Goldman Sachs holds iHeartMedia at neutral with steady stock target

On Tuesday, Goldman Sachs maintained a Neutral rating on shares of iHeartMedia (NASDAQ:), with a steady price target of $1.00. The decision follows iHeartMedia’s second-quarter 2024 earnings, which surpassed consensus expectations in both Revenue and Adjusted EBITDA. Despite the positive performance, the firm provided a third-quarter outlook that was mixed, forecasting Revenue above consensus predictions but Adjusted EBITDA below them.

During the earnings call, iHeartMedia’s management expressed a positive outlook regarding the advertising market’s potential for growth in the second half of 2024. This optimism is based on anticipated increases in political advertising due to a more competitive presidential race, alongside improvements in national advertising and sustained strength in local advertising.

The company’s second-quarter performance demonstrated a robust beat on consensus estimates, which has been a factor in maintaining the current stock rating and price target. The positive results were offset by the cautious projections for Adjusted EBITDA in the upcoming quarter, which prevented an upgrade in the stock’s rating.

Goldman Sachs’ price target of $1.00 remains unchanged, reflecting the firm’s neutral stance on the stock’s future performance. This target is based on the analyst’s assessment of iHeartMedia’s recent financial results and market outlook, including the various factors expected to influence the advertising industry in the near term.

Investors and stakeholders in iHeartMedia will likely monitor the company’s progress in the coming months, especially in relation to the advertising market dynamics and the impact of political spending on the company’s revenues. The management’s confidence in a market recovery could play a significant role in shaping iHeartMedia’s performance in the latter half of the year.

In other recent news, iHeartMedia reported a steady growth in its Q2 2024 earnings, with an adjusted EBITDA reaching $150 million and a 1% year-over-year increase in consolidated revenues. The company’s Digital Audio Group saw a 10% increase in revenues, however, the Multiplatform Group’s revenues declined by 3%.

Looking forward, iHeartMedia expects a mid-single-digit increase in revenues for Q3 and the full year of 2024, with political revenues projected to be 20% higher than the 2020 presidential election cycle.

The company is also investing in technology upgrades, including a Programmatic platform, to enhance advertising efficiency and reach. In an effort to improve its capital structure, iHeartMedia is in active discussions with debt holders. These recent developments highlight the company’s focus on cost efficiency and the recovery of the advertising market.

However, it is worth noting that despite overall growth, the Multiplatform Group’s revenues experienced a slight decline. On a brighter note, the company’s podcasting and digital ex-podcast businesses showed significant revenue growth, contributing to a positive outlook for the upcoming quarters.

InvestingPro Insights

In light of the recent earnings report and Goldman Sachs’ neutral rating on iHeartMedia (NASDAQ:IHRT), it’s important to consider additional insights that could influence investor decisions. According to InvestingPro data, iHeartMedia’s market capitalization stands at a modest $200.37 million, reflecting the challenges faced by the company. The stock’s negative P/E ratio of -0.2 and adjusted P/E ratio for the last twelve months as of Q2 2024 at -0.7 suggest that the market has concerns about the company’s profitability.

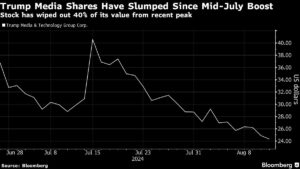

One noteworthy InvestingPro Tip indicates that analysts do not expect iHeartMedia to be profitable this year, which aligns with the negative earnings per share figures reported. Moreover, the company’s stock price has experienced significant volatility, with a one-week total return showing a sharp decline of 20.86%, yet a slight recovery over the past month with a 4.45% increase. Over the last year, the stock has seen a substantial drop in value, with a price total return of -61.83%.

Despite these challenges, iHeartMedia has some financial strengths. For instance, the company’s liquid assets exceed its short-term obligations, which may provide some stability in the face of market fluctuations. Moreover, the gross profit margin remains strong at 59.5%, indicating that the company is able to retain a significant portion of its revenue after accounting for the cost of goods sold.

Investors considering iHeartMedia should be aware of these dynamics and how they may impact the stock’s performance. For more in-depth analysis and additional InvestingPro Tips, such as the company’s trading at a high EBIT valuation multiple and its lack of dividend payments, investors can visit the InvestingPro platform. There, they will find a total of 9 tips that could further inform their investment strategies.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.