Credit Traders Rush to Hedge on US Economy Fears

(Bloomberg) — Debt investors are loading up on insurance against corporate bond defaults as concerns mount about the health of the US economy and the European consumer.

Most Read from Bloomberg

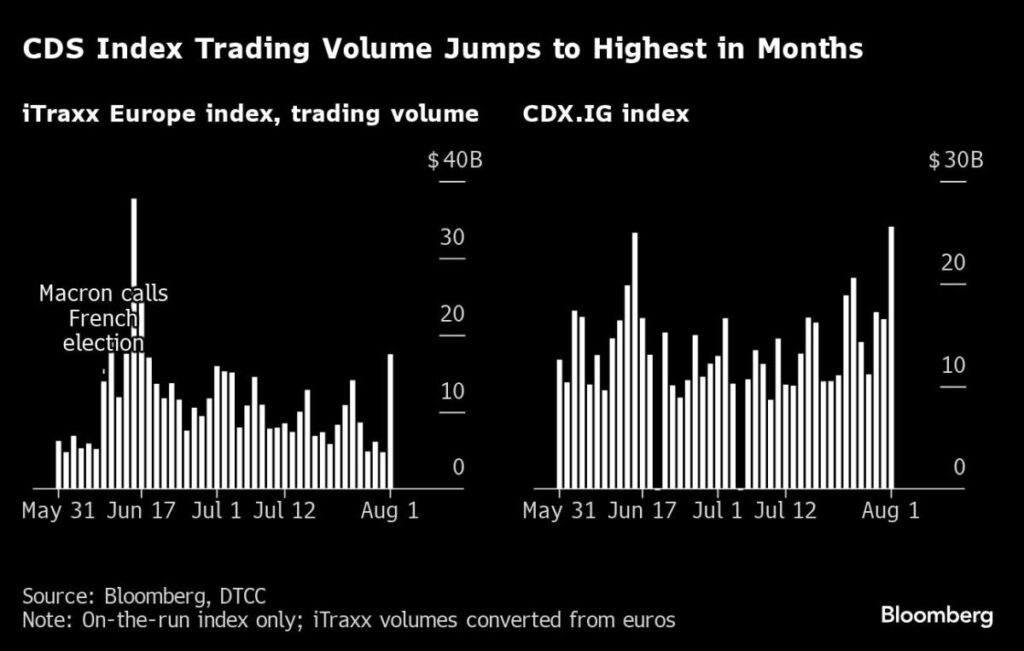

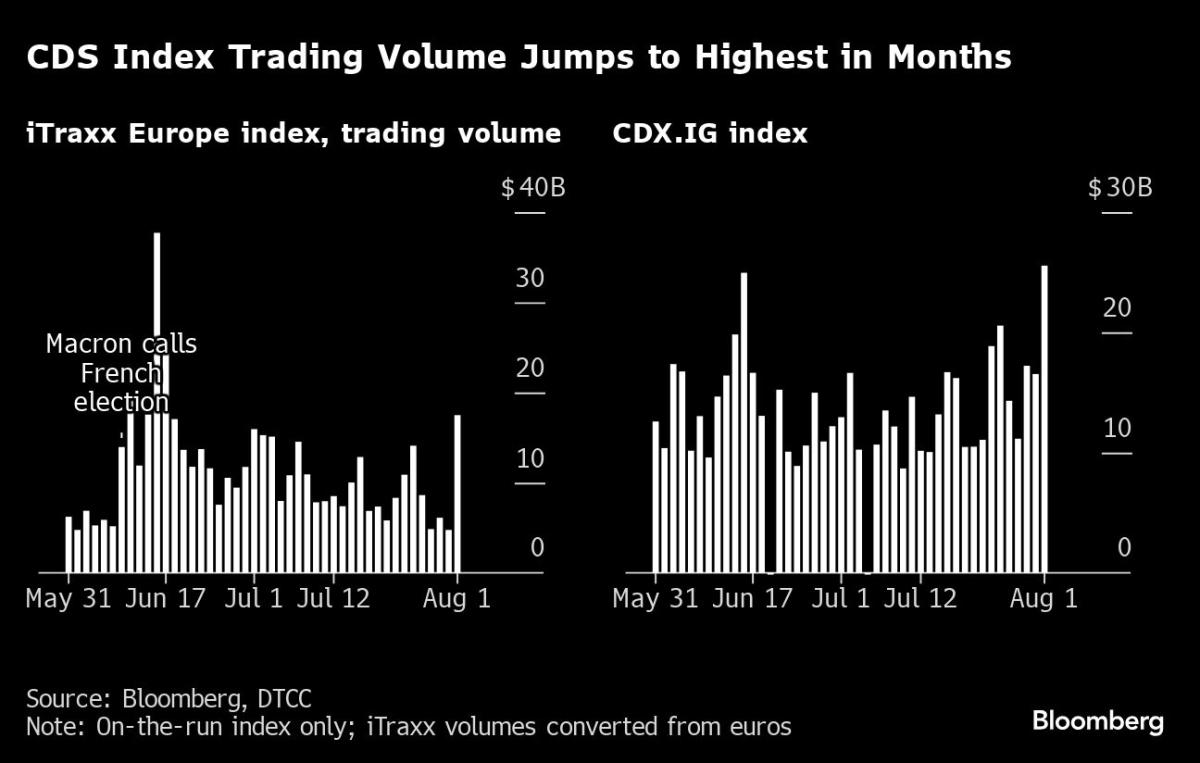

The cost of protecting a basket of North American high-grade credits against default surged on Friday by the most since October. Trading volumes on that credit default swap index, the CDX.NA.IG, reached the highest daily level in about five months on Friday, according to data compiled by Bloomberg. The European equivalent this week had its busiest day since French President Emmanuel Macron in June called a surprise election.

