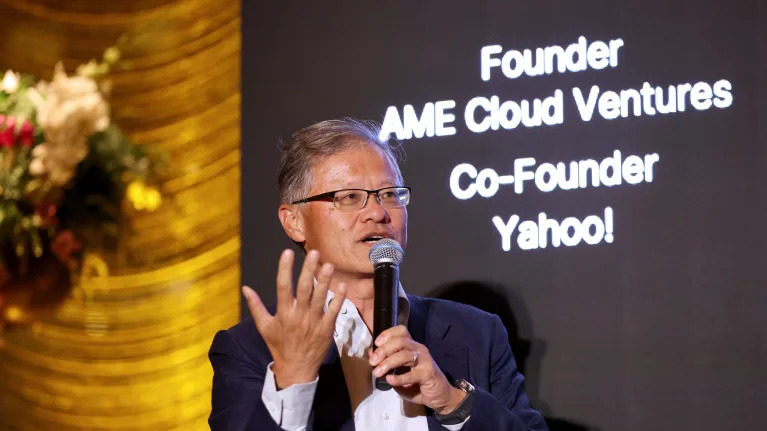

Yahoo co-founder Jerry Yang on AI: The wave is coming

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, YouTube or wherever you find your favorite podcasts.

Given the exponential market run-ups in artificial intelligence stocks such as Nvidia (NVDA), the space is sure to be on many investors’ minds right now — but the seasoned tech players know that too much hype can sometimes spell disaster.

“I think the AI wave is coming,” Yahoo co-founder and AME Cloud Ventures founding partner Jerry Yang said to Yahoo Finance Executive Editor Brian Sozzi on the 100th episode of the Opening Bid podcast (see video above; listen below). “Maybe it’s upon us, depending on who you talk to.”

“We’ve seen a few waves of technology, and with each one of these waves, [we] go through this hype cycle,” Yang said. “And then you cross the chasm and then you come to the other side.”

Yang, 56, has spent his entire career betting on (and mostly winning at) technology.

He was a doctoral student at Stanford when he co-founded “Jerry’s Guide to the World Wide Web” with his friend and classmate David Filo in 1994.

Their pet project served as a website directory that gained steam and attention immediately. The name was initially changed to “Jerry and David’s Guide to the World Wide Web.”

After receiving a million hits by the end of 1994, the duo made another name switch. Yahoo (an acronym for Yet Another Hierarchical Officious Oracle) was incorporated and launched in 1995.

Explosive growth fueled by the rocket-ship-like adoption of the internet led them to take the company public in 1996.

A meeting with Alibaba (BABA) founder Jack Ma in 1997 would ultimately benefit Yang and the company when Yahoo purchased a 40% stake in Alibaba for $1 billion in 2005, an investment it would later sell for $7.6 billion in 2012.

Yang served as CEO of Yahoo from 2007 to 2009 and left the company in 2012. Yahoo has been owned by private equity firm Apollo Global Management (APO) since Sept. 2021.

Today, Yang is an early-stage investor at AME Cloud Ventures — making bold bets on technology like quantum computing with Rigetti Computing (RGTI) — and spends the other part of his time as a Silicon Valley statesman handing out guidance to aspiring visionaries.

One advantage newer companies in the AI domain have over their more senior tech predecessors is the benefit of hindsight.

“When we were building the company and the internet was being built, there was no playbook,” Yang said. “It was literally the Wild West and you were trying to figure out what [everything] looked like.”

Read more: Why Salesforce CEO Marc Benioff is so bullish on AI agents

By 2000, Yahoo was “one of the more valuable companies for no apparent reason other than the stock market driving it up,” Yang explained. “And then the bubble busted, and then it took a few years before all the valuations and the users and the infrastructure really caught up to the hype.”

AI could be on a similar pathway given the demand and market enthusiasm demonstrated in 2024, when Nvidia became the most valuable public company in the world. OpenAI, the maker of ChatGPT, currently boasts a heady valuation of $157 billion, with users turning to the service en masse — but no profits to speak of yet.

Fellow tech veteran Tom Siebel, founder and CEO of C3.ai (AI), said on Opening Bid that generative AI was “getting pretty frothy,” noting that it provided “important technology services [and] solves some very real problems.”

However, OpenAI “could be gone next Monday,” he cautioned, adding that leaders at these companies “think they’re building God in a box.”

Bullishness in general on the AI space could bear out. “If you go now to certain parts of [San Francisco], it’s AI central,” Yang said. “The amount of talent [and] people that are starting to put not only capital but resources and energy into AI is astounding.”

“I think it’s going to be part bubble,” he continued. “But the reality also is going to be really incredible.”

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

Grace Williams is a writer for Yahoo Finance.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance