How Musk and Trump Are Working to Consolidate Government Data About You

Elon Musk’s team is leading an effort to link government databases, to the alarm of privacy and security experts.

Elon Musk’s team is leading an effort to link government databases, to the alarm of privacy and security experts.

The federal government knows your mother’s maiden name and your bank account number. The student debt you hold. Your disability status. The company that employs you and the wages you earn there. And that’s just a start.

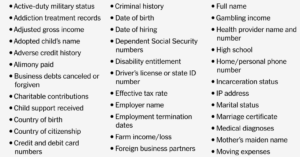

It may also know your …

- Active-duty military status

- Addiction treatment records

- Adjusted gross income

- Adopted child’s name

- Adverse credit history

- Alimony paid

- Business debts canceled or forgiven

- Charitable contributions

- Child support received

- Country of birth

- Country of citizenship

- Credit and debit card numbers

- Criminal history

- Date of birth

- Date of hiring

- Dependent Social Security numbers

- Disability entitlement

- Driver’s license or state ID number

- Effective tax rate

- Employer name

- Employment termination dates

- Farm income/loss

- Foreign business partners

- Full name

- Gambling income

- Health provider name and number

- High school

- Home/personal phone number

- Incarceration status

- IP address

- Marital status

- Marriage certificate

- Medical diagnoses

- Mother’s maiden name

- Moving expenses

- Nonresident alien status

- Parent educational attainment

- Passport number

- Personal bank account number

- Personal email address

- Personal taxpayer ID number

- Place of birth

- Prior status in foster care

- Reason for separation (for unemployment claims)

- Social Security number

- Sources of income

- Spouse’s demographic information

- Student loan defaults

- Taxable I.R.A. distributions

- U.S. visa number

and at least 263 more categories of data.

These intimate details about the personal lives of people who live in the United States are held in disconnected data systems across the federal government — some at the Treasury, some at the Social Security Administration and some at the Department of Education, among other agencies.

The Trump administration is now trying to connect the dots of that disparate information. Last month, President Trump signed an executive order calling for the “consolidation” of these segregated records, raising the prospect of creating a kind of data trove about Americans that the government has never had before, and that members of the president’s own party have historically opposed.

The effort is being driven by Elon Musk, the world’s richest man, and his lieutenants with the Department of Government Efficiency, who have sought access to dozens of databases as they have swept through agencies across the federal government. Along the way, they have elbowed past the objections of career staff, data security protocols, national security experts and legal privacy protections.

So far, the Musk group’s success has varied by agency and sometimes by the day, as differing rulings have come down from federal judges hearing more than a dozen lawsuits challenging the moves. The group has been temporarily blocked from sensitive data at several agencies, including the Social Security Administration. But on Monday, an appeals court reversed a preliminary injunction barring the group’s access at the Treasury, the Department of Education and the Office of Personnel Management.

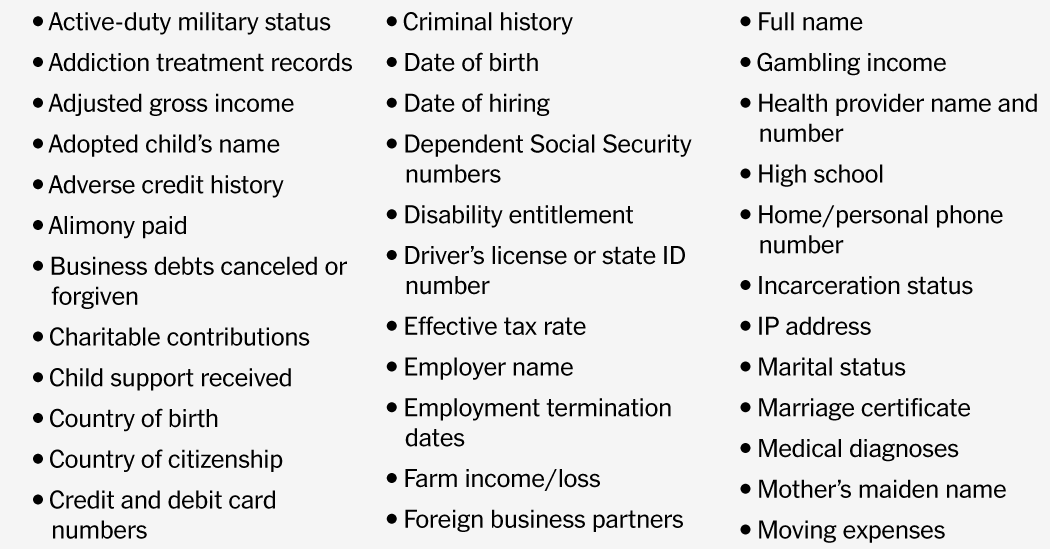

Personal data held in systems DOGE has sought to access

- Academic rank

- Active-duty military status

- Addiction treatment records

- Adjusted gross income

- Adopted child’s gender

- Adopted child’s name

- Adopted child’s placement agency

- Adoption credit claimed

- Adoption Taxpayer ID Number

- Adoptive parent name

- Adoptive placement agency

- Adoptive placement agency Employer ID Number

- Adverse credit history

- Alimony paid

- Alimony received

- Amount of federal taxes owed

- Amount of federal taxes refunded

- Amount of institutionally provided financing owed

- Amount of Medicare conditional payment

- Amount of student loan debt

- Area of medical residency

- Area of study

- Auto insurance effective date of coverage

- Auto insurance policy number

- Automobile medical policies

- Bank

- Bank information (for your Medicare providers)

