Apple Supplier Stocks Slump After Berkshire Nearly Halves Stake

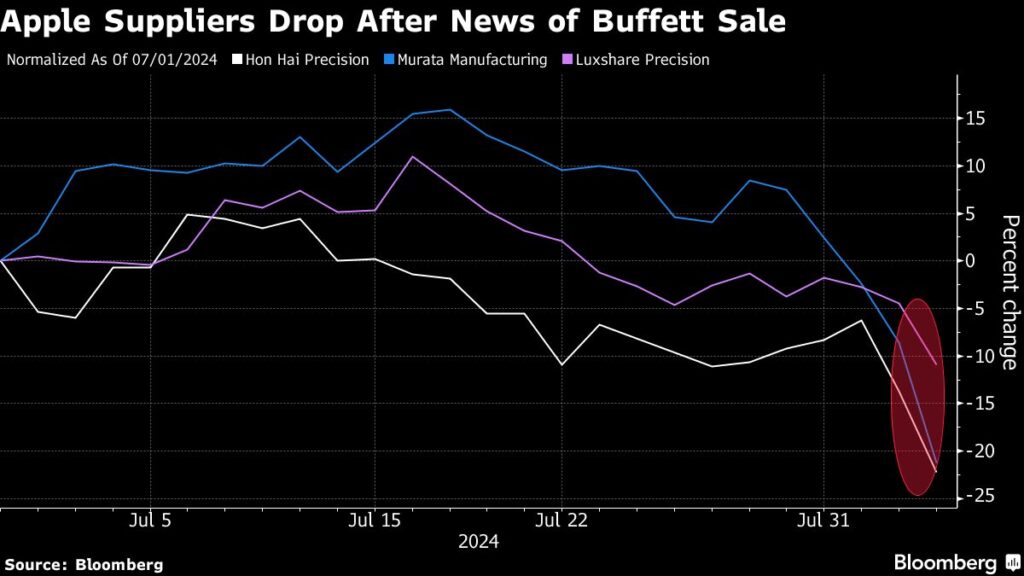

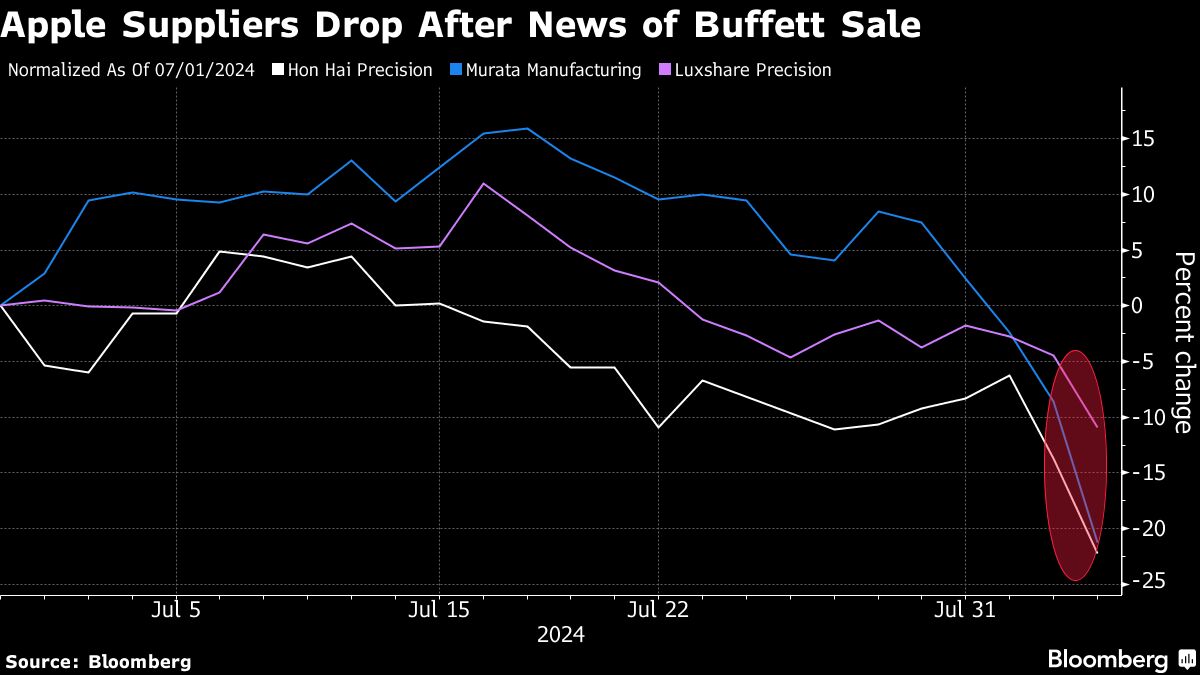

(Bloomberg) — The shares of Apple Inc.’s suppliers slumped after Berkshire Hathaway Inc. nearly halved its stake in the iPhone maker. The decline came amid a broad market selloff Monday.

Most Read from Bloomberg

Taipei-listed iPhone assembler Hon Hai Precision Industry Co. and chipmaker Taiwan Semiconductor Manufacturing Co. slid about 10% each. Among component makers Murata Manufacturing Co. tumbled 15% in Tokyo, while LG Innotek Co. tanked as much as 13% in Seoul and Luxshare Precision Industry Co. fell 7.7% in Shenzhen.

Berkshire Hathaway sold $75.5 billion worth of Apple stock on a net basis in the second quarter, sending Warren Buffett’s cash pile to a record $276.9 billion. The billionaire unloaded shares as US stock gauges climbed toward the peaks reached in mid-July, before the recent wave of profit-taking on the artificial intelligence rally.

“It should be hard for anyone to argue that this is not a market negative,” Mike O’Rourke, chief market strategist at Jonestrading, wrote in a report, referring to Berkshire’s sale of Apple shares.

Shares of Apple climbed 23% in three months to June and touched a record high on July 16, as hopes grew for the company’s AI offerings. However, Apple’s new AI features won’t be ready in time for the initial launch of its upcoming iPhone and iPad software overhauls, Bloomberg News reported last week.

Buffett’s firm revealed in May that it had reduced some of its position in Apple during the first quarter of the year. Even after the latest sales, Apple remains Berkshire’s largest single position.

“It was expected that Berkshire would continue dialing back its position in Apple, although the magnitude of the drop will likely surprise some people,” Adam Crisafulli of Vital Knowledge wrote in a note.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.