Forget This All-Powerful AI Stock and Consider Buying Its Underdog Rival Instead in 2024

Advanced Micro Devices (NASDAQ: AMD) has made many investors bullish since the start of 2023, with its share price up over 115%. The company’s rally has coincided with an explosion of interest in artificial intelligence (AI).

AMD chip rival Nvidia initially took much of the spotlight as its graphics processing units (GPUs) became the preferred hardware for many AI developers. However, Wall Street quickly took notice of AMD, with its No. 2 market share in GPUs and partnerships with many of the most prominent names in tech.

Over the last year, AMD has won over investors with competing AI GPUs, including its MI300X AI accelerator and its MI325X model, which is due to launch in Q4 2024. The company’s hardware has caught the eye of multiple tech firms, and it has added Alphabet, Microsoft, Oracle, and Amazon to its list of chip customers as they each work to further their own positions in AI.

However, while AMD has significant long-term potential, its financials have yet to match its soaring stock price. The chipmaker reported revenue growth of 80% in its AI-focused data center segment in the first quarter but was held back by significant declines in other segments. As a result, total revenue for the period rose just 2% year over year.

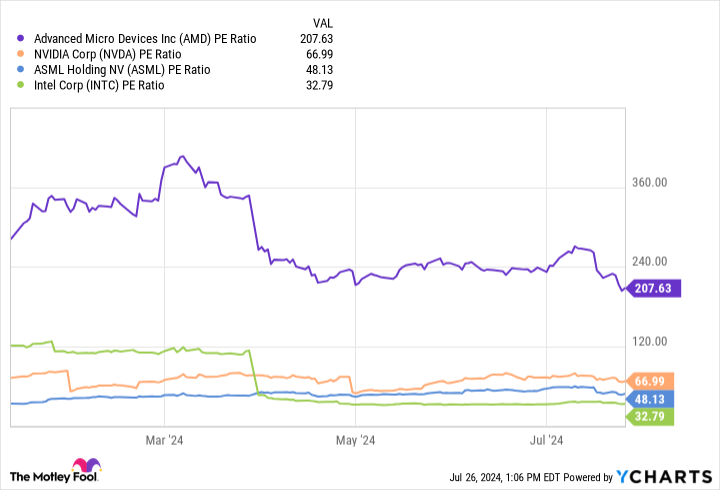

The discrepancy in AMD’s stock growth compared to its earnings saw its price-to-earnings (P/E) ratio hit a hefty 207. Consequently, it’s worth looking at other chip stocks right now that offer more value yet have similar growth potential, if not more.

So, forget this all-powerful AI stock and consider buying its underdog rival instead in 2024.

An increasingly diverse position in AI

Intel‘s (NASDAQ: INTC) shares have been beaten in recent years, falling 41% since 2021, while AMD’s have risen 51%. However, investor sentiment seems to have shifted over the last month, as Intel’s stock has climbed 2%, and AMD’s shares have sunk by over 10%.

After a decade of hurdles for Intel, including lost market share in the chip industry and the end of a lucrative partnership with Apple, investors appear to be gradually getting behind this underdog’s comeback. In fact, the company welcomed new customers to its Gaudi line of AI chips this year, including Bosch, IBM, and Seekr.

Last year, Intel began overhauling its business to prioritize AI and manufacturing. The shift has seen it unveil a series of AI-enabled chips to compete with hardware from AMD and Nvidia and begin construction on the first of at least four chip factories it will build in the U.S.

In June, Intel showcased its Xeon 6 processors, developed to handle heavy data-center workloads, and its Gaudi 3 processor, capable of AI-model training and deployment. The company also announced its Lunar Lake chips, designed specifically for AI-enabled PCs. Each of these products exposes Intel to a different AI sector, diversifying its position in the industry.

In addition to chip design, Intel is potentially a more reliable option than AMD because of its growing focus on the foundry market. Rising tensions between the U.S. and China have brought down many chipmakers’ stocks over the last week since most of these companies rely heavily on Taiwan Semiconductor Manufacturing‘s services. However, Intel’s share price has risen thanks to its plan to expand domestic foundry capacity with its upcoming plants.

Intel investors should have a long-term perspective going in, as it’ll take time for the company’s chip fabs to become operational. However, recent moves show that the company could have a highly lucrative future in AI as it becomes a leading manufacturer and attracts companies to its designs. According to Intel, its foundry expansion will enable it to save “more than $8 billion to $10 billion exiting 2025,” with company execs projecting the company to achieve “non-GAAP gross margins of 60%” and operating margins of 40%.

Meanwhile, Intel Foundry is already making progress. In the first quarter of 2024, it posted operating income of $625 million, significantly improving on the $880 million in losses it reported in the year-ago period.

Recent moves could see Intel become the go-to AI chip manufacturer in the coming years. Alongside a new line of AI chip designs, Intel is gradually carving out a promising position in AI.

Intel’s stock is a bargain that’s just too good to pass up

Investors’ measured approach toward Intel’s stock over the last year compared to other AI stocks has kept it at an attractive price point.

This table shows that AMD’s stock is trading at about 207 times its earnings, which is by far the highest among some of the most prominent names in the chip market and AI. Conversely, Intel’s P/E is the lowest, at 33, indicating that its shares offer far more value than AMD’s and many of its peers, signaling a buying opportunity.

In addition to Intel’s more varied position in AI, the company’s stock is a no-brainer. AMD might seem all-powerful, with its larger market shares in GPUs and partnerships with prominent companies, but Intel’s recovery could be a chance to get in early and profit from its resurgence. As a result, it might be worth taking a chance on this underdog that could soar over the next decade.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $688,005!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget This All-Powerful AI Stock and Consider Buying Its Underdog Rival Instead in 2024 was originally published by The Motley Fool