Here’s what has to happen for Nvidia’s price to be justified, says the dean of valuation

Wednesday was another rough day for the stock market, this time with a weak bond auction contributing to downbeat sentiment.

Nvidia NVDA, the darling of the market for the last two years, slumped 5% and could now be said to be in a bear market, as it’s down more than 20% (23%, to be precise) from its recent high.

Most Read from MarketWatch

For those tempted to wade in, Aswath Damodaran, the NYU Stern School of Business finance professor oft quoted as the “dean of valuation,” says Nvidia’s stock price only makes sense if investors assume the company will invent and succeed in a whole new segment.

“I’ll tell you one thing in favor of Nvidia. I call it my opportunistic growth company,” he said in an interview with Niels Kaastrup-Larsen of the Top Traders Unplugged podcast. “It’s a company that’s managed to find new markets and jump into them ahead of everybody else. It did it with gaming. It did it with crypto. It did it with AI,” he said.

“The first time, you can call them lucky. The second time, you can call them really lucky. The third time around, there’s something the company is doing that’s allowing them to get ahead of their competition and big market,” he added.

Damodaran said while it’s a bet investors can make, “it’s not AI that justifies the [peak valuation] of $3 trillion. It’s the expectation that Nvidia will find another business out there that is big and be the first mover there.”

He made several comparisons of Nvidia to network equipment maker Cisco during the dot-com bubble of 2000. “Even if you believe the Goldman Sachs numbers for AI being a $3 trillion business or a $4 trillion business, the architecture for AI, which is what Nvidia provides, can’t be more than a half a trillion of that. And that’s actually larger than any of the predictions I’ve seen for how high the AI chip business has going,” he said.

Related: Nvidia’s stock offers ‘tremendous opportunity’ after selloff, this analyst says

Perhaps more striking than his analysis of Nvidia is his view toward value investing in general. “I think I will shed no tears for the burial of value investing, as it existed, because it’s time we put it to rest,” he says.

He said he’s never attended a Berkshire Hathaway shareholder meeting in Omaha. He called the meetings “righteous” and “ritualistic,” from their professed reading of Benjamin Graham to “worshipping at the alter of [Warren] Buffett and [Charlie] Munger.”

“’We’re the grownups.’ That’s basically what I heard from value investors. ‘We’re the grownups. These traders, they’re shallow. These tech investors, they’re shallow,’” said Damodaran. “And the problem with being righteous is you think you deserve to be rewarded for doing the right things. And that’s a terrible place to start investing.”

Damodaran said he owns each of the Magnificent Seven stocks. “I didn’t buy them in 2023, thank God, but they were all cheap at a point in time, and I chose to buy them then,” he said. “At the right price, you should be willing to buy any stock.”

The market

U.S. stock-index futures ES00 NQ00 turned higher after jobless-claims data. The yield on the 10-year Treasury BX:TMUBMUSD10Y also turned higher after early declines.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5199.5 |

-5.85% |

-7.71% |

9.01% |

16.38% |

|

Nasdaq Composite |

16,195.81 |

-7.98% |

-13.15% |

7.89% |

18.03% |

|

10-year Treasury |

3.92 |

-6.20 |

-29.70 |

3.91 |

-19.02 |

|

Gold |

2432.3 |

-2.35% |

0.48% |

17.40% |

25.07% |

|

Oil |

75.03 |

-2.47% |

-9.43% |

5.19% |

-9.45% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

There’s another big Treasury auction on tap — this time a $25 billion auction of 30-year notes. Weekly jobless claims dropped to 233,000.

Warner Bros. Discovery WBD took a $9.1 billion charge as viewers retreat from traditional TV and the company deals with a potential future without National Basketball Association games.

Dating app provider Bumble BMBL saw its shares dive after the company lowered its revenue estimates for the year.

Eli Lilly LLY headlined Thursday’s earnings wave, as the drugmaker handily beat earnings expectations and raised its guidance for the year. Rival Novo Nordisk on Wednesday reported pricing pressure on its weight-loss drug.

