outlook may be why the stock is outperforming the Nasdaq Composite, S&P 500, and energy sector year to date.

A new growth catalyst

In addition to the business’s performance and its 5.4% yield, another factor driving Kinder Morgan is its future earnings prospects. Kinder Morgan makes money from building infrastructure like pipelines, terminals, and storage facilities and then generating stable cash flows from those assets over time. Kinder Morgan depends on demand for natural gas and oil to justify its capital-intensive projects. The export of LNG is a multidecade catalyst for Kinder Morgan, but domestic consumption could stagnate or even decline over time due to the shift toward cleaner energy sources.

Complex artificial intelligence (AI) models require massive amounts of computing power — which is driving demand for more data centers. More data centers mean more electricity demand to keep graphics processing units and associated hardware cool and running. On its second quarter 2024 earnings call, executive chair Rich Kinder discussed the reasons why the tech sector has become an unexpected boon for Kinder Morgan and its peers:

The anecdotal evidence over the last few months has been jaw-dropping. Let me give you just a few examples. In Texas, the largest power market in the U.S., ERCOT now predicts the state will need 152 gigawatts of power generation by 2030. That’s a 78% increase from 2023’s peak power demand of about 85 gigawatts. This new estimate is up from last year’s estimate of 111 gigawatts for 2030. Other anecdotal evidence also supports a vigorous growth scenario. For example, one report indicates that Amazon alone is expected to add over 200 data centers in the next several years, consistent with the large expansions being undertaken by other tech companies chasing the need to service AI demand. Annual electricity demand growth over the last 20 years has averaged around one-half of 1%. Within the last 60 days, we’ve seen industry experts predict annual growth from now until 2030 at a range of 2.6% to one projection of an amazing 4.7%.

Kinder Morgan has an advantageous position in a future that requires higher energy usage. It doesn’t particularly care what the end-use case of natural gas is (power generation, industrial, commercial, transportation, etc.) as long as demand is going up. Although Kinder Morgan benefits from higher oil and gas prices, its business is based on collecting fees from long-term contracts to transport those fuels — meaning it isn’t as price-sensitive as an exploration and production company.

Granted, many big tech companies have been adamant about converting to net-zero carbon emissions. Amazon Web Services could very well be the largest single contributor to data center growth. But Amazon has clear energy transition goals. In July, Amazon announced that 100% of electricity consumed across its global operations (including data centers) is now renewable electricity — a goal it originally set for 2030. It achieved that target through a mix of capital investments in its own projects and purchasing renewable energy.

In sum, it remains to be seen what role natural gas will play in the future grid, even if electricity demand growth accelerates.

More reasons to buy Kinder Morgan stock

Kinder Morgan stands out as a reliable passive income source due to its slow and steady growth and high yield. The investment thesis used to center around domestic oil and gas consumption. While that remains a key aspect of the business, the rise of LNG and RNG, the need for safer and more secure grids, and AI-driven electricity usage have strengthened the investment thesis because they reinforce the need for more projects.

Even after its recent run-up, Kinder Morgan is not an inexpensive stock, sporting a price-to-earnings ratio of 19.4 and a price-to-free cash flow ratio of 11.9. Kinder Morgan is worth considering if you believe natural gas and oil have a key role to play in the future energy mix of the U.S. and abroad.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Kinder Morgan. The Motley Fool has a disclosure policy.

Meet the 5.4%-Yielding Dividend Stock That Is Crushing the S&P 500 and Nasdaq Composite in 2024 was originally published by The Motley Fool