Stocks Jolted by Trump’s Plans for Canada Tariffs: Markets Wrap

(Bloomberg) — Stocks fell after President Donald Trump said he’s increasing to 50% a tariff on all steel and aluminum coming into the US from Canada.

Most Read from Bloomberg

Equities pushed lower as Trump said he would also “substantially increase” other tariffs on Canada on April 2 if the country does not drop tariffs on dairy products and other US goods. The S&P 500 extended its slide from an all-time high to 9%. The dollar retreated 0.3%, while the loonie was among the world’s worst performers.

Follow The Big Take daily podcast wherever you listen.

Citigroup Inc. strategists downgraded their view on American shares to neutral from overweight, saying their hegemony of is on pause, at least for now. The neutral take on US stocks is over the next three to six months, Citi strategists including Dirk Willer wrote in a note, adding that more negative US data prints are expected.

“US exceptionalism is at least pausing” for the coming few months, they wrote. “The news flow from the US economy is likely to undershoot the rest of the world in coming months,” they added.

The S&P 500 fell 0.3%. The Nasdaq 100 added 0.1%. The Dow Jones Industrial Average slid 0.7%. The yield on 10-year Treasuries rose two basis points to 4.23%. The Bloomberg Dollar Spot Index fell 0.3%. The loonie dropped 0.2%.

Some 20 US investment-grade borrowers were looking to issue debt Tuesday, but only about eight may proceed as the credit backdrop remains quite fragile, according to an informal survey of debt underwriters who declined to name the firms.

Key events this week:

-

Canada rate decision, Wednesday

-

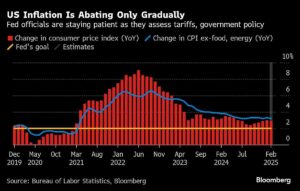

US CPI, Wednesday

-

Eurozone industrial production, Thursday

-

US PPI, initial jobless claims, Thursday

-

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.3% as of 10:07 a.m. New York time

-

The Nasdaq 100 rose 0.1%

-

The Dow Jones Industrial Average fell 0.7%

-

The Stoxx Europe 600 fell 1.2%

-

The MSCI World Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro rose 0.8% to $1.0917

-

The British pound rose 0.4% to $1.2933

-

The Japanese yen fell 0.3% to 147.73 per dollar

Cryptocurrencies

-

Bitcoin rose 1.8% to $80,681.18

-

Ether rose 1.1% to $1,889

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 4.23%

-

Germany’s 10-year yield advanced five basis points to 2.88%

-

Britain’s 10-year yield advanced three basis points to 4.68%

Commodities

-

West Texas Intermediate crude rose 1.2% to $66.85 a barrel

-

Spot gold rose 1.1% to $2,919.93 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Viljoen, Sujata Rao and Aya Wagatsuma.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.