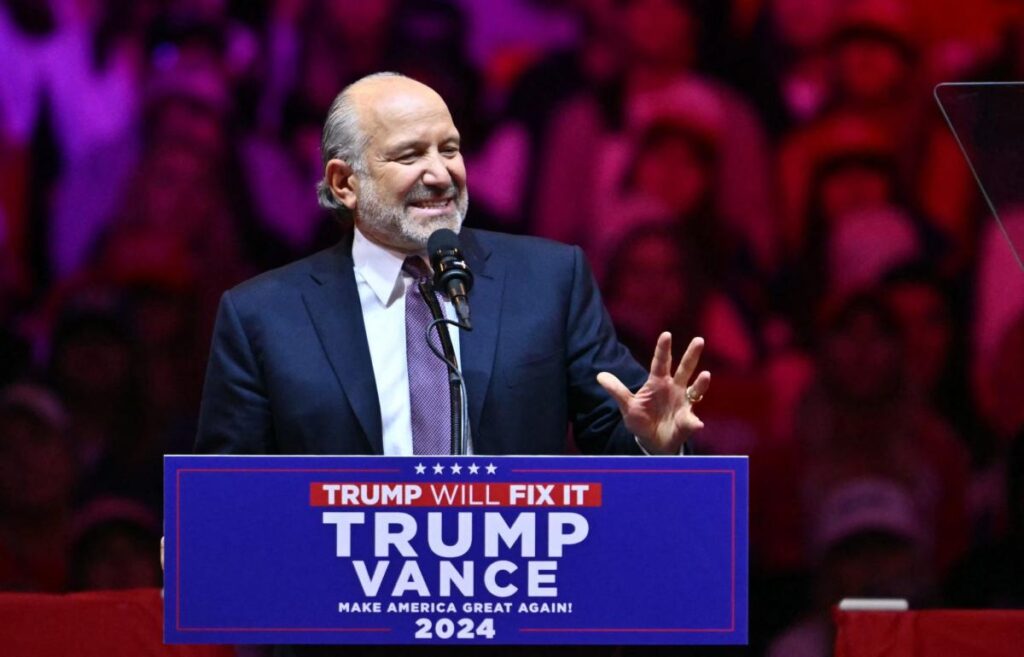

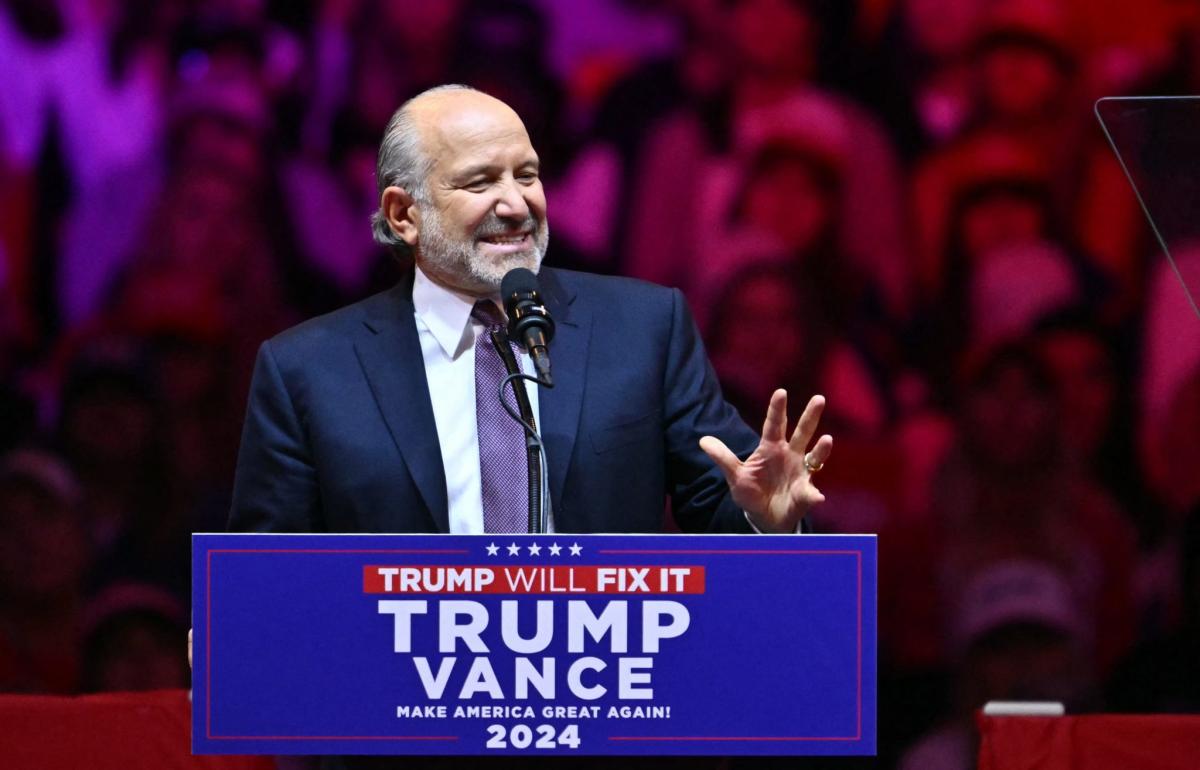

Donald Trump’s commerce secretary pick Howard Lutnick is a Wall Street titan who lost his brother—and nearly 70% of his employees—in the 9/11 attacks

President-elect Donald Trump has named Howard Lutnick—the CEO known for his sharp-elbowed ascent to Wall Street’s upper echelon, as well as his resilience after the 9/11 attacks devastated his company—as his pick for secretary of commerce.

