AMD to report second quarter earnings, as investors look for continued AI growth

Chip giant AMD (AMD) is set to report its second quarter earnings after the bell on Tuesday, as Wall Street looks to see if AI infrastructure spending is continuing its upward trajectory. In its prior quarter, AMD said Data Center revenue increased 80% year-over-year to $2.3 billion thanks to sales of its Instinct graphics processing units (GPUs) and EPYC central processing units (CPUs).

For the second quarter, Wall Street is anticipating adjusted earnings per share (EPS) of $0.68 on revenue of $5.7 billion, according to consensus estimates by Bloomberg. That would be a solid improvement from the same quarter last year when AMD reported adjusted EPS of $0.58 on revenue of $5.4 billion.

Analysts and investors will once again be looking closely at AMD’s Data Center segment, as well as any potential forecasts related to sales of the company’s GPUs. According to Bloomberg data, AMD is expected to report Data Center revenue of $2.75 billion, up from $1.3 billion in the same quarter last year.

Shares of AMD are down some 5% year-to-date. Shares of Intel (INTC), meanwhile, are off more than 38%. On the flip side, shares of Nvidia (NVDA) are up 125%.

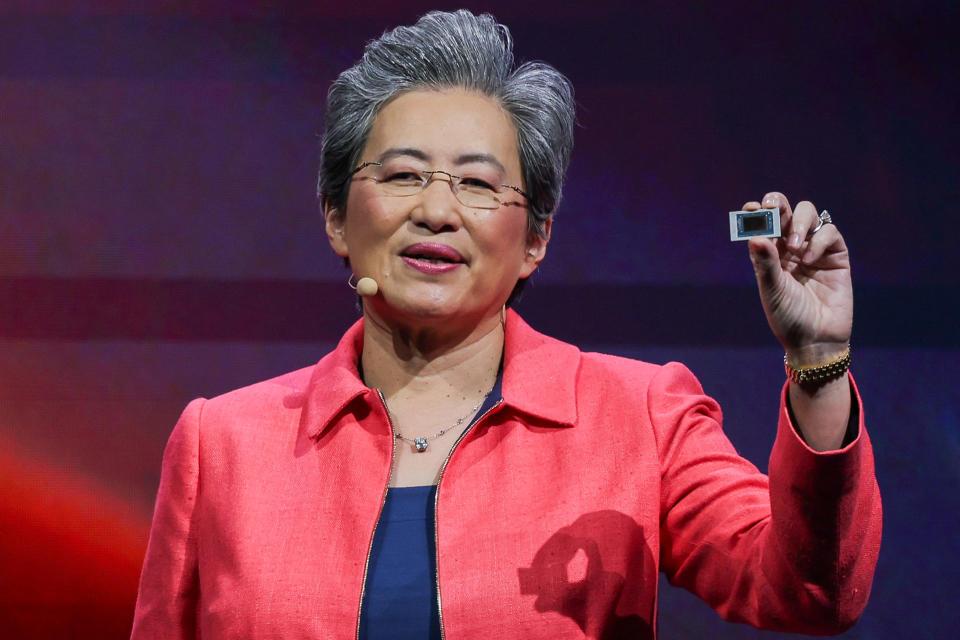

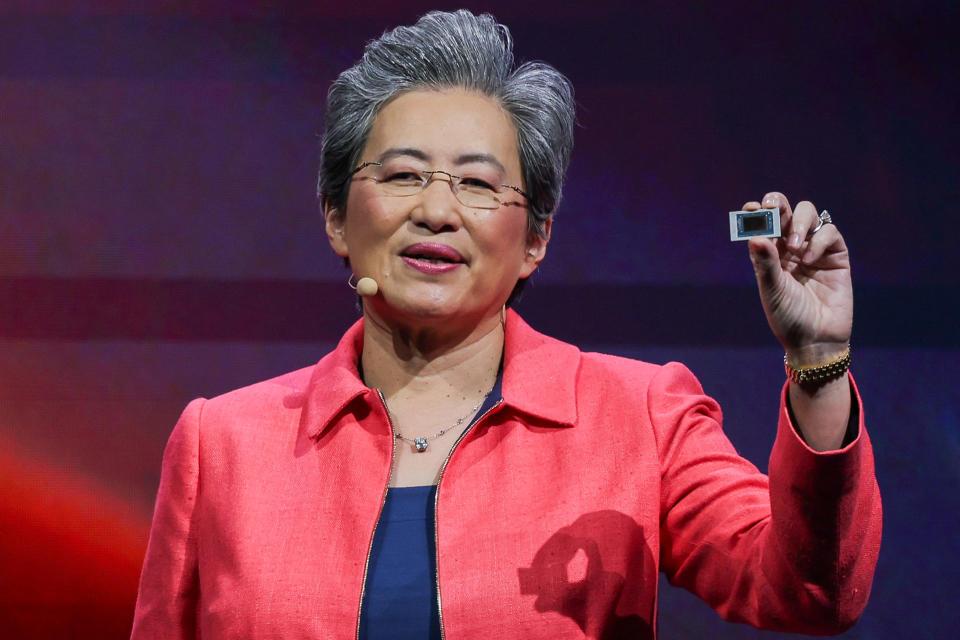

AMD’s current top GPU is its MI300X. During a press conference at the Computex event in Taiwan in June, AMD said partners and customers including Microsoft, Meta, Dell, HPE, and Lenovo are already adopting the chip. The company also revealed that its next-generation MI325X will be available beginning in Q4, while the MI350X will hit the market in 2025. AMD said it will roll out the MI400 in 2026.

It’s not just AI that matters for AMD, though. It’s Client segment, which includes sales of chips for PCs is still an important part of its business. For the quarter, analysts expect AMD to report Client revenue of $1.45 billion, up from $998 million in the same period last year.

The anticipated improvement in Client segment revenue comes as the PC industry continues its turnaround following a significant slowdown after the explosive growth seen at the onset of the pandemic.

But that was four years ago, and consumers are beginning to shop for replacements for the PCs they bought at the start of the pandemic. That, according to IDC has resulted in worldwide PC shipments increasing 3% year-over-year in the second quarter, marking the second quarter of growth after 8 consecutive quarters of declines.

Gaming revenue, however, is set to take a major hit in Q2. Analysts are expecting revenue to decline from the $1.6 billion the segment generated last year to just $646 billion in the second quarter.

Like the PC industry, the gaming industry has also been contending with a slowdown compared to the high-flying sale days of the early pandemic era. Still, there’s hope for the gaming industry going into the end of 2024 and the 2025 as Nintendo prepares to launch its next console and Take-Two readies its highly anticipated “Grand Theft Auto VI” later next year.

AMD is the first of the big three chip companies to report its earnings this quarter. Intel will follow suit on Aug. 1, while Nvidia will report its earnings on Aug. 28.

Email Daniel Howley at [email protected]. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance