Better Cybersecurity Stock: CrowdStrike vs. Palo Alto Networks

Organizations around the world depend on cybersecurity to protect against hackers. The extent of that dependency became apparent on July 19 when a software update made by cybersecurity company CrowdStrike (NASDAQ: CRWD) contained an error, causing widespread disruption across many businesses, including airlines, hospitals, and banks.

This unexpected incident prompted CrowdStrike shares to plummet 11% on the day of the outage. Since then, the stock has continued to drop, falling below $270 at the time of this writing, well off its 52-week high of $398 on July 9. Is this dip an opportunity to pick up the stock?

Or is it better to buy shares in a CrowdStrike rival, such as Palo Alto Networks (NASDAQ: PANW)? The stock’s price has risen in the wake of CrowdStrike’s botched software update. Let’s compare these two cybersecurity companies to decide which is the better investment.

Evaluating CrowdStrike

While CrowdStrike’s July 19 outage is an embarrassment for the company right now, what matters more to an investment decision is how the company can perform over the long haul. Based on its results so far this year, a case can be made for investors with a long-term view to take advantage of the stock’s current price crash and buy.

One reason is CrowdStrike’s outsize revenue growth. In its fiscal first quarter, ended April 30, the company delivered $921 million in sales, a 33% year-over-year increase.

A factor in CrowdStrike’s rising revenue has been customers adopting multiple cybersecurity solutions from the company. Its software platform offers various add-ons beyond basic monitoring, such as asking its security personnel to proactively hunt for cyber threats. In the first quarter, 65% of customers adopted five or more of these additional options, and deals involving eight or more add-ons grew 95% year over year.

Along with impressive sales growth, CrowdStrike’s financials are strong. The company achieved a record free cash flow (FCF) of $322 million in its fiscal Q1, a 42% year-over-year increase.

The company exited Q1 with an excellent balance sheet. Total assets were $6.8 billion with cash and equivalents alone comprising $3.7 billion.

Total liabilities were $4.3 billion, and of that amount, deferred revenue accounted for $3.1 billion. This deferred revenue represents payments received from customers that will eventually be recognized as income once CrowdStrike fulfills its contract obligations.

The case for Palo Alto Networks

While CrowdStrike’s performance to date has been healthy, the same is true of rival Palo Alto Networks. In its fiscal third quarter, ended April 30, Palo Alto Networks saw revenue rise 15% year over year to $2 billion.

In addition, it generated fiscal third-quarter FCF of $492 million, up from the prior year’s $401 million. Its balance sheet at the end of Q3 was exceptional with $17.9 billion in total assets, and cash and equivalents of $1.4 billion. Total liabilities were $13.5 billion with $10.2 billion of that in deferred revenue.

As part of a plan to grow its business, the company introduced a new strategy this year. The plan encourages customers to consolidate their cybersecurity spending from multiple vendors to Palo Alto Networks. So far, the results suggest the strategy is working.

In its fiscal third quarter, the number of accounts spending more than $1 million with the company increased 22% year over year, while those spending greater than $10 million rose 28% year over year.

CEO Nikesh Arora highlighted how one business unhappy with its existing cybersecurity vendor opted for Palo Alto Networks because of its “ability to deliver consolidated capabilities through a platform across half a dozen areas.”

Choosing between CrowdStrike and Palo Alto Networks

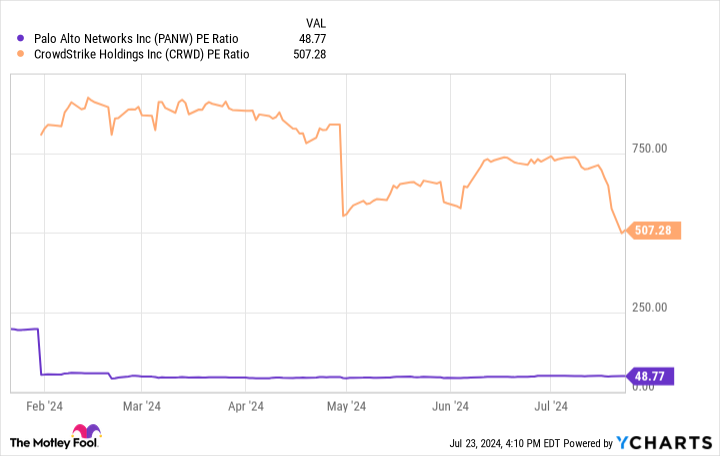

Both CrowdStrike and Palo Alto Networks have delivered impressive performances this year, so another factor to consider when deciding between these two stocks is valuation. The price-to-earnings ratio (P/E ratio) is a commonly used metric for this.

CrowdStrike’s P/E ratio is about 10x higher than Palo Alto Networks’, even after its share price dropped due to the July 19 outage. This indicates Palo Alto Networks’ stock is a better value.

Combining valuation with its strong performance in fiscal 2024 makes Palo Alto Networks stock a compelling investment. Adding to this is that the long-term fallout from CrowdStrike’s bungled software update is unclear at this time.

As a result of the July 19 outage, some Wall Street analysts downgraded CrowdStrike stock. For instance, Guggenheim’s John DiFucci stated, “There likely will be negative effects on its business due to the disorder across the world that CrowdStrike has caused, even if temporary.”

DiFucci has a point. In fact, Tesla CEO Elon Musk announced he halted the use of CrowdStrike after its software issue arose.

Taking all of these factors into account, at this time, the better stock to buy in this contest of cybersecurity titans is Palo Alto Networks.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Robert Izquierdo has positions in CrowdStrike, Palo Alto Networks, and Tesla. The Motley Fool has positions in and recommends CrowdStrike, Palo Alto Networks, and Tesla. The Motley Fool has a disclosure policy.

Better Cybersecurity Stock: CrowdStrike vs. Palo Alto Networks was originally published by The Motley Fool