Intel’s Collapse: This Is What Competitive Disadvantage Looks Like

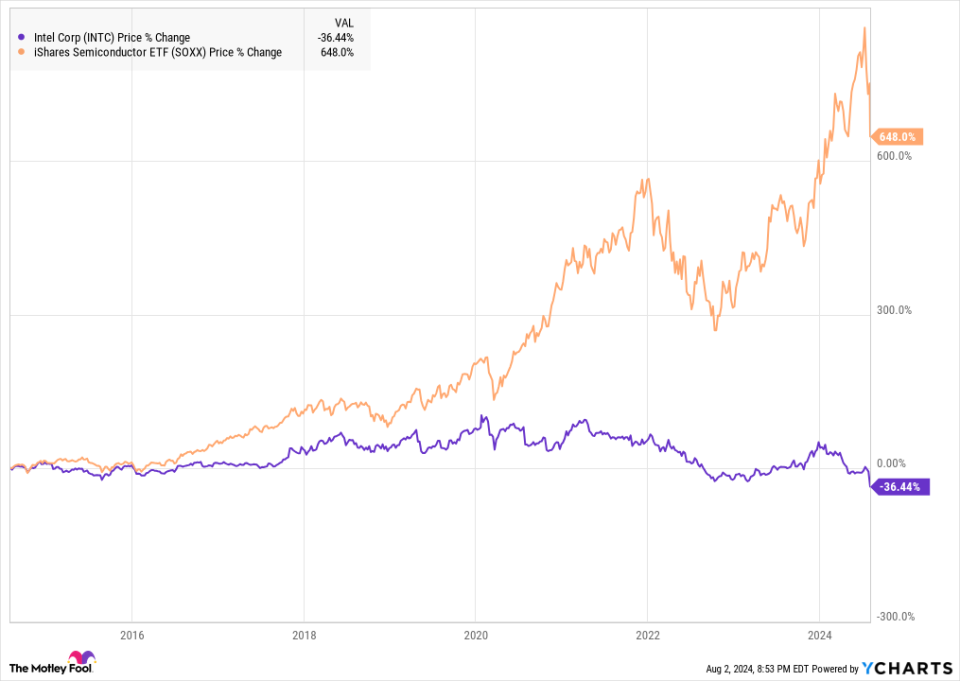

Shares of Intel (NASDAQ: INTC) crashed to a new 10-year low on Aug. 2, but the company’s struggles are nothing new. In fact, there may be no other prominent blue chip stock that has underperformed its industry as badly over so many years. The chart below shows how Intel’s record compares to a popular semiconductor ETF.

As you can see, even with the recent pullback in chip stocks, a basket of semiconductor stocks would have crushed the S&P 500, while Intel has fallen substantially during that time. The stock’s crash on Friday, which comes after most of its peers have surged in the AI boom, owes to weak results and guidance. The company layed off at least 15% of its employees and ended its dividend.

That explains the immediate collapse in the stock, but there’s a better explanation for its longtime underperformance. Investors talk a lot about competitive advantage but often overlook the flip side of that coin: competitive disadvantage, meaning the companies losing to those with competitive advantages. Intel’s challenges and its lost decade offer an example of what competitive disadvantage looks like.

To fab or not to fab

Arguably, Intel’s biggest mistake, or at least its biggest disadvantage, has been its foundry business. Unlike peers including AMD, Nvidia, and Broadcom, which are fabless, Intel owns factories that manufacture chips, though it still outsources some of its production. Not having to worry about manufacturing, which those companies typically outsource to Taiwan Semiconductor, has freed up resources for Intel’s competitors to focus on design, and AMD’s 2009 decision to spin off its manufacturing arm, Global Foundries, is credited with unleashing its growth over the last decade.

Earlier this year, Intel disclosed a $7 billion loss in 2023 in the foundry business and reported a cumulative loss of $17 billion from 2021 to 2023. It also lost $5.3 billion in the first half of 2024, showing that challenges in the segment could be getting worse.

The company now has big plans for the foundry business with the help of the U.S. government, but as the numbers show, the business has been nothing but an albatross in recent years.

Meanwhile, foundry leader TSMC has established a significant advantage over Intel, which is considered to be a generation or two behind TSMC. TSMC is now producing 3-nanometer chips, while Intel’s smallest are 7-nanometer. Even CEO Pat Gelsinger admitted the company is trying to “close the technology gap” with TSMC after “over a decade of underinvestment” before he came back to the company in 2021.

Behind the technology curve

In addition to falling behind fabless chip makers in product design and TSMC in manufacturing, Intel has also failed to capitalize on new technologies and missed out on platform shifts. According to internal critiques, the company was too content to rest on its success in PCs, moved slowly, and was risk-averse.

Intel is best known for its PC chips, and it’s struggled to evolve beyond that area. It missed out on the mobile market and even lost Apple‘s Macs as a key customer in 2020, a reflection of the company having fallen behind in manufacturing.

In the PC or client market, Intel has generally lost market share to AMD over the years, and it’s at risk of missing out on the AI shift despite launching new AI PC chips, including Lunar Lake. It also said its much-anticipated Gaudi 3 AI accelerator for the data center is scheduled to launch in the third quarter.

The Gaudi 3 may be Intel’s most anticipated chip in a long time, and the company expects it to challenge Nvidia’s H100 in the data-center graphics processing unit (GPU) market. However, Intel’s own guidance doesn’t call for much of an impact from the Gaudi 3 as it’s forecasting essentially a year-over-year decline in revenue of 8% in Q3 to $12.5 billion to $13.5 billion at the midpoint from a weak quarter a year ago.

It’s far too early in the AI race to call Intel a loser, but its performance thus far hasn’t inspired confidence, and that’s appropriately reflected in the stock price.

A major restructuring

Intel surprised investors with news of a major restructuring on Thursday, saying it would reduce headcount by 15% as part of a larger cost-cutting plan.

It’s Intel’s biggest restructuring since at least 2016, and the timing seems complicated. Intel, like the rest of the chip sector, is at a significant pivot point as the industry shifts to AI, but the reorganization and layoffs, which won’t be fully implemented until the end of 2025, could make a challenging transition even more difficult.

Intel is cutting its workforce and eliminating its dividend because that’s what Gelsinger thinks the company needs to do to catch up with the industry, be competitive, and drive profitability. The move seems like a natural result of the company’s years of underperformance, and it’s a huge risk.

While Intel could eventually fulfill the big promises Gelsinger has made, it has some huge hurdles to overcome, and competition isn’t standing still. It’s going to take a lot of work and years for Gelsinger to turn Intel’s historical competitive disadvantages into advantages.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $606,079!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Intel’s Collapse: This Is What Competitive Disadvantage Looks Like was originally published by The Motley Fool