Google’s antitrust loss could put billions at risk for Apple

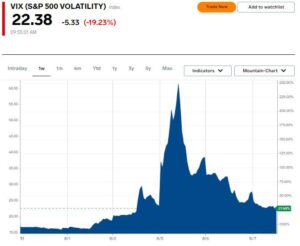

Google (GOOG, GOOGL) suffered a staggering shot to its search and advertising business on Monday as District of Columbia’s Judge Amit Mehta ruled in favor of the Department of Justice in its antitrust suit against the tech giant.

It may cost Apple (AAPL) big-time too.

Here’s how: The ruling could force Google to make dramatic changes to its largest business, but it could also force the company to cancel a long-term revenue-sharing agreement with Apple that requires the iPhone maker to use Google as the default search engine across its various devices.

The deal, called an Information Services Agreement, has been in place since 2002 and has been adjusted over the years as new technologies, such as the iPhone, have been introduced. The gist of the deal is that Apple uses Google as its default search engine for its Safari browser, Spotlight Search, and Siri.

In return, Google pays Apple 36% of the search revenue generated on Apple devices using Google’s services. While Apple doesn’t reveal exactly how much it makes from the deal, court documents pegged the number at an estimated $20 billion in 2022, double what Google paid in 2020.

Apple couldn’t immediately be reached for comment.

The revenue from Google and Apple’s agreement is likely realized under Apple’s Services business segment, which is where it lists third-party advertising licensing agreements. In 2022, Apple saw $78.1 billion in Services revenue. If the $20 billion estimate is accurate, that means the deal accounted for roughly 25% of Apple’s Services revenue for the year.

Apple’s Services business is one of its fastest-growing segments and is seen as a bulwark against the company’s slowing iPhone sales. The company has expanded the segment significantly over the years, adding its Apple Music+ and Apple TV+ platforms to the business. But the Google deal still likely makes up a massive chunk of the Services segment’s revenue.

From a company-wide perspective, Apple generated $394.3 billion in revenue in 2022, meaning the Google agreement accounted for 5% of the company’s annual revenue for the year.

Losing the ISA wouldn’t just hurt Apple, though. According to court documents, Google performed internal modeling in 2020 that found it would lose 60% to 80% of search volume on Apple’s iOS devices if its search engine were replaced as the default option.

Losing that search volume would cut into Google’s bottom line to the tune of $28 billion to $32 billion. With Google bringing in $182.5 billion in revenue in 2020, that would slice $15% to 17% off of the company’s bottom line.

Google is sure to appeal the DOJ’s win, but if Mehta’s ruling stands, Apple and Google could be in for some serious financial pain.

Email Daniel Howley at [email protected]. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance