Is Pfizer Stock a Buy Now After Earnings?

While the COVID-19 pandemic is an increasingly distant memory for most investors, Pfizer (NYSE: PFE) has struggled to move past the overhang of record vaccine sales and earnings in 2021 and 2022. The stock is down about 53% from its all-time high as the market wonders whether the pharmaceutical giant can find its next blockbuster drug.

The good news is that the company’s latest results highlighted a growth rebound. Sales momentum from several recent product launches supports an improving outlook. Could Pfizer stock — which currently has a compelling dividend yield of 5.8% — make a good addition to your portfolio now? Here’s what you need to know.

A solid start to 2024

The challenge for Pfizer right now is to rebuild investor confidence with evidence that its long-term strategy is back on track. Fortunately, the company’s second-quarter earnings (for the period ended June 30) have worked to move in that direction. Revenue growth turned positive, up 3% year over year, but an even more impressive 14% higher excluding the impact of the declining Comirnaty and Paxlovid COVID-19 programs.

In addition to contributions from Seagen, which Pfizer acquired in late 2023, growth this quarter was driven by strong demand for flagship products like Vyndaqel and Eliquis. Sales of Nurtec as an acute migraine medication have also picked up.

A major theme for Pfizer has been its effort to generate financial efficiencies through cost realignment, with a plan to deliver at least $4 billion in savings by the end of the year. It appears the effort is paying off. Second-quarter adjusted earnings per share (EPS) of $0.60 came in $0.14 ahead of the average Wall Street estimate.

This allowed management to hike full-year guidance: Pfizer now expects 2024 adjusted EPS of between $2.45 and $2.65, compared to a prior $2.25 midpoint estimate. The revenue forecast was also bumped higher to a range of $59.5 billion to $62.5 billion, for a 4% increase at the midpoint over 2023.

Pfizer’s attractive high-yield dividend

The market typically rewards a turnaround story, and Pfizer has all the pieces in place to emerge stronger after a difficult couple of years. The attraction of the stock as an investment opportunity starts with its sector leadership and recognized history of innovation.

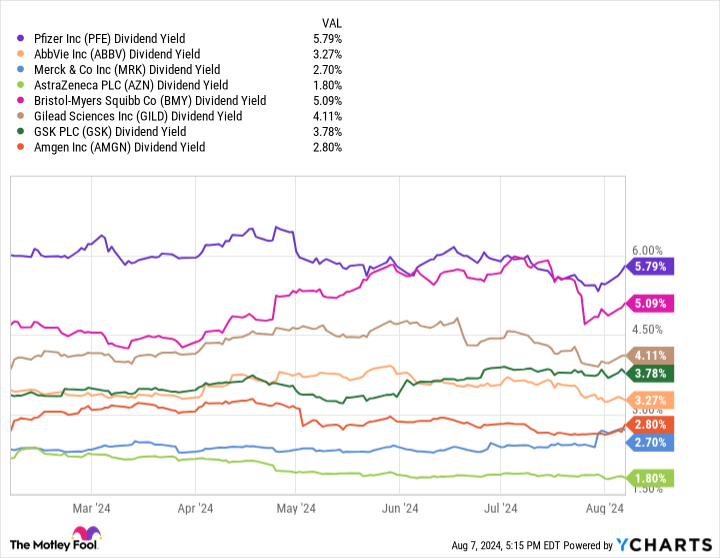

What I like about Pfizer is its compelling value, with a forward price-to-earnings (P/E) ratio of just 11 times management’s 2024 EPS guidance. Pfizer also offers one of the highest dividend yields among a peer group of global drugmakers — currently at 5.8%, based on its $0.42-per-share quarterly payout. This level is well above names like AbbVie with a 3.3% yield, GSK at 3.8%, or even Bristol Myers Squibb at 5.1%.

The takeaway on Pfizer’s stock

The takeaway from the second-quarter earnings report is that the company is finally turning the page on its volatile later-pandemic era. I believe shares of Pfizer deserve a buy rating.

Multiple drug programs pending clinical study readouts are expected through the end of this year, covering weight management, oncology, and hematology. These therapeutic candidates could be catalysts for the stock to rally higher. At the same time, those regulatory decisions are also risks to consider, with any setback in Pfizer’s pipeline likely adding volatility to the stock.

Ultimately, Pfizer looks undervalued, considering the long-term opportunities across its existing portfolio and drug pipeline. The company’s ability to reclaim a profitable growth trajectory should be positive for shares. For investors with a long-term time horizon, Pfizer could be a good choice in the context of a diversified portfolio.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb, Gilead Sciences, Merck, and Pfizer. The Motley Fool recommends Amgen, AstraZeneca Plc, and GSK. The Motley Fool has a disclosure policy.

Is Pfizer Stock a Buy Now After Earnings? was originally published by The Motley Fool