- Biometric identifiers

- Birth certificate

- Business address

- Business bad debt

- Business bank account number

- Business closures

- Business debts canceled or forgiven

- Business depreciation

- Business entity type

- Business income/loss

- Business rents paid

- Business repairs and maintenance costs

- Business taxpayer ID number

- Cancellation of debt

- Capital gain/loss

- Casualty and theft losses from federal declared disaster

- Charitable contributions

- Child and dependent care tax credit claimed

- Child support received

- Children of Fallen Heroes Scholarship eligibility indicator

- Citizenship status

- Classification of instructional programs code

- Clean vehicle credit claimed

- Company named in consumer complaint

- Consumer product complaints (including mortgages, loans, credit cards)

- Cost of goods sold (for business)

- Country of birth

- Country of citizenship

- Course of study completion date

- Course of study completion status

- Course of study program length

- Credit and debit card numbers

- Credit report information

- Criminal history

- Date of accident, injury or illness

- Date of birth

- Date of death

- Date of hiring

- Date of original divorce or separation agreement

- Dates of employment

- Dates of medical service

- Deductible part of self-employment tax

- Degrees

- Delinquency on federal debt status

- Dependency status

- Dependent names

- Dependent of a resident alien

- Dependent of U.S. citizen/resident alien

- Dependent relationship to you

- Dependent Social Security numbers

- Dependent/spouse of a nonresident alien holding a U.S. visa

- Device ID

- Digital assets received as ordinary income

- Disability entitlement

- Disadvantaged background status

- Disability status

- Dividend income

- Driver’s license or state ID number

- Earnings

- Education and training (for unemployment claims)

- Education tax credits claimed

- Educator expenses paid

- Effective tax rate

- Employee benefit plans offered (for business)

- Employee ID number

- Employer account number

- Employer address

- Employer name

- Employer reported total employees

- Employer-provided adoption benefits

- Employer-reported total wages paid by quarter

- Employment information

- Employment status

- Employment termination dates

- Energy efficient commercial buildings deduction

- Energy efficient home improvement credit claimed

- Entitlement benefits held by related Social Security number holders

- Expected student enrollment

- Failure to file taxes penalty

- Failure to pay taxes penalty

- Family court records

- Family size

- Farm income/loss

- Federal Employer ID Number

- Federal housing assistance received

- Federal income tax withheld

- Financial aid profile

- First-time homebuyer credit claimed

- Foreign activities

- Foreign address

- Foreign bank and financial accounts

- Foreign business partners

- Foreign coverage credits

- Foreign earned income exclusion

- Foreign interests in business

- Foreign tax ID number

- Free or reduced-price school lunch received

- Full name

- Funding arrangements of employer group health plan

- Gambling income

- Gender

- Gross business profit

- Gross business receipts or sales

- Health insurance claim number

- Health insurance effective date of coverage

- Health insurance policy number

- Health provider name and number

- Health savings account deduction claimed

- Health supplier name and number

- High school

- Higher ed institutions designated to receive FAFSA form

- Home/mailing address

- Home/personal phone number

- Homeless status

- Hospitalization records

- Household employee name

- Household employee Social Security number

- Household employee wages

- Incarcerated student indicator flag

- Incarceration status

- Income and assets (for student aid eligibility)

- Inventions

- Investment interest received

- IP address

- I.R.A. deduction

- Job title

- Jury duty pay

- Late tax filing interest

- Level of postsecondary education study

- Login security questions and answers

- Login.gov password

- Marginal tax rate

- Marital status

- Marriage certificate

- Medicaid received

- Medicaid waiver payments

- Medical and dental expenses paid

- Medical claims payments

- Medical diagnoses

- Medical notes

- Medical records number

- Medical residency date completed

- Medicare invoices (sent to your provider)

- Medicare payments received (by your provider)

- Military service credits

- Mortgage interest paid

- Mother’s maiden name

- Moving expenses

- Name/address of business partnership

- Names of other corporate officers of an LLC

- Naturalization records

- Nature of medical service

- Net farm profit/loss

- Nonresident alien status

- Nonresident alien student, professor or researcher

- Number of agricultural employees employed

- Number of employees

- Number of family members in college

- Occupation title or code

- Olympic and Paralympic medals, prize money

- Ordinary business income

- Parent demographic information

- Parent educational attainment

- Parent killed in the line of duty

- Parental income and assets (for student aid eligibility)

