Asian Stocks Fully Recover From Last Week’s Plunge: Markets Wrap

(Bloomberg) — Asian stocks rose, recouping their losses from last week’s rout, bolstered by an advance in Japanese shares. US and European equity futures ticked higher ahead of American inflation data later Tuesday and Wednesday.

Most Read from Bloomberg

Japan’s equities gained after a holiday, as a weaker yen was seen providing support for exporters. MSCI’s Asia-Pacific gauge rose as much as 1%. That erased losses from last week’s tumble, when a risk-off move sent indexes around the world plummeting and the VIX US volatility index above 65 at one point, compared with a lifetime average of around 19.5.

“The market’s reaction to last week’s VIX spike reflects a reassessment of positioning rather than just U.S. data points or yen carry unwinding,” said Billy Leung, an investment strategist at Global X Management in Sydney. “However, it’s key to be cautious in reading short-term Asia movements, given signs of foreign outflows and low liquidity.”

Oil remained near the $80 level it hit on Monday, as the US sees an Iranian attack against Israel as increasingly likely. Israel’s sovereign debt was cut by one notch by Fitch Ratings, which kept a negative outlook on the credit as continued military conflict weighs on the country’s public finances. Treasuries held Monday’s gains.

Asia’s stock benchmark tumbled 6.1% on Aug. 5 to mark its worst day since 2008 as fears of a worsening US economy, an extended selloff in Japanese equities and a rotation away from tech shares weighed on the market.

Both the Nikkei 225 and the Topix are down more than 7% since the end of July, when the Bank of Japan raised its benchmark interest rate and unveiled plans to reduce its bond purchases. The benchmarks slid into a bear market on Aug. 5, when losses exceeded 20%.

The rate hike had spurred yen gains before the central bank commented that it won’t tighten so quickly as to risk further market volatility. Investors globally unwound carry trades, in which they had funded purchases of assets from stocks to emerging market bonds with the currency.

