BofA Joins Citi’s Call to Sell Stocks If Trump Win Sparks Rally

(Bloomberg) — Investors should consider selling any rally in US stocks if Donald Trump wins the election, Bank of America Corp.’s Michael Hartnett said, echoing a call from Citigroup Inc. earlier this week.

Most Read from Bloomberg

A White House victory for Trump accompanied by Republican majorities in the Senate and the House of Representatives could result in tax cuts and immigration controls, Hartnett wrote in a note. That would drive inflation and interest-rate hikes, making it risk-off for stocks, he said.

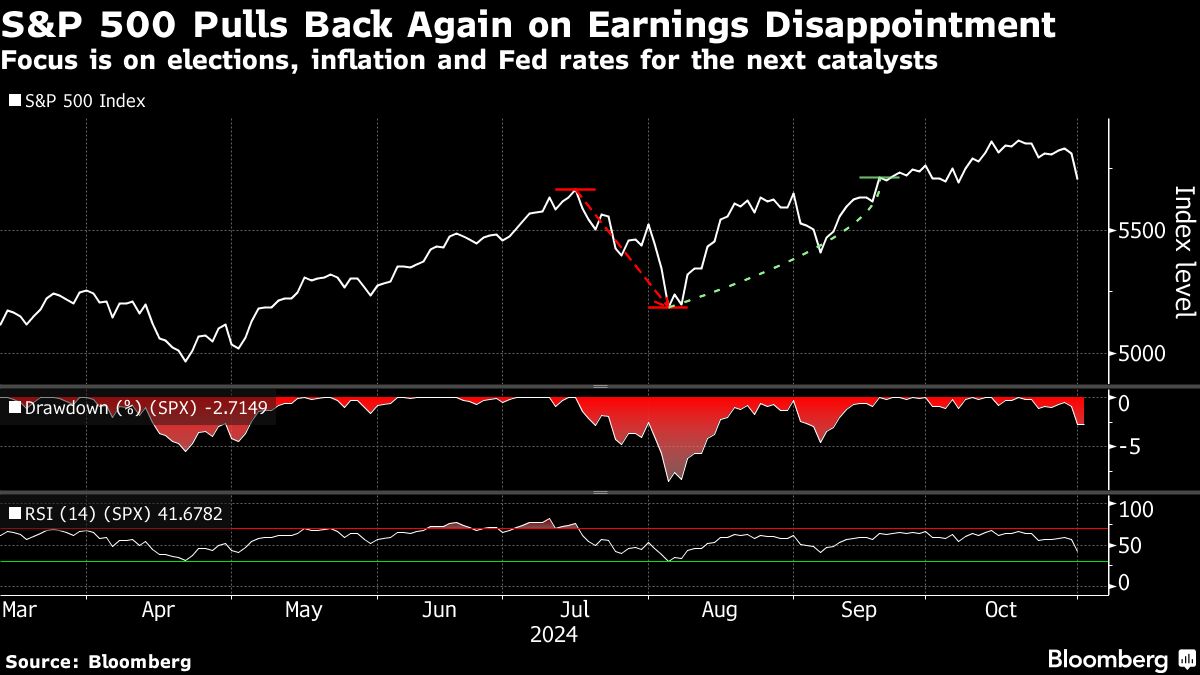

The views from two of the biggest banks on Wall Street clash with the consensus view that a Trump win will boost US equities because his proposals to lower corporate taxes will benefit company earnings. The S&P 500 Index has rallied in recent weeks as betting markets shifted in favor of a victory for Trump.

Many major polls still show Trump and Democratic candidate Kamala Harris in a dead heat.

Hartnett who dubs the views as “contrarian pushbacks,” also recommended buying any dips following a Harris victory because that would maintain the status quo for tech to continue rallying. The strategist said such a scenario would be “best played via China tech.” Tech stocks, which have been the main drivers of this year’s surge in US equities, retreated this week following underwhelming quarterly reports.

Citi’s Scott Chronert also said in his note published earlier this week that any selloff resulting from a Harris victory, alongside a split Congress, would be a buying opportunity.

Neither campaign responded immediately to a request for comment outside of regular working hours in Washington DC.

Other contrarian calls from Hartnett include buying bonds instead of gold if government spending is curbed, and buying European stocks if tariffs force the European Central Bank to cut rates faster than expected.

Investors are also focused on the monthly payrolls report due later on Friday, before a Federal Reserve policy meeting next week. Swaps markets show reduced bets on another interest rate-cut as recent data underscored a resilient US economy.

–With assistance from Jan-Patrick Barnert.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.