- Parents’ demographic information

- Passport number

- Pell Grant additional eligibility indicator

- Pell Grant collection status indicator

- Pell Grant status

- Personal and professional references (for federal job applicants)

- Personal bank account number

- Personal bank account routing number

- Personal email address

- Personal tax payment history

- Personal taxpayer ID number

- Photographic identifiers

- Photographs of government-issued IDs

- Physician name and number

- Place of birth

- Plans for federal grant funding (including schedules, diagrams, pictures)

- Postsecondary education institution

- Power of attorney name and address

- Prescription drug coverage

- Principal business activity

- Principal business product or service

- Prior status as a legally emancipated minor

- Prior status as a ward of the court

- Prior status as an orphan

- Prior status in a legal guardianship

- Prior status in foster care

- Private health insurer/underwriter group name

- Private health insurer/underwriter group number

- Private health insurer/underwriter name

- Prizes and award income received

- Psychological or psychiatric health records

- Qualified electric vehicle credit claimed

- Railroad retirement credits

- Reason for separation (for unemployment claims)

- Relationships to other Social Security number holders

- Rental management fees paid

- Rental, royalty, partnership, etc. income/loss

- Rents received

- Residential clean energy credit claimed

- Royalties received

- Salaries and wages earned

- Salary history (for federal job applicants)

- Scholarship and fellowship grants received

- Seasonable employer status

- Self-employed health insurance deduction

- Self-employment tax

- Self-photograph

- Sex

- Social Security date of filing

- Social Security number

- Social Security numbers of other corporate officers of an LLC

- Social Security primary insurance amount

- Social Security/S.S.I. representative payee

- Sources and amounts of non-Social Security income

- Sources of income

- Spousal income and assets (for student aid eligibility)

- Spouse demographic information

- Spouse of a resident alien

- Spouse of U.S. citizen/resident alien

- Spouse’s demographic information

- Spouse’s Social Security number

- Standard employee identifier

- State and local taxes paid

- Stock options received

- Student entitlement

- Student loan forbearances

- Student loan amount

- Student loan balances

- Student loan cancellations

- Student loan claims

- Student loan collections

- Student loan defaults

- Student loan deferments

- Student loan disbursement dates

- Student loan disbursements

- Student loan ID

- Student loan interest deduction

- Student loan overpayments

- Student loan promissory notes

- Student loan refunds

- Student loan repayment plan

- Student loan status

- Supplemental Nutrition Assistance received

- Supplemental Security Income eligibility

- Supplemental Security Income eligibility amount

- Supplemental Security Income payment amounts

- Tax filing status (married, individual, filing jointly)

- Tax preparer tax ID number

- Taxable dependent care benefits

- Taxable income

- Taxable interest income

- Taxable I.R.A. distributions

- Taxable pension distributions

- Taxable Social Security benefits

- Taxable state/local refunds

- Taxes paid on wagers

- Temporary Assistance for Needy Families received

- Tests for H.I.V./AIDS

- Tip income

- Total number of dependents

- Total number of tax exemptions

- Total payments to all employees

- Total tax owed and paid

- Type of bank account (checking/savings)

- U.S. resident alien status

- U.S. visa expiration date

- U.S. visa number

- Unaccompanied alien child status

- Unaccompanied alien children sponsor status

- Unemployment compensation received

- Vehicle identifiers

- Veteran disability determination dates

- Veteran status

- Visa expiration date

- Wages earned while incarcerated

- WIC nutrition assistance received

- Work email address

- Work experience (for federal job applicants)

- Work phone number

- Workers’ compensation coverage

- Workers’ compensation offset

Ways these agencies may have obtained your data

| Consumer Financial Protection Bureau | • You have filed complaints about companies or products, including about your mortgage or credit cards |

| Education | • You have applied for or received student loan aid |

| General Services Administration | • You have used Login.gov to verify your identify on government forms |

| Health and Human Services | • You are a doctor providing patients care and receiving payment |

| • You have Medicare or Medicaid | |

| • Your employer reported your hiring and wages | |

| • You have received unemployment benefits | |

| • You have applied for a grant | |

| • You have sponsored an unaccompanied alien child | |

| Labor | • Your employer has filed information, including with states, about your employment and wages and unemployment taxes paid |

| • You have received unemployment | |

| Office of Personnel Management | • You have ever applied for a job with the federal government |

| Social Security Administration | • Your parents applied for a Social Security number for you at birth |

| • You have paid Social Security taxes through your job | |

| • You have applied for or collect Social Security or Supplemental Security Income benefits | |

| Treasury | • You have filed taxes or tax forms |

| • You have been listed in tax forms filed by others | |

| • You have ever received payments from or made payments to the government |