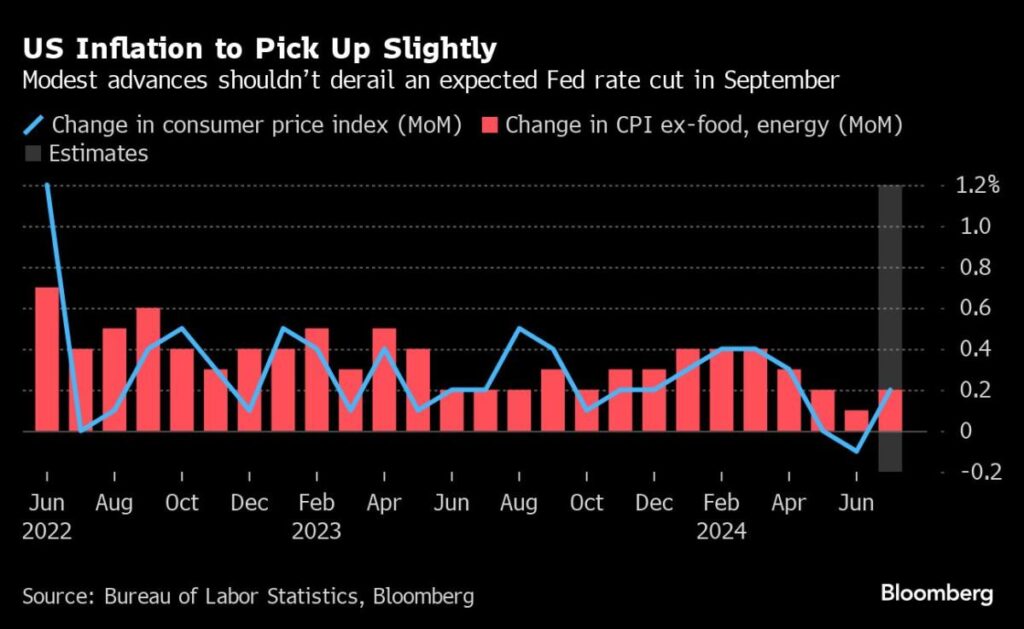

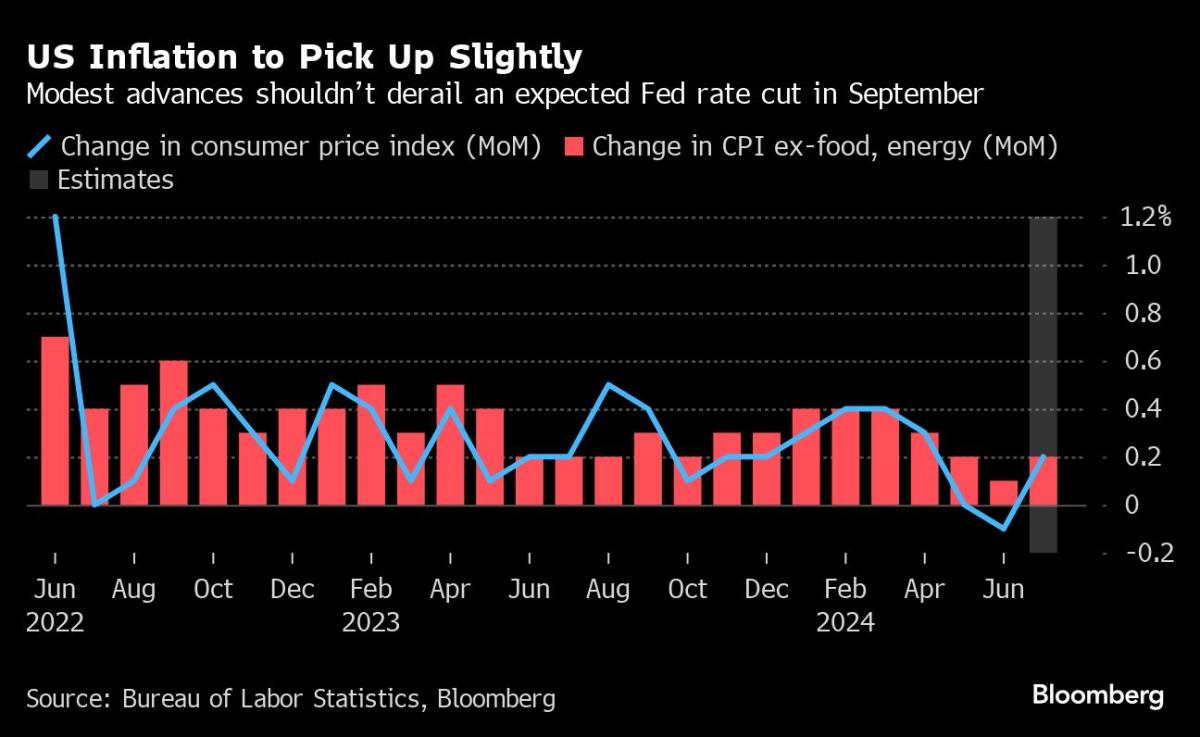

After last week’s turmoil, markets will be focused on Wednesday’s US consumer price index to see if the Fed will have a freer or more constrained hand in refocusing on the labor market and front-loading rate cuts sufficiently to secure a soft landing, according to Krishna Guha at Evercore.

“The first wave of yen carry trade unwind should be complete by now, and investor focus is now on US inflation and retail sales data to gauge the soft-landing probability,” said Linda Lam, head of equity advisory North Asia at Union Bancaire Privee. “Risk sentiment is on the mend with most Asian markets expected to stabilize at current range, barring major shocks that could dramatically change Fed interest rate cut trajectory,” she said.

Elsewhere in Asia, stocks in Hong Kong and mainland China fluctuated, as sentiment remains bearish after share transactions in China shrank to their lowest level in over four years. MSCI Inc. continues to cull China stocks from its indexes, setting the stage for a further drop in the nation’s share of a key emerging-market benchmark.

“The Chinese internet giants reporting this week will be very important to see if consumption weakness in China weighs on margins and ROIs,” said Britney Lam, head of equities-long/short at Magellan Investments Holding Ltd. “I do see China having a tactical rally soon given incrementally positive policy support in the past few weeks, and the key measure on macro datapoint for China is liquidity – be it quantity of money supply, loan growth and the cost of liquidity i.e. interest rates.”

Regulators told commercial banks in China’s Jiangxi province not to settle their purchases of government bonds, taking some of the most extreme measures yet to cool a market rally that has alarmed Beijing. At least four Chinese brokerages have started fresh measures to cut back trading of domestic debt beginning last week, people familiar with the matter said.

The crackdown is beginning to take a toll on corporate debt markets, as the average yield for one-year corporate yuan bonds with AA ratings — typically considered junk debt in the onshore market — saw the largest jump since December 2022.

In the corporate world, shares of baby-products retailer Brainbees Solutions Ltd. jumped on their debut in Mumbai, the latest deal to boost India’s burgeoning market for new share sales.

Key events this week:

-

Germany ZEW survey expectations, Tuesday

-

US PPI, Tuesday

-

Fed’s Raphael Bostic speaks, Tuesday

-

Eurozone GDP, industrial production, Wednesday

-

US CPI, Wednesday

-

China home prices, retail sales, industrial production, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 6:50 a.m. London time

-

Nasdaq 100 futures rose 0.3%

-

The MSCI Asia Pacific Index rose 1%

-

The MSCI Emerging Markets Index rose 0.1%

-

Japan’s Topix rose 2.6%

-

Australia’s S&P/ASX 200 rose 0.2%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite fell 0.1%

-

Euro Stoxx 50 futures rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0938

-

The Japanese yen fell 0.4% to 147.76 per dollar

-

The offshore yuan was little changed at 7.1790 per dollar

-

The British pound was little changed at $1.2777

Cryptocurrencies

-

Bitcoin rose 0.8% to $59,313.44

-

Ether fell 0.8% to $2,659.06

Bonds

-

The yield on 10-year Treasuries was little changed at 3.91%

-

Germany’s 10-year yield was little changed at 2.23%

-

Britain’s 10-year yield declined three basis points to 3.92%

-

Australia’s 10-year yield declined four basis points to 4.01%

Commodities

-

Spot gold fell 0.4% to $2,462.46 an ounce

-

West Texas Intermediate crude fell 0.7% to $79.53 a barrel

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Jason Scott.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.