Alibaba, Tencent to Provide Snapshot of China’s Economic Landscape

(Bloomberg) — Alibaba Group Holding Ltd., Tencent Holdings Ltd. and JD.com Inc. will provide a snapshot of China’s economy and consumer sentiment, as another somber earnings season is expected in the region.

Most Read from Bloomberg

The tech giants remain focused on boosting shareholder returns, so more buybacks might be in store when they report, according to Bloomberg Intelligence analysts Robert Lea and Jasmine Lyu.

“The Chinese technology sector’s balance sheet is strong, with many companies accumulating substantial cash reserves in recent years, providing ample scope to boost shareholder returns via buybacks and dividends,” they said.

China’s slowing economy is still affecting them. Tencent’s advertising, fintech and business services operations are sensitive to deteriorating economic growth, while Alibaba and JD.com are spending more on online perks and discounts to drive sales growth. China’s consumer prices rose more than expected in July, offering hope of a recovery in domestic demand.

On the hardware side, Hon Hai Precision Industry Co. and subsidiary Foxconn Industrial Internet Co. probably saw revenue rise double-digits this quarter, as they increasingly rely on artificial intelligence to boost growth. Earlier, Taiwan Semiconductor Manufacturing Co.’s sales rose 45% in July, also thanks to sustained strong demand for artificial intelligence chips from the likes of Nvidia Corp.

Highlights to look out for:

Monday: International Container Terminal Services (ICT PM) should see continued revenue growth after its first-quarter consolidated revenue rose on higher yields and volume from its Americas region, COL Financial said. Current port expansions and acquisitions of port terminals should also help sustain its growth.

Tuesday: Foxconn Industrial’s (601138 CH) first-half net income jumped 22%, according to its preliminary results. That was driven by growth in cloud computing business and robust demand for AI servers, BI said. Its gross margin could improve as an increasing sales mix of high-end AI servers boosted profitability, they added. Its lucrative internet segment may have been pressured by China’s slow economic growth.

-

Wilmar’s (WIL SP) second-quarter core net income may remain flat, as the period is usually weak due to the lack of festive demand, UOB Kay Hian said. The agribusiness group’s tropical oil business is also expected to face continued margin pressure amid competition among Indonesian refiners, it said.

-

Airports of Thailand’s (AOT TB) third-quarter revenue likely rose more than 25% as international arrivals continued to rise, BI said. Chinese tourist arrivals may miss the official 8 million projection this year, though visitors from other countries may cover the shortfall.

