How to survive the stock market bloodbath, according to financial advisors

On the worst day in stock markets in nearly two years, financial advisors say: “Stop freaking out and just stay in.”

Friday’s jobs report set the weekend off on the wrong foot, and now most of the global markets look like they’re shaking off an epic hangover this Monday.

Add global socio-political conflict in the Middle East and poor earnings among tech and consumer-facing companies to the mix and you have a fully boiling pot, as Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute, explained in a note on Monday. Seemingly unbeatable tech stocks have floundered; Japan saw its worst market day in decades after raising its interest rates last week, and U.S. markets saw their worst plunge since 2022. In short, a lot is happening—perhaps too much for the beleaguered consumer.

Monday ushered in broken records, as the CBOE Volatility Index (VIX), known as Wall Street’s “fear gauge,” reached its highest level in two years and Japan’s Nikkei 225 had its worst day since 1987, plummeting by 12%. It’s a case of the Mondays for sure. But that doesn’t mean it’s time for investors to freak out, explain financial advisors.

“In reality, what you’re seeing here is really a lot of noise,” Douglas Boneparth, president of Bone Fide Wealth in New York City, told Fortune.

Hold steady, don’t sell

“You don’t want to be reactionary, it could very well easily come right back,” Dan Casey, investment advisor and founder of Bridgeriver Advisors, said to Fortune of the current market downturn.

It’s a natural instinct to feel a little panicked during times of volatility. But that doesn’t mean we need to indulge our urge to march into the bank and get our tuppence back, a la Mary Poppins. During these times, it’s all about taking a deep breath and a step back.

“If you’re worrying about or focusing on things that you have no impact over, are you spending your energy and time wisely? Probably not,” Boneparth said, cautioning investors to instead pay attention to what they can control like the media they consume and the way their investment portfolio is aligned with their financial goals.

Part of the issue when you listen to the anxiety, either warranted or not, is that it creates new problems down the line, said Casey. He often tells his clients the following: “When you sell in [a downturn] like this, you temporarily create a solution. But you’re creating another problem, which is, when do I get back in?” In other words, people who try to time the market—including by selling after stocks have plummeted—often face the problem of having to buy back in, at a higher price. Sometimes Casey tells a client to split the difference, keeping half of their money in the market while withdrawing half.

Casey often tells his clients that any dollar going into the stock market “better have a five year window on it.” That’s all to say, you’re in it for the long haul, and just pulling out one day “creates havoc,” and potentially a global turmoil if millions of investors fall prey to panic at the same time.

Even as talk of recession anxiety swirls, investors should remind themselves that the stock market isn’t the economy—and many consumers are not demonstrating signs of fear. “The spending is still good. Travel is still good…people are out and about,” said Casey. “There’s nothing that I’m looking at that shows that the consumer is in a recession. Everything as of right now is still just fine.”

Sensational headlines about a meltdown reminiscent of Black Monday don’t make Casey bat an eyelash. “Maybe 20 years ago that would have freaked me out,” he said, but with computers and algorithms trading on a large scale “you don’t see, sometimes, minor corrections anymore.”

Think of long-term goals

So what should we do, if not panic? Think to the future.

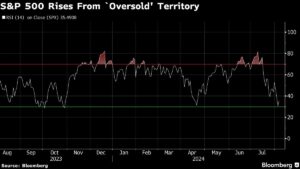

Boneparth points out that the market often has three pullbacks of 5% and one of 10% in any given year, meaning the current turmoil is not all that uncommon. Taking a far-off vantage point on the chaos can be helpful, not only to understand the upheaval in the context of regular economic volatility but also to get a holistic view of what you want as a consumer and investor.

“If you don’t have a plan in place, this is a great time to be thinking about doing that, either on your own or working with a financial advisor,” Boneparth adds, explaining that moments like these only further emphasize the importance of having a long-term financial strategy. He notes that those who already have a strong cash reserve and a strategy “aren’t going to be too rocked by a bad batch of headlines here,” as these safety nets can be a comfort during times of where knee-jerk nervousness abounds. What’s more, because sell-offs make stocks cheaper, he noted that investors who have regular contributions set up, such as to a 401(k), will automatically benefit from market downturns through dollar-cost averaging.

Ups and downs are unfortunately part of the game when it comes to the stock market. As Boneparth notes, recessions happen, and people who don’t consider downturns when making long-term investments are making “probably an error.”

That’s why most financial advisors suggest stock-market investing for the long term—meaning, any money you might need to rely on in the next few years (say, an emergency fund or a down payment on a house you’re about to make an offer on) should be in another type of account, like a CD, high-yield savings account or Treasury bonds.

So what does a strategy look like? Lavina Nagar, president at wealth management company Maya Advisors, offers one example.

“Whereas we cannot control the market cycles, we can control how they impact our lives. It is for this reason we maintain sufficient cash buffers to tide us through the downturns,” she says. “When we are working, we maintain 6-12 months of emergency cash to sustain us if there is a job loss. When we are retired, we maintain sufficient cash, so we do not depend on our portfolios until markets recover.”

“When the markets are going wild, stop and think – do I need money from my portfolio now? If the answer is no, ride out the volatility.”

Accounting for short-term error and long-term objectives is crucial, per Casey. “Every kind of bucket of money that you have needs to have a purpose, and for the bucket of money that’s in the stock market, the purpose is long term growth,” he said. “So stop freaking out and just stay in.”

Perhaps, get involved

If you’re feeling like rolling the dice now might be a surprisingly good time to do so, if you take some advisors’ word for it.

“Bottom line, like Warren Buffet says, be greedy when others are fearful. So if many are selling, maybe it is time for you to buy,” said Greg Giardino, VP Financial Advisor at Wealth Enhancement Group. He adds that, in buying as in selling, caution is warranted. “If there were some stocks you were looking to buy, if the rationale hasn’t changed, they are cheaper now… If you were looking to buy $10,000, buy $5,000 and wait a day or so and maybe buy the rest.”

With stocks so low, those who are willing to bank on optimism might have a chance to strike while the iron is—well, not hot, but acting up. Boneparth speaks of this moment as an opportunity for some to get cheaper stocks if this is just a market correction. Say, if a long-term investor is looking at a major index drop of 10%, “You might see some discounts materialize, and you might be in a position to take advantage of that,” he says.