Intel is the latest Fortune 500 giant to test the ‘4 wrong CEOs’ rule

Sometimes a CEO’s most fateful decisions are apparent only years later. Example: If one decision had gone the other way, chipmaker Intel today might be on the leading edge of AI rather than struggling to regain its onetime industry leadership.

In 2017 and 2018 the company had a chance to buy a 15% stake in OpenAI for $1 billion, Reuters recently reported. If CEO Bob Swan had said yes, that investment would now be worth an estimated $12 billion, based on a February evaluation of OpenAI by venture capitalists and private investors. But Intel missed much more. It reportedly might have received an additional 15% in return for selling hardware to OpenAI at cost. With 30% ownership it could have been at the forefront of generative AI, which OpenAI released to the world in 2022. From the vantage point of 2017 and 2018, however, Swan judged the potential deal a loser. (Swan did not respond to Reuters’s request for comment.)

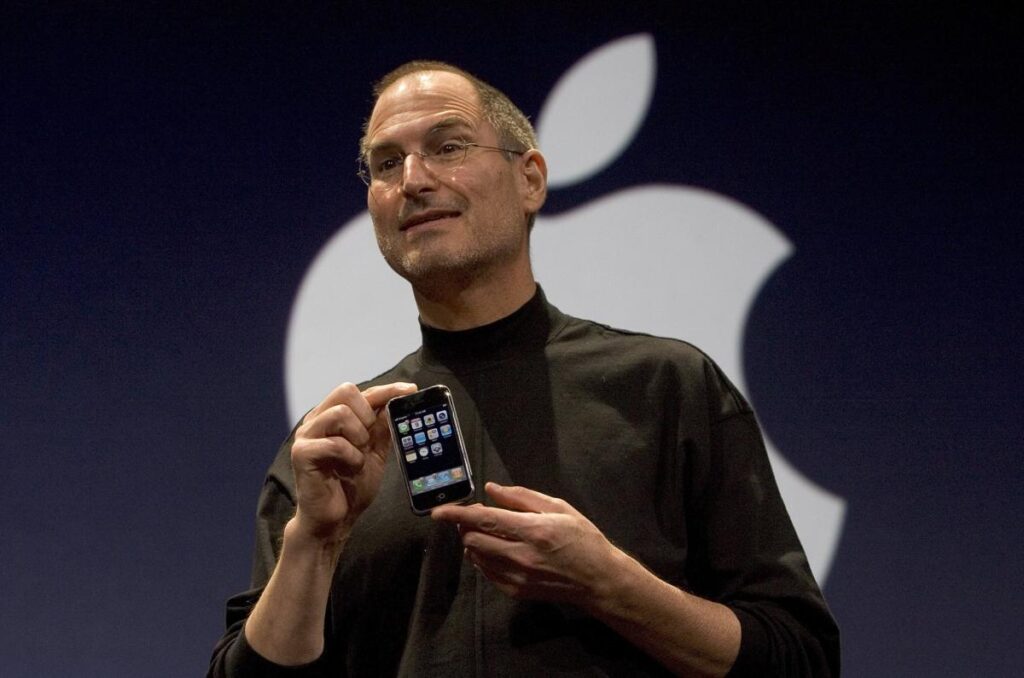

The episode recalls a similar decision, in 2006, when Apple CEO Steve Jobs asked Intel CEO Paul Otellini to make chips for a product that didn’t yet exist, which would be called the iPhone. Otellini said no. When he retired in 2013, he seemed to grasp the magnitude of his decision, telling an interviewer, “The world would have been a lot different if we’d done it.” (You can read the full story about the fallout from that decision here.)

Intel now tests the longtime observation that a company can survive a wrong CEO, but no company can survive four consecutive wrong CEOs. After Intel’s great CEO Andy Grove stepped down in 1998, he was followed by four CEOs, including Swan and Otellini, who were arguably wrong for the job at that time. As performance deteriorated, the directors in 2021 brought in former Intel chief technology officer Pat Gelsinger as CEO to lead an ambitious high-stakes rescue mission. The outcome remains unclear; Intel’s stock price recently plunged 26% on poor quarterly results.

The Intel saga is a grim reminder that some of America’s greatest companies have succumbed to the four-wrong-CEOs disease. Consider Westinghouse, a jewel of American industry for 100 years. Four consecutive wrong CEOs from 1983 to 1993 damaged Westinghouse so grievously that the board brought in an outsider CEO who disassembled and re-created the company. An entity called Westinghouse remained, but the awesome institution was gone, and the new-look company has since disintegrated.

Even more dramatic was the demise of Sears, the world’s largest retailer for decades. Four wrong CEOs from 1962 to 1986 led Sears onto a downward trajectory from which it couldn’t recover. Under the first of those CEOs, Sears’ market value reached its apex and began to decline, a reversal the top leaders explained away as a quirk of the economy. Under the fourth, Sears diversified heavily into financial services and demoted the retail business to a cash cow to be milked until it stopped. The financial services strategy failed and was unwound in 1992, but by then Walmart had surpassed Sears, which had lost its momentum forever. Investor Eddie Lampert bought the company in 2004 but couldn’t revive it. Sears once had 3,500 stores. Now it has 11.

It’s worth asking why corporate doom often takes four CEOs. Surely just one really terrible boss could do the job, right? Yes, but in companies of significant size, truly awful CEOs will probably be pushed out before they can destroy the whole thing. Ruining a substantial, successful business takes some doing, as explained by Jim Collins, author of multiple business mega-sellers (Built to Last, Good to Great, Great by Choice). In How the Mighty Fall, he identifies five stages of decline: hubris borne of success; undisciplined pursuit of more; denial of risk and peril; grasping for salvation; capitulation to irrelevance or death. Intellectually and emotionally, a single CEO would have a tough time going through all five stages, and a board could scarcely let one CEO take a company through all five.

To see how those stages play out, and why even three wrong CEOs might not be enough to wreck a company, examine Apple’s situation in 1997. The company was 20 years old. Three consecutive wrong CEOs had taken the company through the first three stages of decline. The company had been close to bankruptcy and was now in the fourth stage, grasping for salvation. A wrong fourth CEO would almost surely have taken Apple to the final stage. The board of directors, desperate, brought back co-founder Steve Jobs, who had been fired in 1985 and (believe it or not) had never been Apple’s CEO. The rest is history, but it could so easily have gone the other way.

It must be said that wrong CEOs are not dim-witted or evil. Most often they’re intelligent, highly accomplished, and motivated to succeed, but experience or temperament unsuited them for the job in that company at that time. Four of them in a row is as unlikely as four of a kind in poker, but in the corporate world it doesn’t happen by chance. Ultimately blame must fall on those fallible humans in the board room.

This story was originally featured on Fortune.com