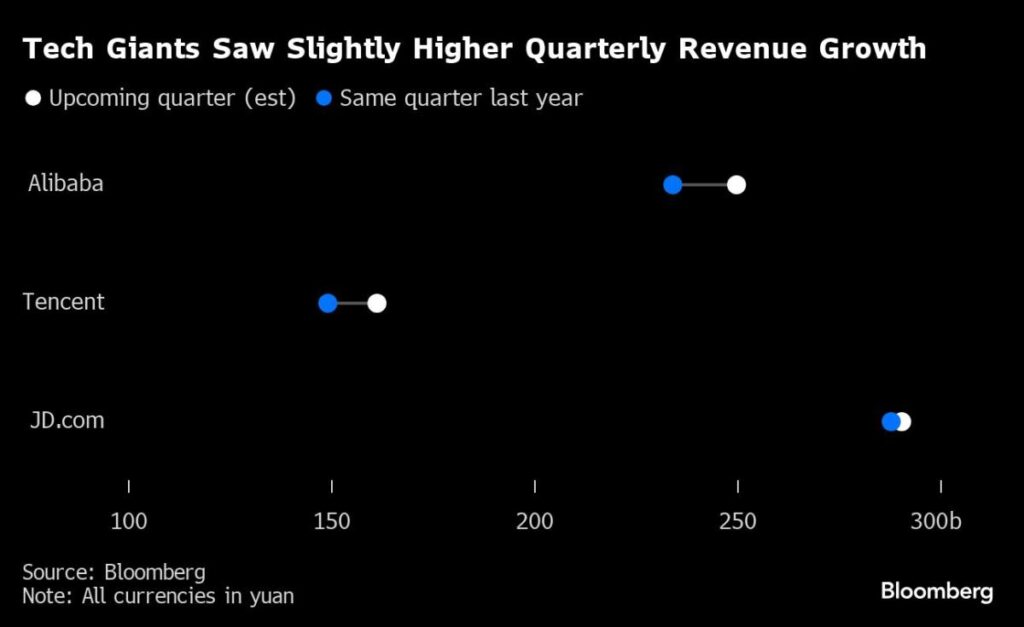

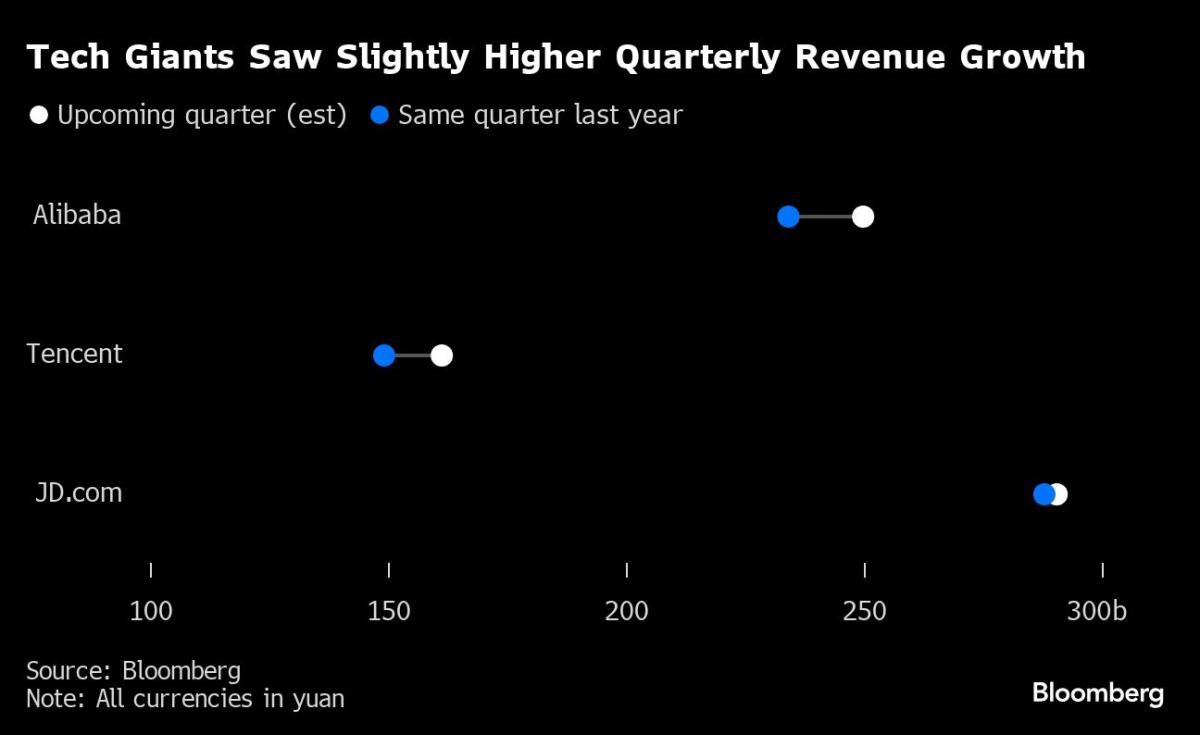

Wednesday: Tencent (700 HK) probably saw second-quarter revenue rise 8.1%, helped by sustained demand momentum for online advertising and domestic video games. The current buyback program may be expanded, BI said. Look out for strategies to boost domestic gaming and rejuvenating existing games during the earnings call, Jefferies said.

-

Hon Hai Precision’s (2317 TT) second-quarter sales likely surged 17%. BI expects cloud products to be the biggest growth drivers, supported by strong demand for AI servers. The launch of a new iPad Pro and recovering PC demand probably boosted computer segment revenue.

-

Commonwealth Bank of Australia’s (CBA AU) second-half profit is expected to contract, though less than at rivals as the fall in margins stabilized. BI said the bank may deploy surplus capital to boost its buyback program.

Thursday: Alibaba (BABA US) probably saw quarterly revenue grow 6.7%, although it spent more on advertising and user perks to attract more shoppers outside China, according to BI. Lackluster business sentiment in China may have limited gains in Taobao-Tmall group revenue, with consensus pointing to a slowdown in growth to 2.3%.

-

JD.com’s (JD US) second-quarter retail revenue growth likely shrank to a nine-month low, BI said. An increase in higher-margin third-party revenue, particularly during China’s 618 sales event, probably boosted its retail operating margin amid intensifying price competition with rivals including Alibaba.

-

Lenovo’s (992 HK) quarterly profit probably jumped 31%, estimates show, as the global PC market recovers. UOB Kay Hian expects PC shipments grew 3.5%.

(Updates with TSMC’s sales. An earlier version of this story corrected Foxconn Industrial’s preliminary net income.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.