In the new role, Lutnick, who has cochaired Trump’s transition team, will lead the incoming administration’s strategy on tariffs and trade and maintain direct responsibility over the Office of the United States Trade Representative, Trump announced in a post on Truth Social on Tuesday.

Lutnick, a longtime New York power player, became president and CEO of Cantor Fitzgerald, a Wall Street investment banking and financial services firm, in the early 1990s at just 29 years old.

Throughout Trump’s 2024 campaign, Lutnick—who has donated over $1 million to Trump’s super PAC and hosted a $15 million fundraiser at his Hamptons house this summer—has served as a top economic advisor.

Lutnick was one of the primary voices in Trump’s camp advocating for higher tariffs, in a bid to slash corporate taxes stateside and insulate U.S.-based business from competition overseas.

For months, many suspected Trump would tap Lutnick for Treasury secretary, a role that remains unfilled.

A representative for Lutnick did not immediately respond to Fortune’s request for comment.

Lutnick, 63, climbed the business ladder quickly, but he didn’t have an easy start: Both his parents had died by the time he was 18, leaving him and his two siblings to fend for themselves.

The New York native joined Cantor Fitzgerald as a bond trader shortly after graduating college and quickly formed a close mentor-mentee relationship with the firm’s founder, Bernard Cantor.

Eight years after joining, Lutnick was named Cantor Fitzgerald’s president and CEO—having reportedly “elbowed his way to the top” as Cantor was on his deathbed—and five years after that, he became chairman.

“There is no sugarcoating the fact that before, and even after, Sept. 11, Mr. Lutnick was widely disliked in the industry,” Susanne Craig wrote in the New York Times in 2011. “A ruthless competitor even by Wall Street standards, he has made more than a few enemies over the years. In 1996, as Mr. Cantor, his mentor, lay dying, Mr. Lutnick fought with Mr. Cantor’s wife, Iris, for control of Cantor Fitzgerald. She later barred him from the funeral.”

Cantor Fitzgerald was brutalized by the 9/11 attacks. The firm was headquartered on the 101st through 105th floors of the World Trade Center’s North Tower; the hijacked flight hit floors 93 through 99, leaving those on the Cantor floors with no way of escaping.

Every single worker who had been in the office—658 employees—died that morning, representing nearly 70% of the firm’s headcount. Lutnick was dropping his son off at kindergarten that morning and wasn’t in the office, but his younger brother, Gary, also a Cantor employee, was killed. Cantor employees represented nearly one in four of the victims killed in New York that day.

Within a week, Lutnick returned to the trading desk and, amid widespread criticism, announced the firm would be cutting off paychecks to its deceased employees. He later pledged 25% of the firm’s profits over the next decade to their next of kin, along with ongoing health insurance coverage. He also gave them $90 million from his own personal savings.

Today, Lutnick stands as one of Wall Street’s longest-serving CEOs, with 41 years at the helm of Cantor Fitzgerald. During his tenure, Lutnick has overseen the $1.3 billion merger of BGC Partners, a financial services company, with eSpeed, an electronic bond trading platform, as well as taken Rumble, a video platform, public via a special purpose acquisition company (SPAC). Earlier this year, through BGC Group—of which Lutnick is also CEO—he unveiled a futures exchange called FMX, which counts Morgan Stanley, Citi, and Goldman Sachs among its equity partners. Meanwhile, his economic stake in the company is about 60%, up from 25% two decades ago.

Over the past few months, Lutnick has balanced his CEO duties with his Trump campaign leadership by working for Cantor between 6:30 a.m. and 9 a.m., and then from 4 p.m. to 10:30 p.m., with Trump time in between, the Wall Street Journal reported.

One of Trump’s primary talking points throughout his campaign has been his commitment to raising tariffs. As commerce secretary, Lutnick will be closer to that promise than any other appointee.

“Tariffs are an amazing tool [for] the president to use,” Lutnick told CNBC in October, arguing that the Trump administration will use tariffs to “build.”

“If we want to make it in America, tariff it, or if we’re competing with it, tariff it,” he added.

Lutnick has become increasingly close to Elon Musk, another key Trump advisor, the New York Times pointed out, “and, given the Commerce Department’s role in expanding broadband internet access, [Lutnick] could provide the tech mogul’s Starlink with a significant boost.”

As part of the transition team, Lutnick has been instrumental in recruiting and hiring. He has promised to do the same as a member of the administration, NPR reported—exclusively “stacking” the team with “loyalists.”

Many, however, have voiced concern over Lutnick’s potential conflicts of interest, including regarding cryptocurrency; Cantor Fitzgerald manages a handful of reserve funds for Tether, a stablecoin.

This story was originally featured on Fortune.com