Is Now the Time to Buy Energy Transfer Stock?

Energy Transfer (NYSE: ET) once again increased its full-year guidance when it reported its second-quarter results, showing the strong operational momentum the company has. The stock has performed well this year with an over 20% return, including distributions.

Despite its strong performance this year, the master limited partnership (MLP) still has an enticing forward distribution yield of about 7.9% and trades at an attractive valuation.

Let’s dive into the company’s Q2 results and guidance, and look at why the stock is an attractive option for income-oriented investors.

Momentum continues

The pipeline company continued to see strong volume growth across its segments, led by a 22% jump in crude oil transportation volumes. Crude oil terminal and NGL fractionation volumes, meanwhile, were both up 11%, and refined product volumes rose 9%.

This led to a nearly 21% increase in adjusted EBITDA in the quarter to $3.8 billion. Distributable cash flow (DCF) to partners, which is how much cash the company generates before growth capital expenditures (capex), was $2 billion, up nearly 32% from a year ago. The company increased its per-share distribution by 3.2% year over year to $0.32.

The company paid out $1.2 billion in distributions to unitholders in the quarter. That equates to a distribution coverage ratio of nearly 1.7 times based on its DCF. After paying out distributions, Energy Transfer had about $800 million in excess cash flow, and it spent $549 million in growth capex in the quarter. As such, its distribution remains well covered.

Looking ahead, Energy Transfer raised its full-year EBITDA guidance to a range of $15.3 billion to $15.5 billion from a previous forecast of $15 billion to $15.3 billion..

The new guidance reflects its acquisition of WTG Midstream and the outperformance of its base business. It notes that the forecast includes $100 million of transaction costs associated with the deal. It also boosted its growth capex guidance to between $3 billion and $3.1 billion from a prior range of $2.8 billion to $3 billion.

Energy Transfer’s updated outlook continues to point to solid growth and distribution coverage moving forward. The adjusted EBITDA forecast implies full-year DCF of approximately $9 billion, while it will spend around $3.1 billion in growth capex. It has paid $2.3 billion in distributions thus far this year and should pay around $4.7 billion total for the year. That would give it about $1.2 billion in cash toward paying down debt.

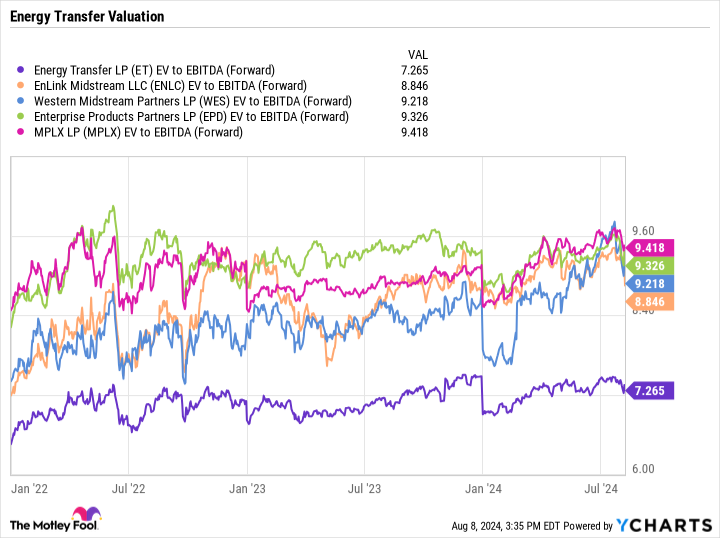

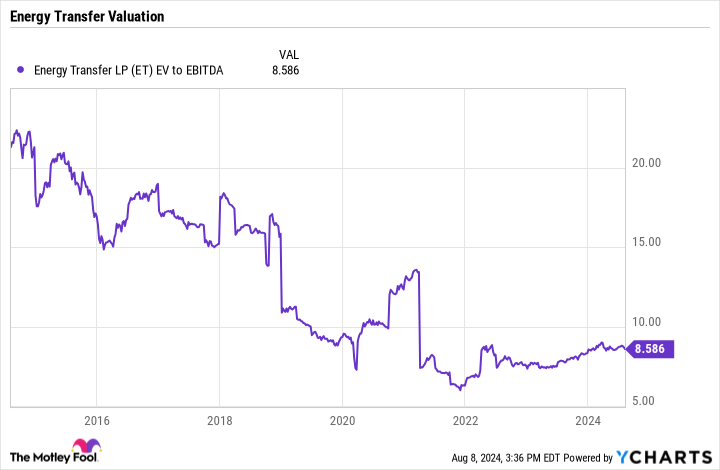

An attractively valued stock

Energy Transfer trades at an attractive forward enterprise value (EV)-to-EBITDA multiple of just 7.3x. That is a much lower valuation than those of its MLP peers, as well as below the valuation the company traded at prior to the pandemic. (NYSE: ENLC) (NYSE: WES) (NYSE: EPD) (NYSE: MPLX) ((NYSE: MCO)

The midstream industry as a whole, meanwhile, trades at a nice discount compared to the 13.7x EV/EBITDA multiple the stocks averaged between 2011 and 2016.

At the same time, Energy Transfer’s balance sheet is in strong shape, as evidenced by the recent senior unsecured debt upgrade it received from Moody’s, and its distribution coverage remains robust. The company is also well positioned to benefit from increased natural gas demand that is starting to arise from higher power demand due to the buildout of artificial intelligence (AI) infrastructure. The company noted that it serves 185 gas-fired power plants in 15 states and has recently signed deals across its system to provide over 500,000 MMBtus per day. It is also in talks with data centers that are looking to add generation capacity on site.

The combination of growth stemming from increased natural gas demand and potential multiple expansion (when stock valuations rise) makes Energy Transfer one of the most intriguing energy stocks out there. Investors get a nearly 8% yield to boot. As such, this looks like a great time to buy the stock at current levels.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Geoffrey Seiler has positions in Energy Transfer, Enterprise Products Partners, and Western Midstream Partners. The Motley Fool has positions in and recommends Moody’s. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Is Now the Time to Buy Energy Transfer Stock? was originally published by The Motley Fool