Former Manufacturing Giant SunPower Files for Bankruptcy

(Bloomberg) — SunPower Corp. has filed for bankruptcy in Delaware and plans to wind down operations, ending the decades-long run of the once-venerated US solar firm.

Most Read from Bloomberg

The rooftop solar company listed assets and liabilities of $1 billion to $10 billion in its Chapter 11 petition in the US Bankruptcy Court for the District of Delaware. Top shareholders in the firm include France’s TotalEnergies SE.

It also agreed to sell assets including its Blue Raven Solar installation unit and new homes businesses to Complete Solaria Inc. as a stalking horse buyer for $45 million, according to a statement late Monday. It asked the court to approve the deal by the end of September.

“The proposed transaction offers a significant opportunity for key parts of our business to continue our legacy under new ownership,” Tom Werner, SunPower’s executive chairman, said in the statement. “We are working to secure long-term solutions for the remaining areas of our business, while maintaining our focus on supporting our valued employees, customers, dealers, builders, and partners.”

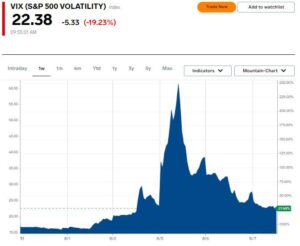

High interest rates and subsidy changes in California — the US sector’s biggest market — have been a drag for solar firms that expected big growth from President Joe Biden’s signature climate law of 2022. SunPower has also faced its own woes, including defaulting on a credit agreement in 2023 and restating earnings. This year, the firm replaced its chief executive officer, restructured its operations and lost its accountant.

SunPower, founded in 1985, long had a reputation for producing some of the best solar panels in the industry, but it spun off its manufacturing operations in 2020 to focus on then-surging demand for rooftop installations. That bet soon unraveled as inflation and high interest rates boosted costs for consumers. Meanwhile, the firm’s own corporate struggles stymied its operations.

Listen on Zero: The Godfather of Solar Predicts Its Future

The company notified dealers on July 17 that it was halting new installations and shipments. Analysts interpreted the move as a sign that the company was ceasing operations, prompting some to suspend coverage or lower their share-price targets to $0.

–With assistance from Yi Wei Wong, Alice Huang and Dan Murtaugh.

(Updates with proposed sale of some assets in third paragraph and CEO comment in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.