Credit derivatives are often the first instruments to show signs of weakness in a market downturn, in part because selling bonds can take longer. Traders upped their purchases of protection after a slew of weak labor market data raised concerns that the Federal Reserve has waited too long to cut interest rates.

Money managers have also been rattled by underwhelming earnings from technology companies and consumers cutting back on everything from fast food to luxury handbags.

“Weaker macro and impact on earnings going forward is the one underpriced risk in the markets in our view,” said Raphael Thuin, head of capital market strategies at Tikehau Capital. “This could end up affecting credit spreads, at a time when valuations are nowhere near cheap.”

Bond spreads look poised to widen because they are currently at the tight end of a range that was justified by factors including rate cut expectations and buyers paying more attention to absolute yield levels than relative valuations, said Srikanth Sankaran, Citigroup Inc.’s head of European credit strategy.

‘Cheap Hedges’

In the same region, JPMorgan Chase & Co. strategists “recommend setting cheap hedges” through the investment-grade iTraxx Europe credit default swap index, arguing that “earnings season is off to a shaky start.” BNP Paribas SA’s credit strategy desk suggests betting on widening spreads through a CDS gauge tracking senior financial issuers.

Even with the rise in volumes, the iTraxx Europe index is trading at around 63 basis points, far closer to multiyear lows than the triple-digit levels recorded in 2022 and 2023. The CDX.NA.IG index has reached about 58 basis points, its highest level since January, but is still below its five-year average.

In a sign of market concern about economic weakness, traders are now pricing in Fed rate cuts of more than a percentage point this year, and at the end of the week the US stock market had its worst two-day slide since March 2023. Central bank officials had previously penciled in a single rate cut in 2024, according to the median projection released in June.

It comes as companies in the US are on track to report their lowest aggregate earnings beat over forecasts since the fourth quarter of 2022. Sales among the European companies that have reported second-quarter earnings have come in about 1.2% below analysts’ expectations, data compiled by Bloomberg shows.

‘Cyclical Theme’

“There is a cyclical theme to it which hasn’t been present before. It illustrates that the balance of risk is probably shifting from ‘too hot, rates higher’ toward ‘too cold, rates lower’,” said Viktor Hjort, global head of credit strategy and desk analysts for BNP Paribas. For him, the market is currently between the two states.

Despite the concerns, some bond buyers, especially those driven by yield, will keep bidding for credit. That demand means it may take time for weakness to show up in the corporate bond market, but even before it does, the CDS market will be the place to see emerging cracks.

When volatility rises, “the usual effect is that people hedge using the liquid CDS index and then sell their bonds later,” said Matt King, founder of researcher Satori Insights. “Usually what forces the cash index to move is if people start to have significant outflows,” and “based on the global numbers I don’t think that’s happened yet, but will be a significant risk.”

Week in Review

-

Companies have been borrowing heavily in US debt markets this summer, spurring money managers to pack their laptops when they head out on vacation during what was historically a quiet time of year.

-

The corporate-bond market is seeing a surge of trading as the Federal Reserve moves closer toward cutting interest rates, setting off a rush by investors to lock in elevated yields.

-

US retailer J. Crew is feeling out investor interest in refinancing a loan it used to exit bankruptcy four years ago.

-

Corporate governance reforms that have underpinned a nearly $2 trillion rally in Japanese stocks are increasing the draw for investors in credit, allowing Japanese corporate dollar bonds to outperform US peers.

-

South Korean investors bet big on riskier loans for office buildings from New York to Los Angeles. But with high borrowing costs and slumping property prices, more investors are trying to pull back from that mezzanine debt and taking a massive hit on their way out.

-

Ares Management Corp. sees credit quality holding up even as the Federal Reserve is poised to cut interest rates as soon as next month.

-

Netflix Inc. received more than $19 billion of orders for its first investment-grade bond sale.

-

Morgan Stanley is sounding out investors for a bond offering that would help offload risk tied to a more than $4 billion portfolio of loans to private market funds. Separately, Goldman Sachs Group Inc. is marketing a similar offering backed by $2 billion of subscription lines.

-

McAfee’s former enterprise business reached a deal in principle to reshape its debt load and receive $400 million of new money.

On the Move

-

The co-heads of Carlyle Group Inc.’s European buyout team, Marco De Benedetti and Jonathan Zafrani, are ceding leadership roles. Michael Wand, who co-heads the European technology strategy, will assume more responsibilities managing the region’s buyout platform.

-

Barings LLC made key hires in its direct-lending team which was depleted earlier this year. The recent hires include Joseph Plank as a managing director in the firm’s global private finance group.

-

BNP Paribas SA’s head of investment-grade credit trading, Nabil Benjelloun, is leaving the bank and is being replaced by RBC’s Nikesh Parmar.

-

DWS Group, the asset management arm of Deutsche Bank AG, has hired Max Elliott-Taylor as CLO portfolio manager.

-

Bank of Montreal has hired two bankers — Carole Ly-Marin and Matteo Segnalini — to bolster its debt capital markets business for financial institutions in Europe.

-

Farallon Capital Management has recruited Blackstone Inc. managing director Avner Husen to head US real estate credit.

–With assistance from Dan Wilchins.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.