A Coinbase user thought he called customer support. Instead he lost $100,000 in 20 minutes to scammers

Google banned crypto ads for years—in hindsight that may have been the right policy.

The crypto market was heating up and Fred, who is in his 60s and lives in Connecticut, figured it was a good time to shift some of the positions he held in his Coinbase account. After encountering some difficulties with the website, Fred decided to call the company. He searched for Coinbase on Google and, at top of the page, he saw an ad that prominently displayed a customer service phone number. Upon calling it, a representative informed Fred that he had “one of the older accounts” but required updating. That’s when the trouble began.

Less than 20 minutes later, Fred—who asked his last name not be used to avoid attracting unwanted attention—had been robbed of more than $100,000 of Bitcoin, Ethereum and cash. It turned out the Indian-accented representative he had called did not work for Coinbase at all but for scammers. In their short conversation, the rep not only persuaded Fred to share his Coinbase password but also to open his online banking portal—Fred only cut off the scammer upon receiving a call from Wells Fargo asking him about unusual activity.

Fred feels sheepish about the episode, saying his lack of crypto knowledge made him a “lamb to a slaughter.” He is angry at Coinbase for making it possible to drain his accounts so quickly, but he has special ire for Google for letting a scammer open shop at the top of its website.

“How can Google allow this? The site is set up for fraud. Anybody can do it. Their phone rings and, yippee, they know they have a sucker on the line,” he complains.

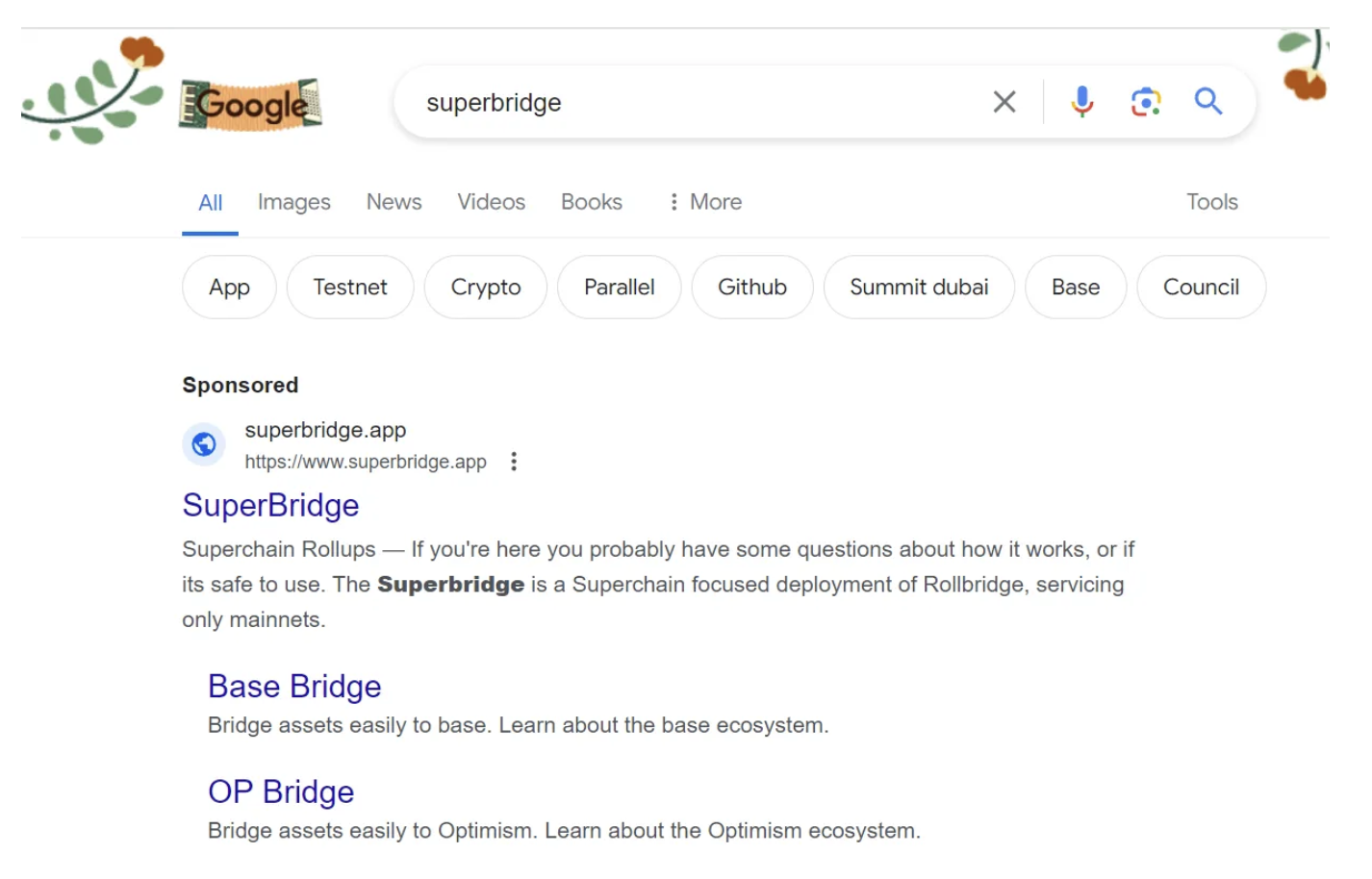

It may come as cold comfort to Fred but it is not only crypto novices who have been fleeced as a result of Google ads. In a recent post on Medium, a pseudonymous author recounts how he sought the website for Superbridge, a so-called bridge service of the sort that some experienced crypto users employ to convert lesser-known cryptocurrencies. His Google search returned an ad that displayed a link to “Superbridge.app”—the service’s legitimate website.

The user clicked the link and commenced a transaction, only to have $3000 worth of the USDC stablecoin disappear from his wallet. It turned out that the Superbridge.app linkn displayed in the Google ad, when clicked upon, redirected to a site called Seperbridge.app controlled by crooks. The only way to notice such a switcheroo is by confirming the address in the web browser—something most people do not do as a matter of course.

In the post, the Medium author shared this screenshot of the Google ad, which looks highly convicing:

Currently, Google searches for “Coinbase customer service” do not appear to display any malicious ads. Meanwhile, in an email to Fortune, the company says it deleted the account of the fake “Superbridge” advertiser. Coinbase declined to comment for this article.

“Our team is always working to prevent scams on our platforms and we have strict policies that specifically prohibit these kinds of ads. When we identify ads that violate our policies we move quickly to remove the ads and suspend the associated advertiser account when applicable,” said a Google spokesperson.

Other news reports, however, cite a number of other examples of crooks purchasing ads on Google in order to fleece users, suggesting the company may have a systemic problem on its hands when it comes to crypto ads—which it largely banned for years before changing its policy last December.

In its email, Google said it is vigilant about banning bad actors, stating that it suspended 12.7 million advertiser accounts in 2023 alone. The company added, though, that crooks have become more sophisticated when it comes to deploying “cloaking” and other tricks to get around the automated tools it uses to screen advertisers.

As for Fred, who was bilked by the fake Coinbase support ad, he says the local police directed him to the FBI office in New Haven, Connecticut, where an agent put him on the phone with law enforcement in India, who said his money is sitting in a crypto wallet where it is intermingled with funds from other fraud victims. The law enforcement agencies are moving to seize the wallet, leading Fred to hope he may recover at least a portion of what it was taken.

Meanwhile, Fred says he is done for now with investing in the crypto markets. But he added that, if the FBI is able to return his funds, he might “buy one Bitcon and call it a day.”