Analysis-China’s stuttering recovery darkens global corporate growth outlook

By Medha Singh

(Reuters) – Global burger chains to car manufacturers are increasingly feeling the pinch from a faltering recovery in the world’s No. 2 economy, China, and are strapping in for a bumpy ride ahead.

A protracted downturn in the property market and high levels of job insecurity have knocked the wind out of a fragile recovery in China, a global trading powerhouse, and the effects of its slowdown can be felt across borders.

Coffee chain Starbucks (NASDAQ:), carmaker General Motors (NYSE:) and technology firms hurt by curbs on exports to China are among those that have sounded the alarm on weakness in the nation. The Chinese government’s stimulus measures have so far failed to boost consumption, and the overleveraged property market has made consumers less likely to spend.

“It’s a difficult market right now. And frankly, it’s unsustainable, because the amount of companies losing money there cannot continue indefinitely,” General Motors CEO Mary Barra said last week as the automaker’s division in China shifted from being a profit engine to a drain on its finances.

China’s $18.6 trillion economy grew more slowly than expected in the second quarter, and cautious households are building up savings and paying off debts. Retail sales growth sank to an 18-month low in June, and businesses cut prices on everything from cars to food to clothes.

In a bid to stem the rot, China outlined stimulus directed at consumers last month to support equipment upgrades and consumer goods trade-ins, but that has not allayed concerns.

Some analysts have warned that barring a structural shift that gives consumers a greater role in the economy, the current path fuels risks of a prolonged period of near-stagnation and persistent deflation threats.

“There is a deep concern that Beijing is not introducing the kind of stimulus that helps broaden the economic base,” said Quincy Krosby, chief global strategist for LPL Financial (NASDAQ:).

“It’s becoming more difficult for U.S. companies to look to the Chinese market as a reliable partner.”

China remained a drag on Apple (NASDAQ:) last quarter. The iPhone maker’s sales declined a much steeper-than-expected 6.5% in the country, which accounts for a fifth of its total revenue.

French cosmetics giant L’Oreal said the Chinese beauty market will remain slightly negative into the second half of 2024 with no visible improvement in sentiment.

Other consumer companies’ sales have been hurt as well, including Starbucks, McDonald’s (NYSE:) and Procter & Gamble (NYSE:), while soft domestic travel demand prompted a revenue warning from Marriott.

The sluggish growth was also evident in underwhelming results from luxury goods makers LVMH and Gucci-owner Kering (EPA:) and profit warnings from Burberry and Hugo Boss.

“The world was surprised at how weak China was economically as this year unfolded,” said Marc Casper, CEO of medical equipment maker Thermo Fisher (NYSE:).

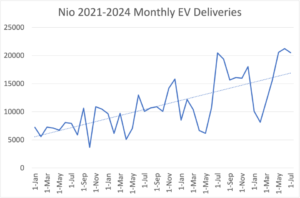

Meanwhile, foreign automakers from Tesla (NASDAQ:) to BMW (ETR:), Audi and Mercedes, are locked in an intense price war in China after ceding market share to domestic EV makers, led by BYD (SZ:), who offer high-tech, low-cost models.

To be sure, the MSCI World with China Exposure Index, which tracks 52 companies with high revenue exposure to China, is up 11.6% this year, not far off a 12% rise in MSCI’s broad gauge of global stocks.

However, most of the China-focused index’s performance is thanks to a surge in semiconductor stocks, including Broadcom (NASDAQ:) and Qualcomm (NASDAQ:), which have benefited from AI-driven demand.

POLICY CHALLENGES

Mounting Sino-U.S. trade tensions and certain domestic policies have added to multinational companies’ woes.

Beijing’s anti-corruption campaign that began last year has caused disruptions that partly prompted GE HealthCare (NASDAQ:) to lower its revenue growth forecast and sparked concerns over sales of Merck’s Gardasil vaccine.

Meanwhile, tighter U.S. export curbs on sharing high-end chip technology with China are impeding chipmakers from serving one of the largest markets for semiconductors.

Qualcomm said it took a revenue hit from the U.S. curbs on exports to China, overshadowing its otherwise upbeat forecast on Wednesday.

Analysts said the pressures are unlikely to ease soon.

“It has been a surprise that (the slowdown) has lasted so long,” said Stuart Cole, chief macroeconomist at Equiti Capital.

“Once the Covid restrictions were lifted the general expectation was that China would bounce back. But the Chinese pace of expansion we saw previously will not be seen any time soon.”