Best of the web

History suggests stock market to retest lows in 4-step process.

Consumer spending will determine if economy slides into a recession.

Mnuchin says it’s time to kill the Treasury bond he created.

Top tickers

Here were the most active stock-market tickers on MarketWatch of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

SMCI |

Super Micro Computer |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AAPL |

Apple |

|

LUMN |

Lumen Technologies |

|

PLTR |

Palantir Technologies |

|

AMD |

Advanced Micro Devices |

|

AMC |

AMC Entertainment |

The chart

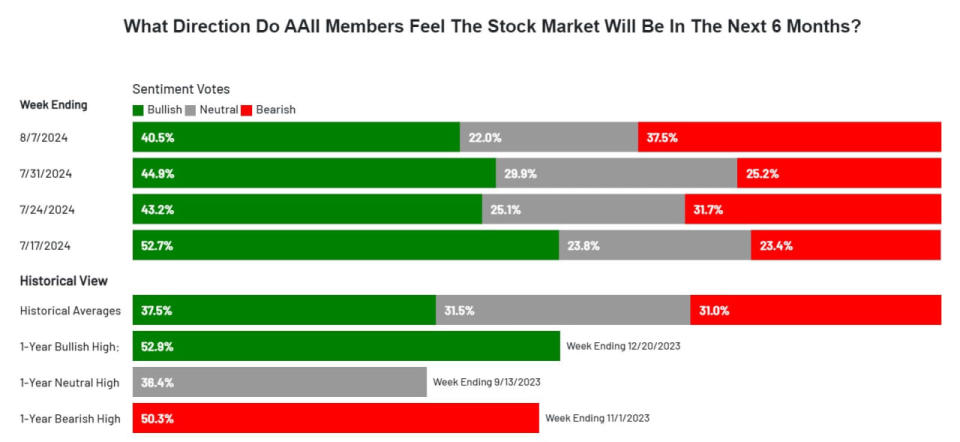

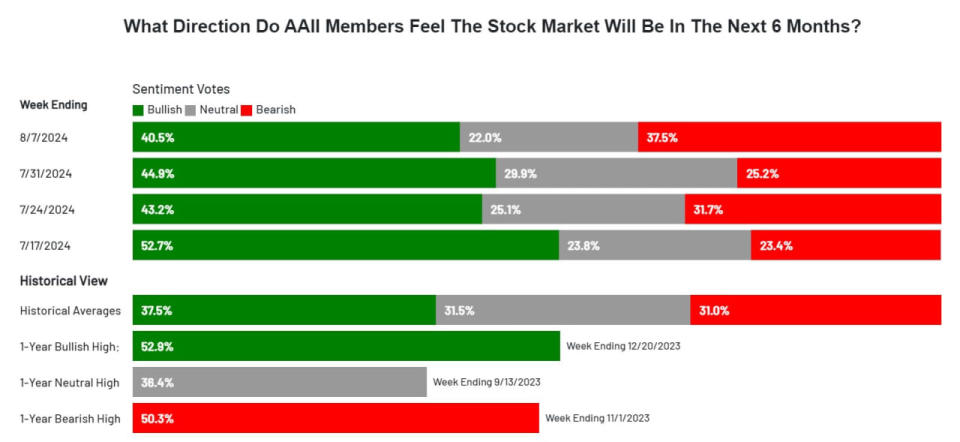

The latest American Association of Individual Investors survey finds retail investors are the most pessimistic they’ve been in nine months. That comes after the S&P 500 on Monday had its worst single day in two years, with the index finishing Wednesday down 8% from its mid-July record high. The AAII survey is closely followed as a measure of retail investor sentiment, and analysts do find it serves as a contrarian indicator.

Random reads

This Nantucket man lost his money, not to the stock market but to a seagull.

The anonymous artist known as Banksy made his third animal-themed artwork, in London, in a week.

In the nothing-is-satire anymore, Dolce & Gabbana has launched a perfume — for dogs.