Is Nvidia Stock a Buy?

Nvidia (NASDAQ: NVDA) has pulled off a historic rise over the last decade, with its share price up more than 25,000% since 2014. The company has taken the chip market by storm, almost singlehandedly building the consumer chip industry into what it is today.

Nvidia was one of the first companies to begin selling graphics processing units (GPUs) directly to customers, who use these chips to build high-performance PCs for activities like gaming and video editing.

The chipmaker’s direct-to-consumer business remains lucrative, with its gaming segment up 18% year over year in the first quarter of fiscal 2025. Nvidia’s success in desktop GPUs has given it the brand power and financial resources to expand to multiple other sectors, including artificial intelligence (AI), cloud computing, healthcare, government, robotics, and self-driving vehicles.

Nvidia’s stock has climbed about 140% in the last 12 months but appears to only just be getting started. So, despite recent growth, Nvidia’s stock remains a compelling option worth considering this year.

The potential to achieve a market cap above $3 trillion

Nvidia temporarily achieved a market cap above $3 trillion earlier this year, joining Microsoft and Apple in the elite club of trillion-dollar companies. However, its market cap is currently around $2.7 billion after a slight correction and pullback from tech industry investors. Yet, Nvidia’s significant growth potential suggests it won’t be long before it rises above that $3 trillion milestone again — and this time, for good.

AI has highlighted the crucial role chips have to play in the future of tech, equipping developers with the power necessary to build the generative software. Meanwhile, AI is only one of many industries that require high-powered chips to move forward, representing many growth catalysts for Nvidia.

Data from JPMorgan Chase shows that prominent tech giants Microsoft, Amazon, Alphabet, and Meta Platforms will reach capital expenditures totaling $201 billion by May 2025. That figure will be up from about $140 billion in 2023, representing a 44% rise. Much of that will be spent on expanding their positions in AI, building data centers, and equipping them with GPUs.

Meanwhile, Nvidia is well-positioned to enjoy massive gains from increased AI spending, with its GPUs responsible for about 90% of the market. The company posted revenue gains of 262% year over year in Q1 2025, up 18% sequentially. The increase was mainly thanks to a 427% increase in its data center segment, illustrating a rise in AI chip sales.

Nvidia has enjoyed stellar growth from AI, even while many markets have barely scratched the surface of what’s possible with the technology. Large language models like OpenAI’s ChatGPT have proven the utility of language generation. However, as Meta Chief Scientist Yann LeCun recently pointed out, these platforms “don’t really understand the physical world. They don’t really have persistent memory. They can’t really reason, and they certainly can’t plan.”

The best and most efficient use of AI has likely not even been thought of yet, with decades of understanding likely ahead. And Nvidia is well-equipped to continue fueling the market’s development. Increased spending in AI will likely continue to boost earnings and raise its market cap to well above $3 trillion.

Nvidia isn’t trading at a bargain, but its stock is a better value than you might think

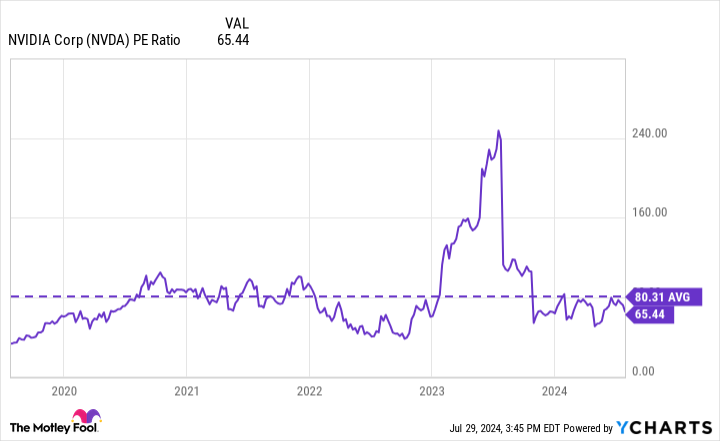

Nvidia’s stock recently was trading at about 65 times its earnings. That figure beats its biggest rival, Advanced Micro Devices, which has a price-to-earnings (P/E) ratio of an eye-watering 206. The data shows that Nvidia is a better value than its competitor, but not exactly a huge bargain.

However, this chart shows that Nvidia’s current P/E is below its five-year average for the metric, during which the company’s stock price skyrocketed by 2,450%. As a result, a high P/E doesn’t necessarily mean the company’s stock will fall short in growth.

In addition to Nvidia’s monster potential in AI and tech in general, its stock is too good to ignore for anyone looking for a long-term investment. The company will likely continue profiting from rising chip demand for years as more and more markets require powerful hardware to develop.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $669,193!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, JPMorgan Chase, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Nvidia Stock a Buy? was originally published by The Motley Fool